Question: Exhibit 16.2 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM The following information is provided in the context of a two-period (two six-month periods) binomial

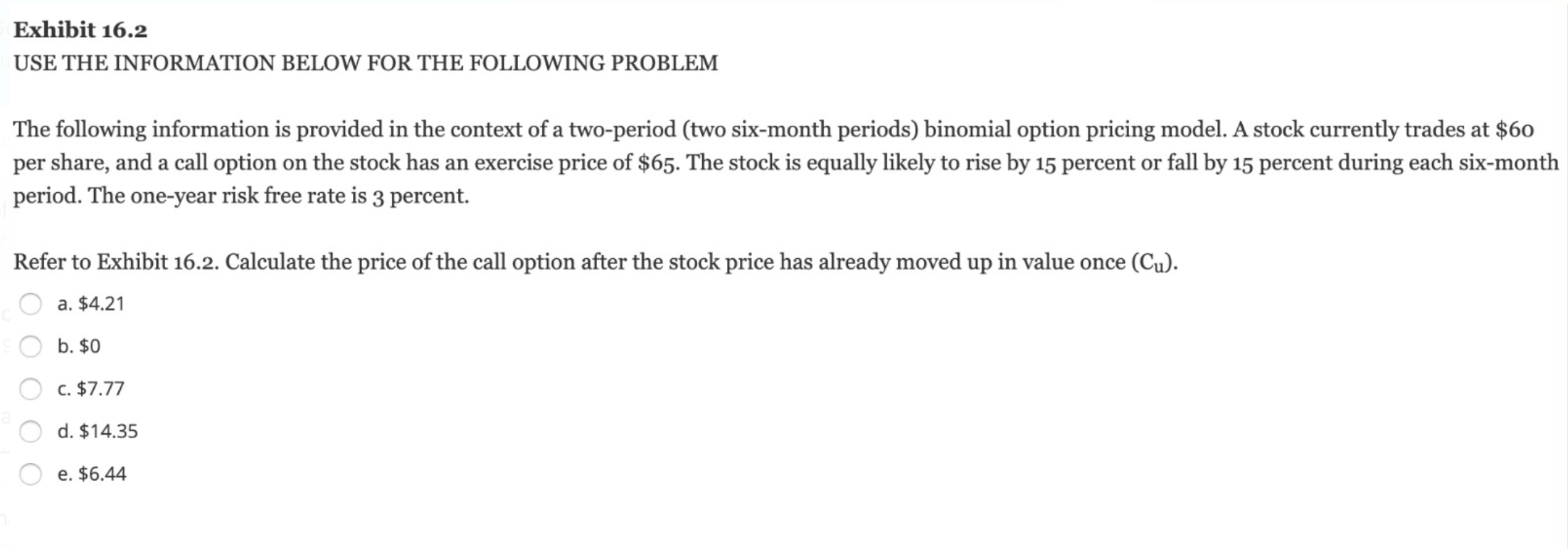

Exhibit 16.2 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM The following information is provided in the context of a two-period (two six-month periods) binomial option pricing model. A stock currently trades at $60 per share, and a call option on the stock has an exercise price of $65. The stock is equally likely to rise by 15 percent or fall by 15 percent during each six-month period. The one-year risk free rate is 3 percent. Refer to Exhibit 16.2. Calculate the price of the call option after the stock price has already moved up in value once (Cu). a. $4.21 b. $0 c. $7.77 d. $14.35 e. $6.44

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts