Question: Exerclse 7 - 2 5 ( Algorithmic ) ( LO . 4 ) Belinda was involved in a boating acoident in 2 0 2 4

Exerclse AlgorithmicLO

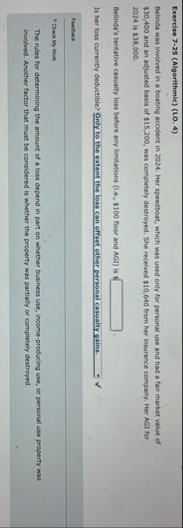

Belinda was involved in a boating acoident in Her speedboat, which was used only for personal use and had a fair market value of $ and an adjusted basis of $ was completely destroyed. She received $ from her insurance company. Her AGI for is $

Belinda's tentative caswaity loss before any limitations $ foor and is $

Is her loss currently deductible? Onty to the extent the less can offiset ether personal casuality gains. darr

Fentlack

T Oleck My Won

The nules for determining the amount of a loss depend in part on whether business use, incomeproducing use, or personal use property was involved. Another factor that must be considered is whether the property was partially or completely destroved.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock