Question: Exerclse 8 - 2 3 ( Static ) LIFO Ilquidation [ LO 8 - 4 , 8 - 6 ] The Churchill Corporation uses a

Exerclse Static LIFO Ilquidation LO

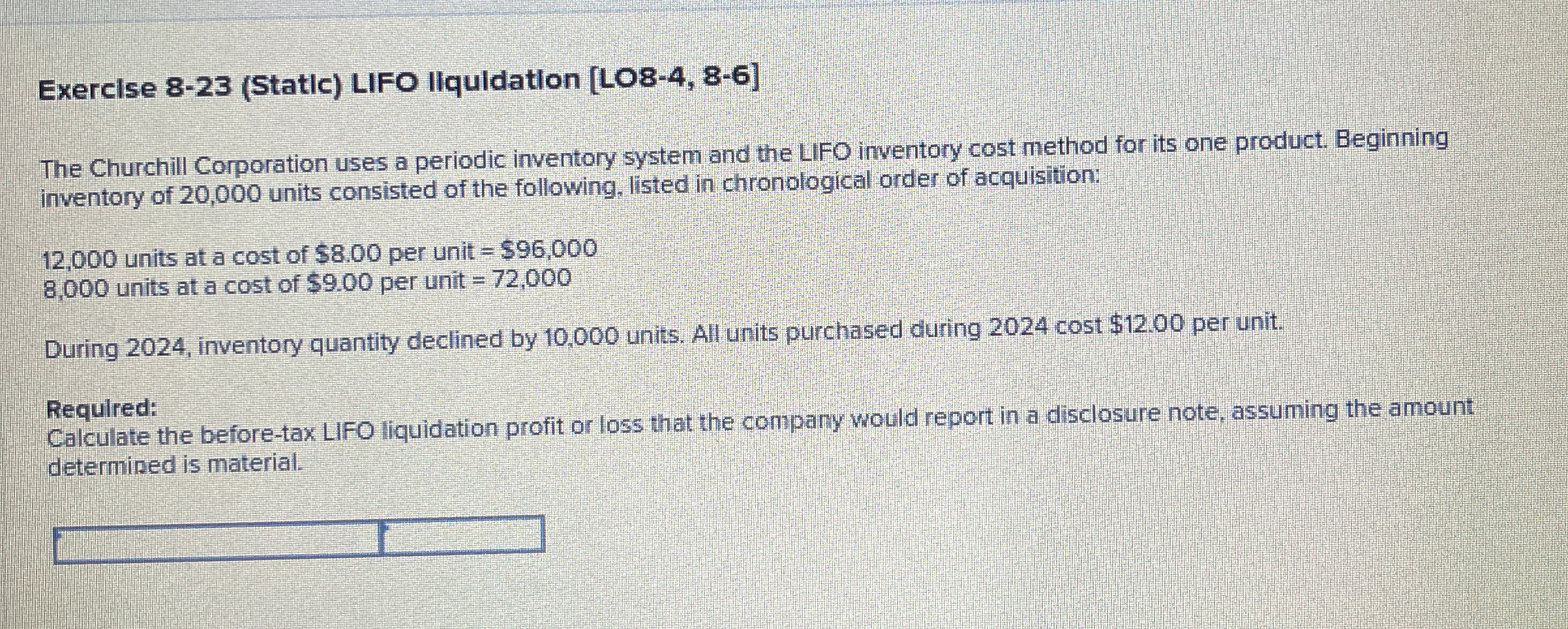

The Churchill Corporation uses a periodic inventory system and the LFO inventory cost method for its one product. Beginning inventory of units consisted of the following, listed in chronological order of acquisition:

units at a cost of $ per unit $

units at a cost of $ per unit

During inventory quantity declined by units. All units purchased during cost $ per unit.

Requlred:

Calculate the beforetax LIFO liquidation profit or loss that the company would report in a disclosure note, assuming the amount determined is material.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock