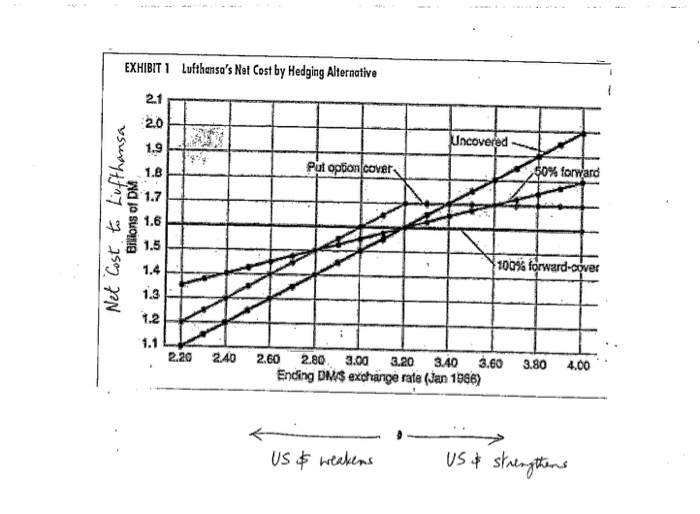

Question: EXHIBIT 1 Lufthansa's Net Cost by Hedging Alternative Uncovered Put option cover 50% forward to Lufthansa Britons of DM Cost 100% forward-cover Net 2.20 240

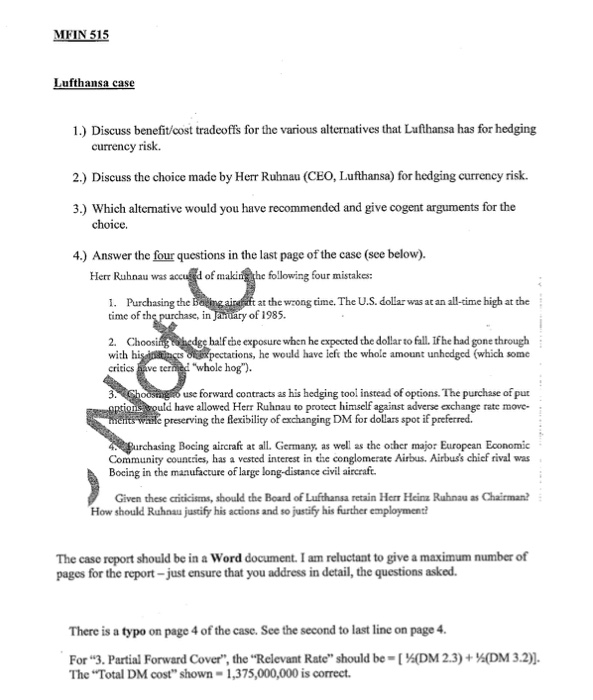

EXHIBIT 1 Lufthansa's Net Cost by Hedging Alternative Uncovered Put option cover 50% forward to Lufthansa Britons of DM Cost 100% forward-cover Net 2.20 240 3.80 4.00 2.60 2.80 3.00 3.20 3.40 3.60 Ending DNS exchange rate (Jan 1986) US $ weakens US & strengthens MFIN 515 Lufthansa case 1.) Discuss benefit/cost tradeoffs for the various alternatives that Lufthansa has for hedging currency risk. 2.) Discuss the choice made by Herr Ruhnau (CEO, Lufthansa) for hedging currency risk. 3.) Which alternative would you have recommended and give cogent arguments for the choice. 4.) Answer the four questions in the last page of the case (see below). Herr Ruhnau was accused of making the following four mistakes: 1. Purchasing the Boeing airauft at the wrong time. The U.S. dollar was at an all-time high at the time of the purchase, in January of 1985. 2. Choosing hedge balfebe exposure when he expected the dollar to fall. If he had gone through with his i nces expectations, he would have left the whole amount unhedged (which some critics have tried "whole hog"). 3. Choosing to use forward contracts as his hedging tool instead of options. The purchase of pur option would have allowed Herr Ruhnau to protect himself against adverse exchange rate move merits While preserving the flexibility of exchanging DM for dollars spot if preferred. 4. Barchasing Boeing aircraft at all. Germany, as well as the other major European Economic Community countries, has a vested interest in the conglomerate Airbus. Airbus's chief rival was Boeing in the manufacture of large long-distance civil aircraft. Given these criticisms, should the Board of Lufthansa retain Herr Heinz Ruhnau as Chairman? How should Ruhnu justify his actions and so justify his further employment? The case report should be in a Word document. I am reluctant to give a maximum number of pages for the report - just ensure that you address in detail, the questions asked. There is a typo on page 4 of the case. See the second to last line on page 4. For "3. Partial Forward Cover", the "Relevant Rate" should be - [DM 2.3) + (DM 3.2)] The "Total DM cost" shown - 1,375,000,000 is correct. EXHIBIT 1 Lufthansa's Net Cost by Hedging Alternative Uncovered Put option cover 50% forward to Lufthansa Britons of DM Cost 100% forward-cover Net 2.20 240 3.80 4.00 2.60 2.80 3.00 3.20 3.40 3.60 Ending DNS exchange rate (Jan 1986) US $ weakens US & strengthens MFIN 515 Lufthansa case 1.) Discuss benefit/cost tradeoffs for the various alternatives that Lufthansa has for hedging currency risk. 2.) Discuss the choice made by Herr Ruhnau (CEO, Lufthansa) for hedging currency risk. 3.) Which alternative would you have recommended and give cogent arguments for the choice. 4.) Answer the four questions in the last page of the case (see below). Herr Ruhnau was accused of making the following four mistakes: 1. Purchasing the Boeing airauft at the wrong time. The U.S. dollar was at an all-time high at the time of the purchase, in January of 1985. 2. Choosing hedge balfebe exposure when he expected the dollar to fall. If he had gone through with his i nces expectations, he would have left the whole amount unhedged (which some critics have tried "whole hog"). 3. Choosing to use forward contracts as his hedging tool instead of options. The purchase of pur option would have allowed Herr Ruhnau to protect himself against adverse exchange rate move merits While preserving the flexibility of exchanging DM for dollars spot if preferred. 4. Barchasing Boeing aircraft at all. Germany, as well as the other major European Economic Community countries, has a vested interest in the conglomerate Airbus. Airbus's chief rival was Boeing in the manufacture of large long-distance civil aircraft. Given these criticisms, should the Board of Lufthansa retain Herr Heinz Ruhnau as Chairman? How should Ruhnu justify his actions and so justify his further employment? The case report should be in a Word document. I am reluctant to give a maximum number of pages for the report - just ensure that you address in detail, the questions asked. There is a typo on page 4 of the case. See the second to last line on page 4. For "3. Partial Forward Cover", the "Relevant Rate" should be - [DM 2.3) + (DM 3.2)] The "Total DM cost" shown - 1,375,000,000 is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts