Question: Exhibit 1 : Simplified Balance Sheets for ABC Tech Inc. ( in $ thousands ) table [ [ Year , 2 0 2 3

Exhibit : Simplified Balance Sheets for ABC Tech Inc. in $ thousands

tableYearAssetsCash & Cash Equivalents,Accounts Receivable,InventoryProperty Plant & Equipment,Less: Accumulated Depreciation,Net Property, Plant & Equipment,Total Assets,

tableLiabilities & Stockholders' Equity,,,,,Accounts Payable,Shortterm Debt,Longterm Debt,Total Liabilities,Stockholders Equity,Total Liabilities and Equity,

Exhibit : Simplified Income Statements for ABC Tech Inc. in $ thousands

tableYearRevenuesCost of Goods Sold,Gross Profit,Selling General and Admin. Expenses,DepreciationOperating Income EBITInterest Expense,Income Before Taxes,Taxes Net Income, Exhibit : Simplified Balance Sheets for ABC Tech and Peer Firms as of in $ thousands

Liabilities & Stockholders'

Equity

Exhibit : Simplified Income Statements for ABC Tech and Peer Firms as of in $ thousandsQuestion

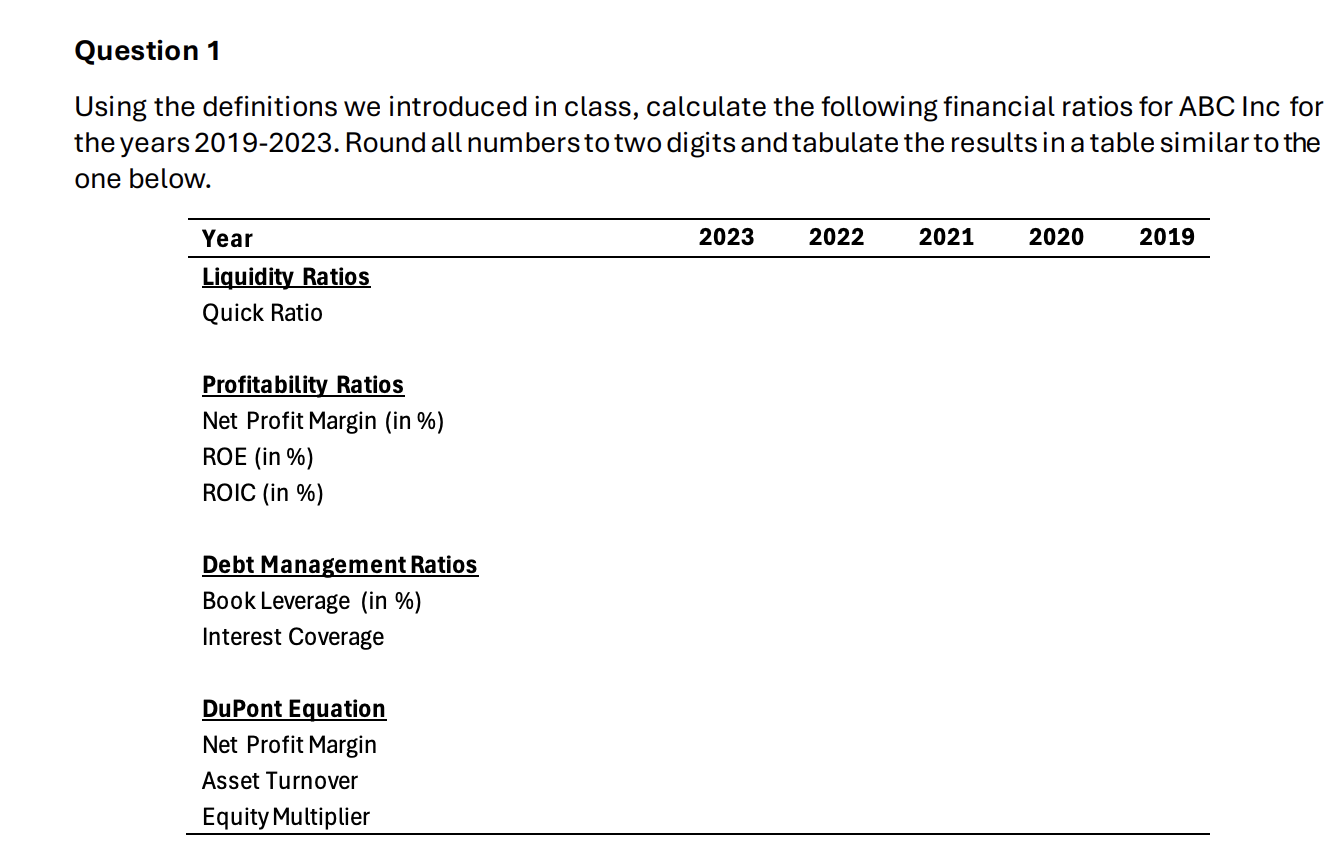

Using the definitions we introduced in class, calculate the following financial ratios for ABC Inc for

the years Round all numbers to two digits and tabulate the results in a table similar to the

one below.

Part :

Based on your analysis in Question briefly answer the following questions about ABC financial

health and performance over the past five years.

How has ABCs quick ratio evolved over the past five years? What does ABCs current liquidity

ratio imply about its ability to meet its shortterm obligations?

How have ABCs debt management ratios evolved over the past five years? How is the firm

positioned to meet its interest expenses?

How has ABCs ROE evolved over the past five years?

Based on the components of the DuPont Equation, why is ABCs ROE in higherlower

than its ROE in

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock