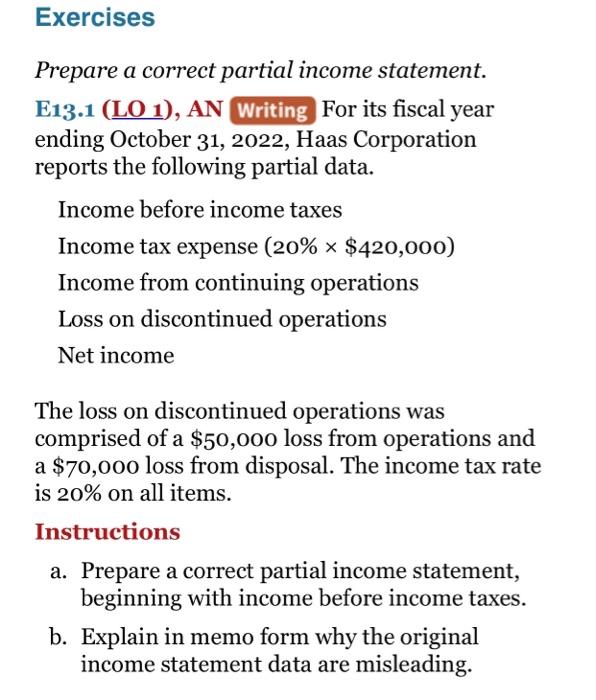

Question: Exercises Prepare a correct partial income statement. E13.1 (LO 1), AN Writing For its fiscal year ending October 31, 2022, Haas Corporation reports the following

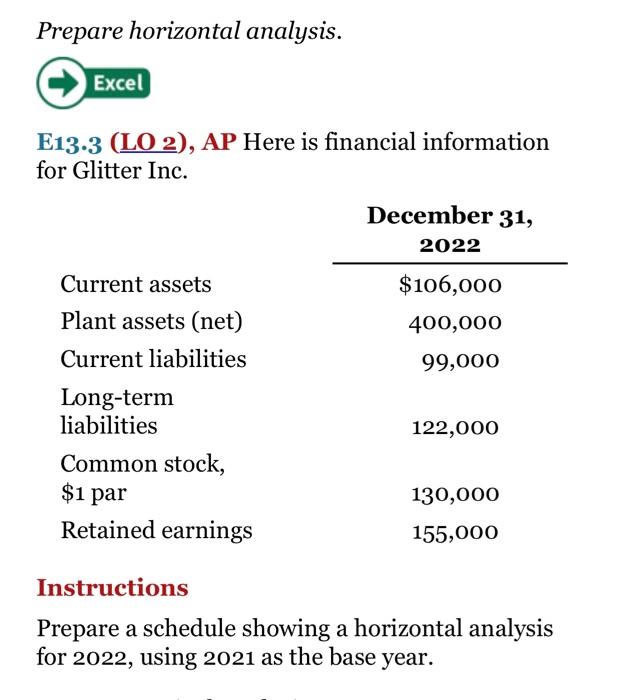

Exercises Prepare a correct partial income statement. E13.1 (LO 1), AN Writing For its fiscal year ending October 31, 2022, Haas Corporation reports the following partial data. Income before income taxes Income tax expense (20% $420,000) Income from continuing operations Loss on discontinued operations Net income The loss on discontinued operations was comprised of a $50,000 loss from operations and a $70,000 loss from disposal. The income tax rate is 20% on all items. Instructions a. Prepare a correct partial income statement, beginning with income before income taxes. b. Explain in memo form why the original income statement data are misleading. Prepare horizontal analysis. Excel E13-3 (LO 2), AP Here is financial information for Glitter Inc. Current assets Plant assets (net) Current liabilities Long-term liabilities Common stock, December 31, 2022 $106,000 400,000 99,000 122,000 $1 par Retained earnings 130,000 155,000 Instructions Prepare a schedule showing a horizontal analysis for 2022, using 2021 as the base year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts