Question: EXHIBIT 2 - 5 Dickson Company: An Example Using Multiple Predetermined Overhead Rates Change the total fixed manufacturing overhead cost for the Milling Department in

EXHIBIT Dickson Company: An Example Using Multiple Predetermined Overhead Rates Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $ keeping all of the

other data the same as in the original example. Consider a new job, Job with the following characteristics:

In your worksheet, enter this new data in the cells for Job

What is the new selling price for Job

Without changing the data for the job from requirement above, what is the selling price for Job if the total number of machine

hours in the Assembly Department increases from machinehours to machinehours?

Restore the total number of machinehours in the Assembly Department to machinehours. And keep the job data the same

as it was in Requirement What is the selling price for Job if the total number of direct laborhours in the Assembly Department

decreases from direct laborhours to direct laborhours? Complete this question by entering your answers in the tabs below.

What is the new selling price for Job

Note: Round your final answer to decimal places.

Selling price for Job Required

Required

Without changing the data for the job from requirement above, what is the selling price for Job if the total number of

machinehours in the Assembly Department increases from machinehours to machinehours?

Note: Round your final answer to decimal places.

Selling price for Job Complete this question by entering your answers in the tabs below.

Required

Required

Restore the total number of machinehours in the Assembly Department to machinehours. And keep the job data the

same as it was in Requirement What is the selling price for Job if the total number of direct laborhours in the

Assembly Department decreases from direct laborhours to direct laborhours?

Note: Round your final answer to decimal places.

Selling price for Job

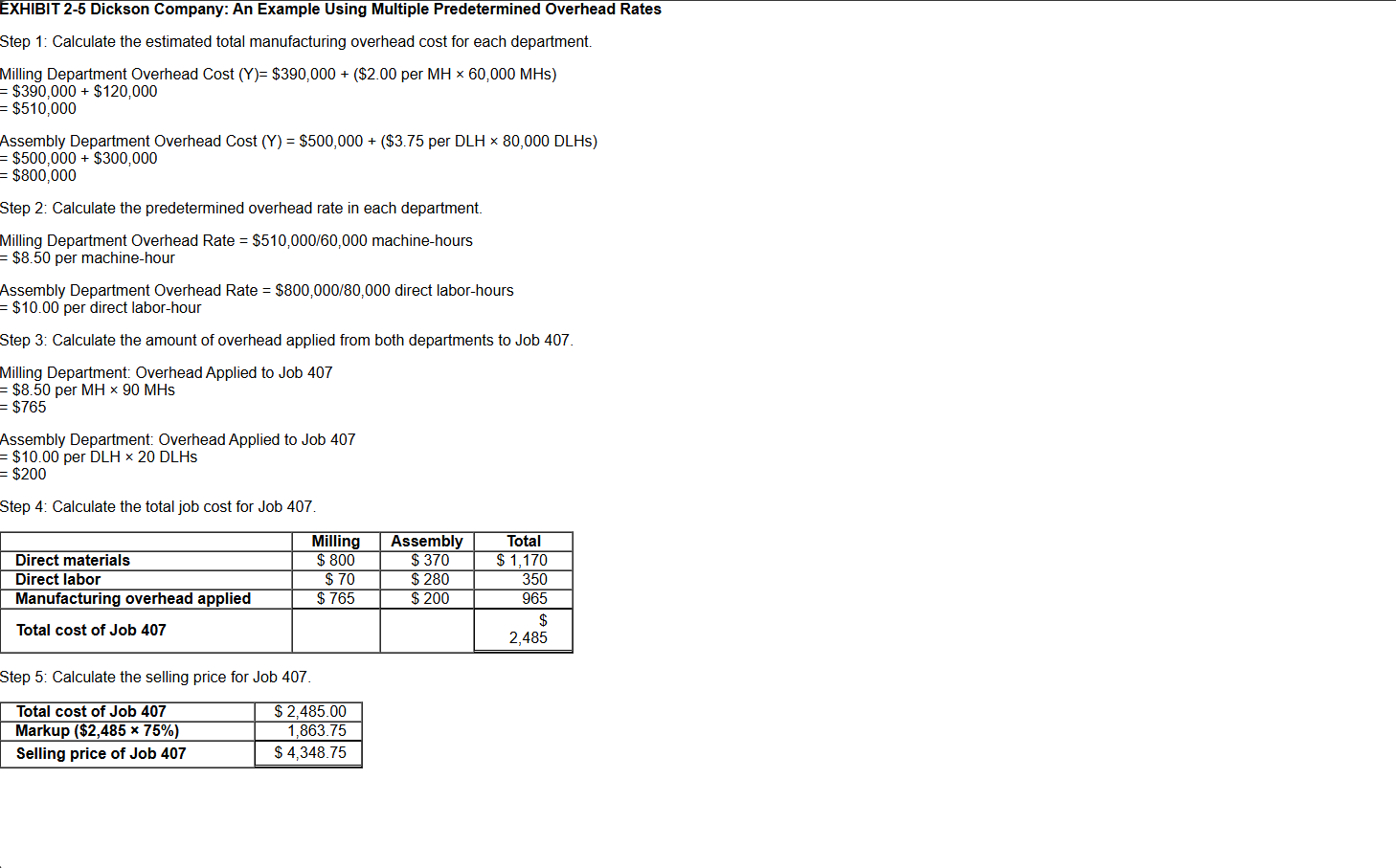

Step : Calculate the estimated total manufacturing overhead cost for each department.

Milling Department Overhead Cost $$ per

$$

$

Assembly Department Overhead Cost per DLH DLHs

Need answers for "Required

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock