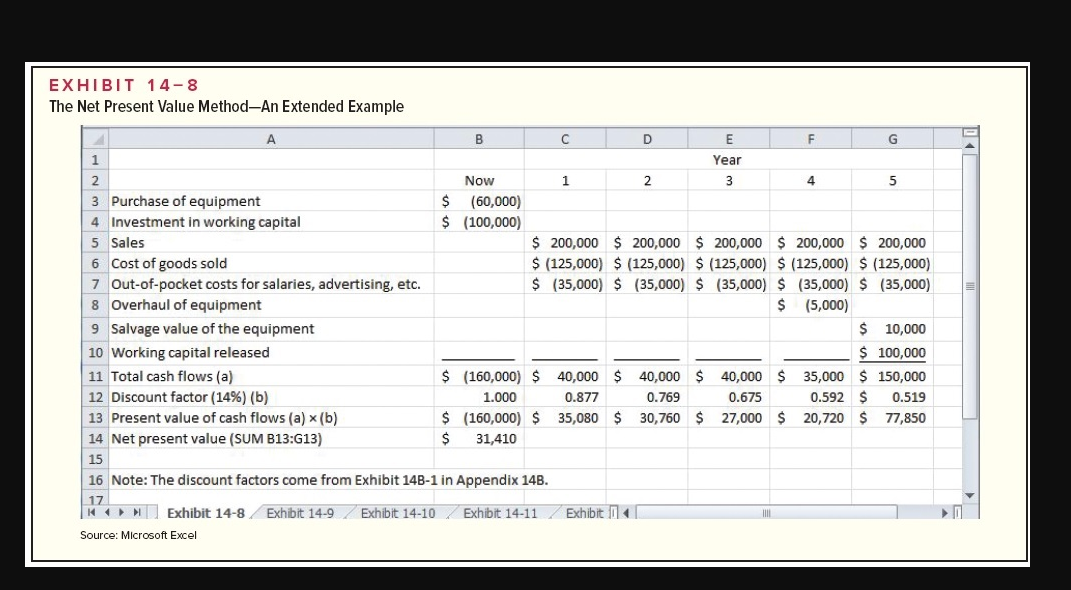

Question: EXHIBIT 14-8 The Net Present Value Method-An Extended Example G 4 A B D E F 1 Year 2 Now 1 2 3 5 3

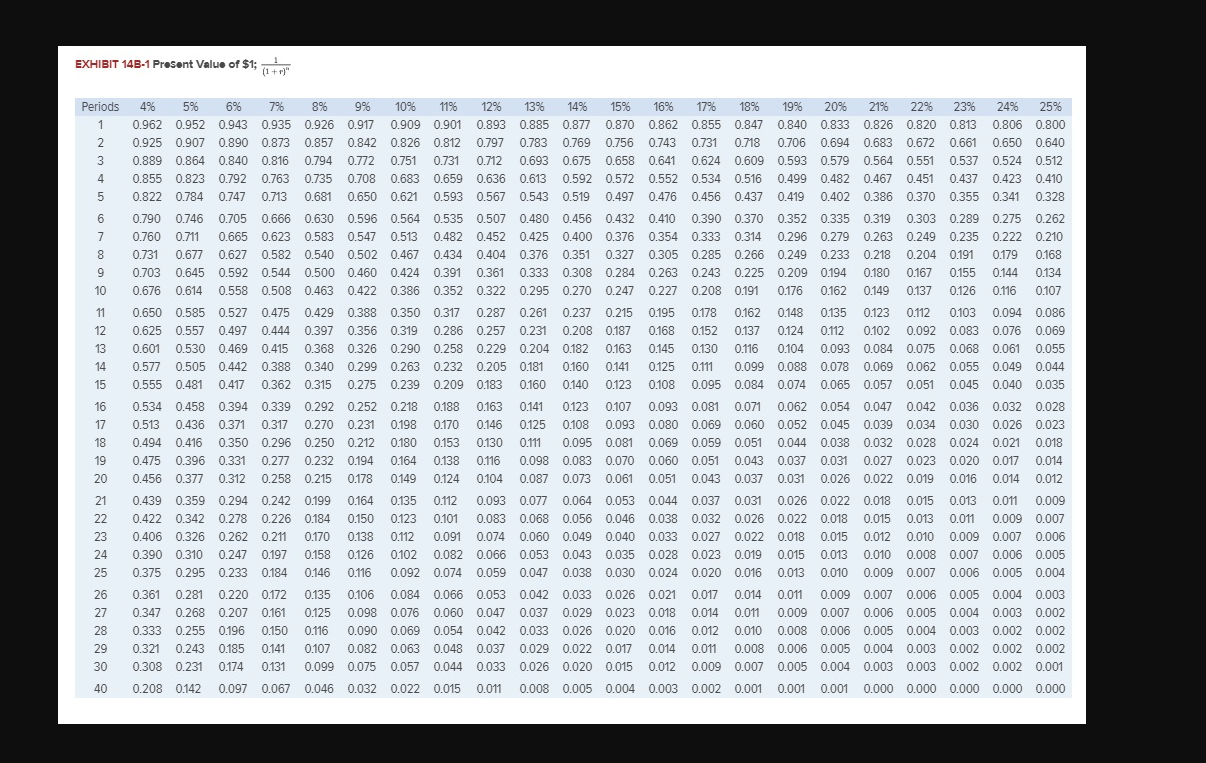

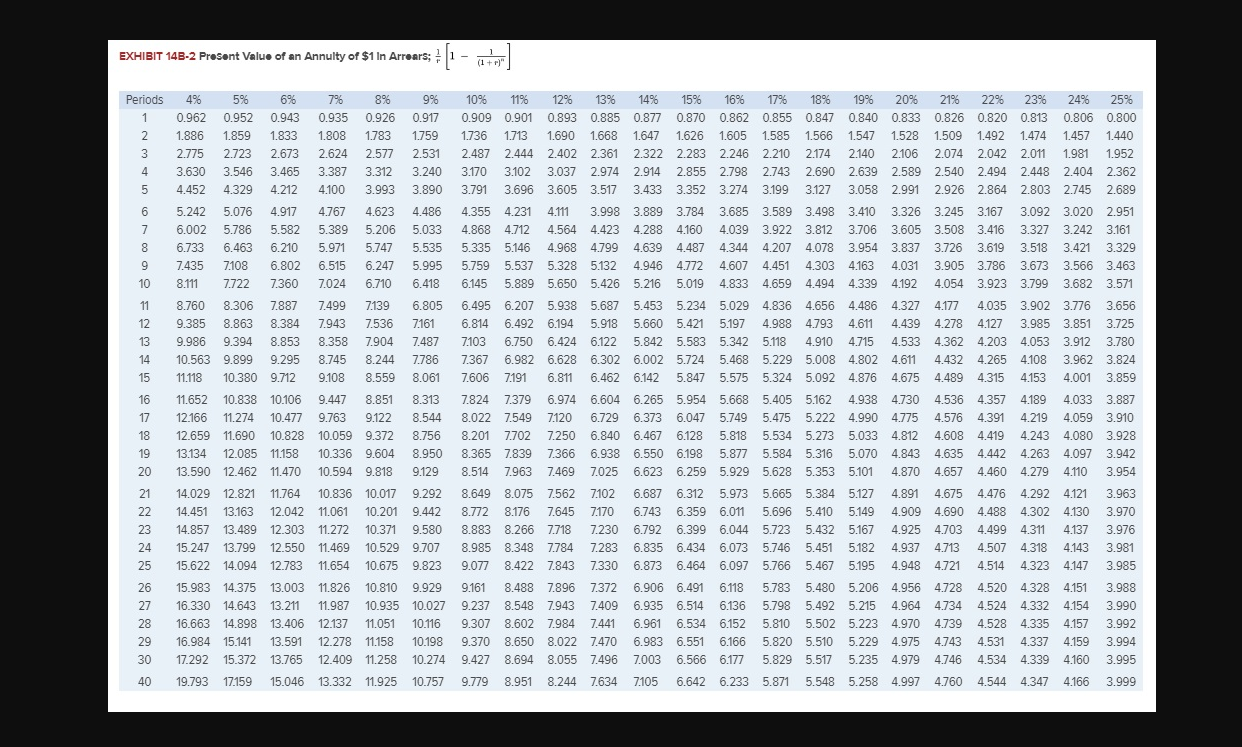

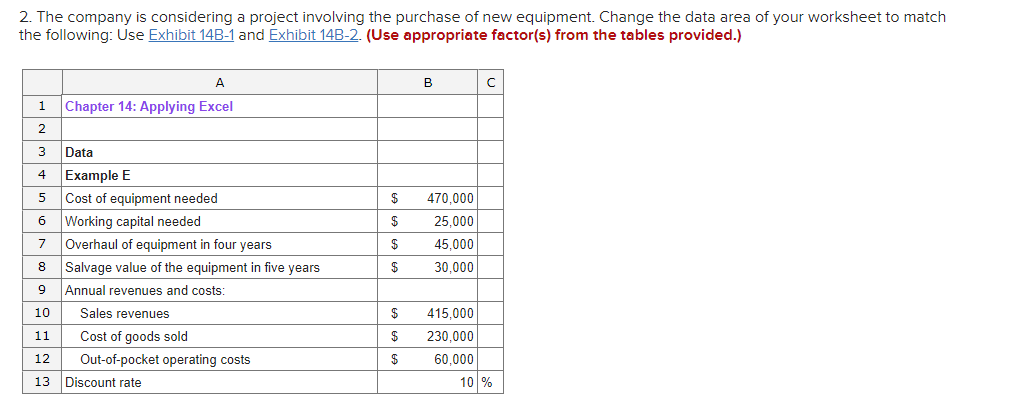

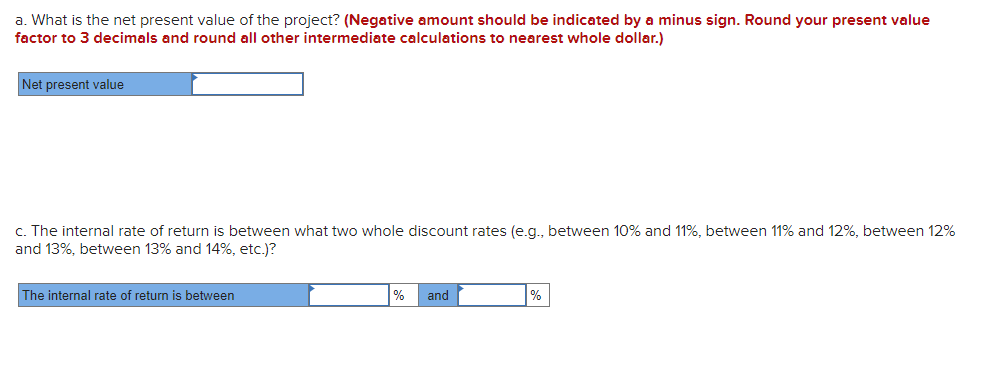

EXHIBIT 14-8 The Net Present Value Method-An Extended Example G 4 A B D E F 1 Year 2 Now 1 2 3 5 3 Purchase of equipment $ (60,000) 4 Investment in working capital $ (100,000) 5 Sales $ 200,000 $ 200,000 $ 200,000 $ 200,000 $200,000 6 Cost of goods sold $ (125,000) $ (125,000) $ (125,000) $ (125,000) $ (125,000) 7 Out-of-pocket costs for salaries, advertising, etc. $ (35,000) $ (35,000) $ (35,000) $ (35,000) $ (35,000) 8 Overhaul of equipment $ (5,000) 9 Salvage value of the equipment $ 10,000 10 Working capital released $ 100,000 11 Total cash flows (a) $ (160,000) $ 40,000 $ 40,000 $ 40,000 $ 35,000 $ 150,000 12 Discount factor (14%) (b) 1.000 0.877 0.769 0.675 0.592 $ 0.519 13 Present value of cash flows (a) (b) $ (160,000) $ 35,080 $ 30,760 $ 27,000 $ 20,720 S 77,850 14 Net present value (SUM B13:513) $ 31,410 15 16 Note: The discount factors come from Exhibit 14B-1 in Appendix 14B. 17 RExhibit 14-8 Exhibit 14-9 Exhibit 14-10 Exhibit 14-11 Exhibit Source: Microsoft Excel EXHIBIT 14B-1 Present Value of $1; 1+ (r)" Periods 1 2 3 4 5 6 7 8 9 10 11 12 0.178 13 14 15 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 15% 16% 1796 18% 19% 20% 21% 22% 23% 24% 25% 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 0.877 0.870 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 0.925 0.907 0.890 0.873 0.857 0.842 0.842 0.826 0.812 0.797 0.783 0.769 0.756 0.743 0.731 0.718 0.706 0.694 0.683 0.672 0.661 0.650 0.640 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.693 0.675 0.658 0.641 0.624 0.609 0.609 0.593 0.579 0.564 0.551 0.537 0.524 0.512 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.613 0.592 0.572 0.552 0.534 0.516 0.499 0.482 0.467 0.451 0.437 0.423 0.410 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.543 0.519 0.497 0.476 0.456 0.437 0.419 0.402 0.386 0.370 0.355 0.341 0.328 0.790 0.746 0.705 0.666 0.630 0.630 0.596 0.564 0.535 0.507 0.480 0.456 0.432 0.410 0.390 0.370 0.352 0.335 0.319 0.303 0.289 0.275 0.262 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.452 0.425 0.400 0.376 0.354 0.333 0.314 0.296 0.279 0.263 0.249 0.249 0.235 0.222 0.210 0.731 0.677 0.627 0.582 0.540 0.502 0.467 0.582 0.540 0.502 0.467 0.434 0.404 0.376 0.404 0.376 0.351 0.327 0.305 0.285 0.305 0.285 0.266 0.249 0.233 0.218 0.204 0.191 0.179 0.168 0.703 0.645 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.333 0.333 0.308 0.308 0.284 0.263 0.243 0.225 0.225 0.209 0.194 0.180 0.167 0.155 0.144 0.134 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.322 0.295 0.270 0.247 0.227 0.208 0.191 0.176 0.162 0.149 0.137 0.126 0.116 0.107 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.261 0.237 0.215 0.195 0.162 0.148 0.135 0.123 0.112 0.103 0.094 0.086 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.231 0.208 0.187 0.168 0.152 0.137 0.124 0.112 0.102 0.092 0.083 0.076 0.069 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.204 0.182 0.163 0.145 0.130 0.116 0.104 0.093 0.093 0.084 0.075 0.068 0.061 0.061 0.055 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.263 0.232 0.205 0.181 0.160 0.141 0.125 0.111 0.099 0.088 0.078 0.069 0.062 0.055 0.049 0.044 0.555 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.160 0.140 0.123 0.108 0.095 0.084 0.074 0.065 0.057 0.051 0.045 0.040 0.035 0.534 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.141 0.123 0.107 0.093 0.081 0.071 0.062 0.054 0.047 0.042 0.036 0.032 0.028 0.513 0.436 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.125 0.108 0.093 0.080 0.069 0.060 0.052 0.045 0.039 0.034 0.030 0.026 0.026 0.023 0.494 0.416 0.350 0.296 0.250 0.212 0.180 0.153 0.130 0.111 0.095 0.081 0.069 0.059 0.051 0.044 0.038 0.032 0.028 0.024 0.021 0.018 0.475 0.396 0.331 0.277 0.232 0.232 0.194 0.164 0.138 0.116 0.098 0.083 0.070 0.060 0.051 0.043 0.037 0.031 0.027 0.023 0.020 0.017 0.014 0.456 0.377 0.312 0.258 0.215 0.178 0.149 0.124 0.104 0.087 0.073 0.061 0.051 0.043 0.037 0.031 0.026 0.026 0.022 0.019 0.016 0.014 0.014 0.012 0.439 0.359 0.294 0.294 0.2420.199 0.164 0.135 0.112 0.093 0.077 0.064 0.053 0.044 0.037 0.037 0.031 0.026 0.022 0.018 0.015 0.013 0.011 0.009 0.422 0.342 0.278 0.226 0.184 0.150 0.123 0.101 0.083 0.068 0.056 0.046 0.038 0.038 0.032 0.026 0.022 0.018 0.015 0.013 0.0110.009 0.007 0.406 0.326 0.262 0.211 0.170 0.138 0.112 0.091 0.074 0.074 0.060 0.049 0.040 0.033 0.027 0.022 0.018 0.015 0.012 0.010 0.009 0.007 0.006 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.053 0.043 0.035 0.028 0.023 0.019 0.015 0.013 0.010 0.008 0.007 0.006 0.005 0.375 0.295 0.233 0.184 0.116 0.092 0.074 0.059 0.047 0.038 0.030 0.024 0.020 0.016 0.013 0.010 0.009 0.007 0.006 0.005 0.004 0.361 0.281 0.281 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0.042 0.033 0.026 0.021 0.017 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.347 0.268 0.207 0.161 0.125 0.098 0.076 0.060 0.047 0.037 0.029 0.023 0.018 0.014 0.011 0.009 0.007 0.006 0.005 0.004 0.003 0.002 0.333 0.255 0.196 0.150 0.116 0.090 0.069 0.054 0.042 0.033 0.026 0.020 0.016 0.012 0.010 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.321 0.243 0.185 0.141 0.107 0.082 0.063 0.048 0.037 0.029 0.022 0.017 0.014 0.011 0.008 0.006 0.005 0.004 0.003 0.002 0.002 0.002 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 0.020 0.015 0.033 0.026 0.020 0.015 0.012 0.009 0.007 0.005 0.004 0.003 0.003 0.002 0.002 0.001 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 0.005 0.004 0.003 0.002 0.001 0.001 0.001 0.000 0.000 0.000 0.000 0.000 16 17 18 19 20 21 22 23 24 25 0.146 26 27 28 29 30 40 EXHIBIT 14B-2 Present Value of an Annulty of $1 In Arrears; } - (1 + Periods 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 4% 5% 6% 7% 8% 9% 0.962 0.952 0.943 0.935 0.926 0.917 1.886 1.859 1.833 1.808 1.783 1.759 2.775 2.723 2.673 2.624 2.577 2.531 3.630 3.546 3.465 3.387 3.312 3.240 4.452 4.329 4.212 4.100 3.993 3.890 5.242 5.076 4.917 4.767 4.623 4.486 6.002 5.786 5.582 5.389 5.206 5.033 6.733 6.463 6.210 5.971 5.747 5.535 7.435 7.108 6.802 6.515 6.247 5.995 8.111 7.722 7.360 7.024 6.710 6.418 8.760 8.306 7.887 7.499 7.139 6.805 9.385 8.863 8.384 7.943 7.536 7161 9.986 9.394 8.853 8.358 7.904 7.487 10.563 9.899 9.295 8.745 8.244 7.786 11.118 10.380 9.712 9.108 8.559 8.061 11.652 10.838 10.106 9.447 8.851 8.313 12.166 11.274 10.477 9.763 9.122 8.544 12.659 11.690 10.828 10.059 9.372 8.756 13.134 12.085 11.158 10.336 9.604 8.950 13.590 12.462 11.470 10.594 9.818 9.129 14.029 12.821 11.764 10.836 10.017 9.292 14.451 13.163 12.042 11.061 10.201 9.442 14.857 13.489 12.303 11.272 10.371 9.580 15.247 13.799 12.550 11.469 10.529 9.707 15.622 14.094 12.783 11.654 10.675 9.823 15.983 14.375 13.003 11.826 10.810 9.929 16.330 14.643 13.211 11.987 10.935 10.027 16.663 14.898 13.406 12.137 11.051 10.116 16.984 15.141 13.591 12.278 11.158 10.198 17.292 15.372 13.765 12.409 11.258 10.274 19.793 17.159 15.046 13.332 11.925 10.757 10% 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 21% 22% 23% 24% 25% 0.909 0.901 0.893 0.885 0.877 0.870 0.862 0.855 0.847 0.840 0.833 0.826 0.820 0.813 0.806 0.800 1.736 1.713 1.690 1.668 1.647 1.626 1.605 1.585 1.566 1.547 1.528 1.509 1.492 1.474 1.457 1.440 2.487 2.444 2.402 2.361 2.322 2.283 2.246 2.210 2.174 2.140 2.106 2.074 2.042 2.011 1.981 1.952 3.170 3.102 3.037 2.974 2.914 2.855 2.798 2.743 2.690 2.639 2.589 2.540 2.494 2.448 2.448 2.404 2.362 3.791 3.696 3.605 3.517 3.433 3.352 3.274 3.199 3.127 3.058 2.991 2.926 2.864 2.803 2.745 2.689 4.355 4.231 4.111 3.998 3.889 3.784 3.685 3.589 3.498 3.410 3.410 3.326 3.245 3.167 3.092 3.020 2.951 4.868 4.712 4.564 4.423 4.288 4.160 4.039 3.922 3.812 3.706 3.605 3.508 3.416 3.327 3.242 3.161 5.335 5.146 4.968 4.799 4.639 4.487 4.344 4.207 4.078 3.954 3.837 3.726 3.619 3.518 3.421 3.329 5.759 5.537 5.537 5.328 5.132 4.946 4.772 4.607 4.451 4.303 4.163 4.031 3.905 3.786 3.673 3.566 3.463 6.145 5.889 5.650 5.426 5.216 5.019 4.833 4.659 4.494 4.339 4.339 4.192 4.054 3.923 3.799 3.799 3.682 3.571 6.495 6.207 5.938 5.687 5.453 5.234 5.029 4.836 4.656 4.486 4.327 4.177 4.035 3.902 3.776 3.656 6.814 6.492 6.194 5.918 5.660 5.421 5.197 4.988 4.793 4.611 4.439 4.278 4.127 3.985 3.851 3.725 7.103 6.750 6.424 6.122 5.842 5.583 5.342 5.118 4.910 4.715 4.533 4.362 4.203 4.203 4.053 4.053 3.912 3.780 7.367 6.982 6.628 6.302 6.002 5.724 5.468 5.229 5.008 4.802 4.611 4.432 4.265 4.108 3.962 3.824 7.606 7191 6.811 6.462 6.142 5.847 5.575 5.324 5.092 4.876 4.675 4.489 4.315 4.153 4.001 3.859 7.824 7.379 6.974 6.604 6.265 5.954 5.668 5.405 5.162 4.938 4.730 4.536 4.357 4.189 4.033 3.887 8.022 7.549 7.120 6.729 6.373 6.047 5.749 5.475 5.222 4.990 4.775 4.576 4.391 4.219 4.059 3.910 8.201 7.702 7.250 6.840 6.467 6.128 5.818 5.534 5.273 5.033 4.812 4.608 4.419 4.243 4.080 3.928 8.365 7.839 7.366 6.938 6.550 6.198 5.877 5.584 5.316 5.070 4.843 4.635 4.442 4.263 4.097 3.942 8.514 7.963 7.469 7.025 6.623 6.259 5.929 5.628 5.353 5.101 4.870 4.657 4.460 4.279 4.110 3.954 8.649 8.075 8.075 7.562 7.102 6.687 6.312 5.973 5.665 5.384 5.127 4.891 4.675 4.476 4.292 4.121 3.963 8.772 8.176 7.645 7.170 6.743 6.359 6.011 5.696 5.410 5.149 4.909 4.690 4.690 4.488 4.302 4.130 3.970 8.883 8.266 7.718 7.230 6.792 6.399 6.044 5.723 5.432 5.167 4.925 4.703 4.499 4.311 4.137 3.976 8.985 8.348 7.784 7.283 6.835 6.434 6.073 5.746 5.451 5.182 4.937 4.713 4.507 4.318 4.143 3.981 9.077 8.422 7.843 7.330 6.873 6.464 6.097 5.766 5.467 5.195 4.948 4.721 4.514 4.323 4147 3.985 9.161 8.488 7.896 7.372 6.906 6.491 6.118 5.783 5.480 5.206 4.956 4.728 4.520 4.328 4.151 3.988 9.237 8.548 7.943 7.409 6.935 6.514 6.136 5.798 5.492 5.215 4.964 4.734 4.524 4.332 4.154 3.990 9.307 8.602 7.984 7.441 6.961 6.534 6.152 5.810 5.502 5.223 4.970 4.739 4.739 4.528 4.335 4.157 3.992 9.370 8.650 8.022 8.022 7.470 6.983 6.551 6.166 5.820 5.510 5.229 4.975 4.743 4.531 4.337 4.159 3.994 9.427 8.694 8.055 7496 7.003 6.566 6.177 5.829 5.517 5.235 4.979 4.746 4.534 4.339 4.160 3.995 9.779 8.951 8.244 7.634 7.105 6.642 6.233 5.871 5.548 5.258 4.997 4.760 4.544 4.347 4.166 3.999 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 40 2. The company is considering a project involving the purchase of new equipment. Change the data area of your worksheet to match the following: Use Exhibit 14B-1 and Exhibit 14B-2. (Use appropriate factor(s) from the tables provided.) A B 1 Chapter 14: Applying Excel 2. 3 4 5 $ 6 $ 470,000 25,000 45,000 30.000 7 $ Data Example E Cost of equipment needed Working capital needed Overhaul of equipment in four years Salvage value of the equipment in five years Annual revenues and costs: Sales revenues Cost of goods sold Out-of-pocket operating costs Discount rate 8 $ 9 $ 10 11 $ 415,000 230,000 60,000 10 % 12 $ 13 a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value factor to 3 decimals and round all other intermediate calculations to nearest whole dollar.) Net present value c. The internal rate of return is between what two whole discount rates (e.g., between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etc.)? The internal rate of return is between % and % d. Reset the discount rate to 10%. Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a positive net present value? Minimum salvage value required to generate a positive present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts