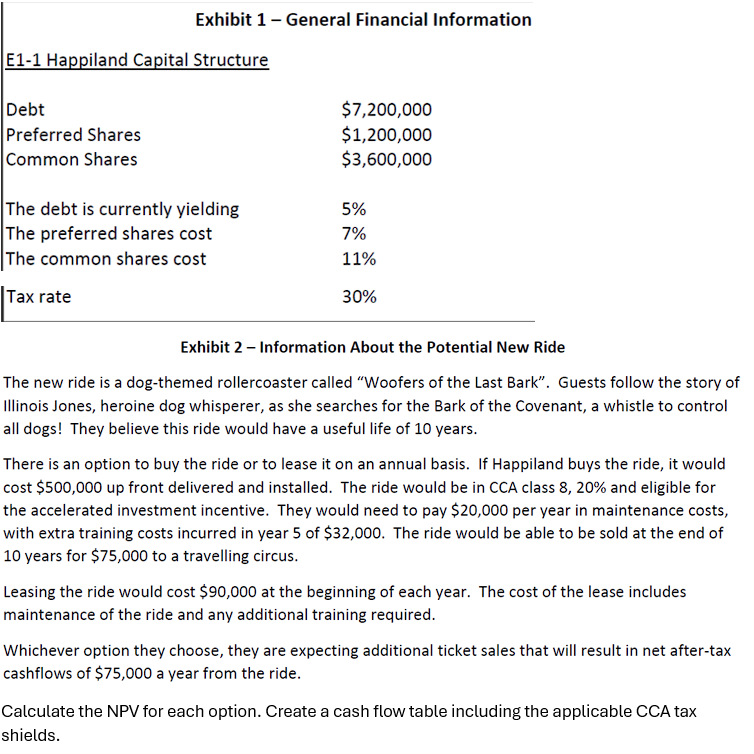

Question: Exhibit 1 - General Financial Information E1-1 Happiland Capital Structure Debt $7,200,000 Preferred Shares $1,200,000 Common Shares $3,600,000 The debt is currently yielding 5%

Exhibit 1 - General Financial Information E1-1 Happiland Capital Structure Debt $7,200,000 Preferred Shares $1,200,000 Common Shares $3,600,000 The debt is currently yielding 5% The preferred shares cost 7% The common shares cost 11% Tax rate 30% Exhibit 2 - Information About the Potential New Ride The new ride is a dog-themed rollercoaster called "Woofers of the Last Bark". Guests follow the story of Illinois Jones, heroine dog whisperer, as she searches for the Bark of the Covenant, a whistle to control all dogs! They believe this ride would have a useful life of 10 years. There is an option to buy the ride or to lease it on an annual basis. If Happiland buys the ride, it would cost $500,000 up front delivered and installed. The ride would be in CCA class 8, 20% and eligible for the accelerated investment incentive. They would need to pay $20,000 per year in maintenance costs, with extra training costs incurred in year 5 of $32,000. The ride would be able to be sold at the end of 10 years for $75,000 to a travelling circus. Leasing the ride would cost $90,000 at the beginning of each year. The cost of the lease includes maintenance of the ride and any additional training required. Whichever option they choose, they are expecting additional ticket sales that will result in net after-tax cashflows of $75,000 a year from the ride. Calculate the NPV for each option. Create a cash flow table including the applicable CCA tax shields.

Step by Step Solution

There are 3 Steps involved in it

To calculate the net present value NPV for each option buying or leasing the ride we need to create ... View full answer

Get step-by-step solutions from verified subject matter experts