Question: exhibit 2.5 below Required information Chopter 2: Applying Excel This Excel worksheet relates to the Dickson Company example that is summarized in Exinibit 2.5. Chapter

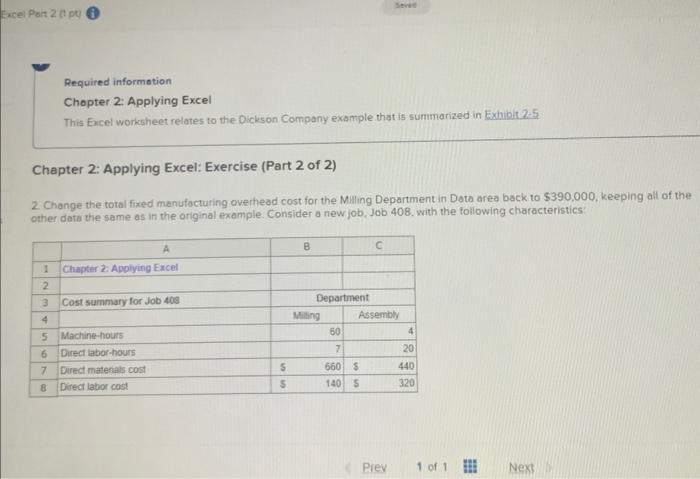

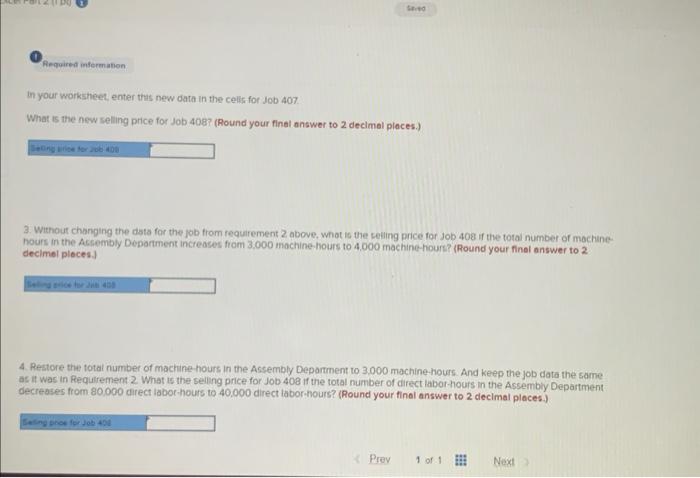

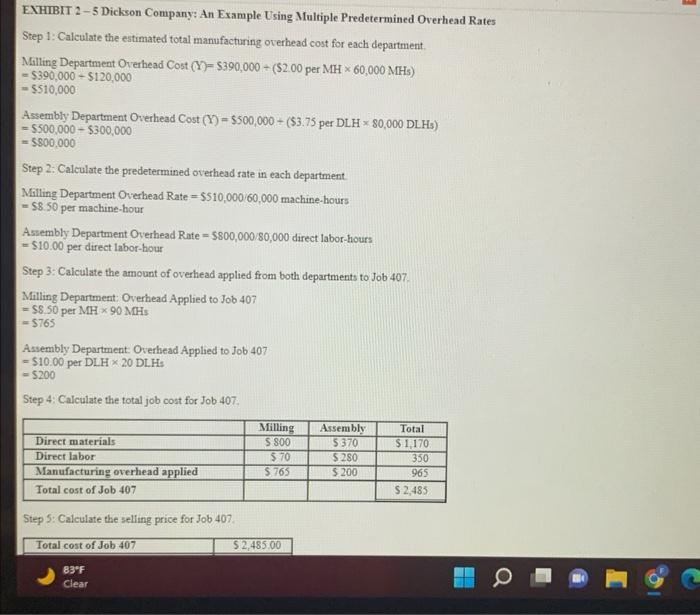

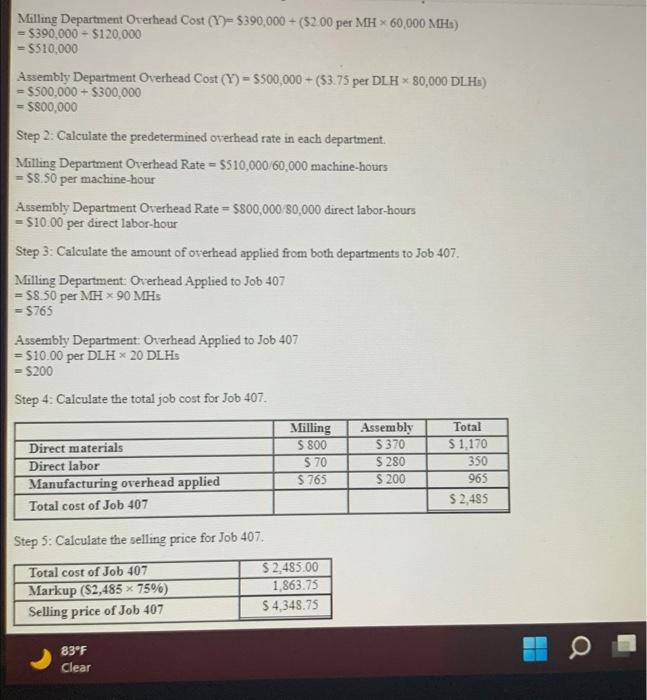

Required information Chopter 2: Applying Excel This Excel worksheet relates to the Dickson Company example that is summarized in Exinibit 2.5. Chapter 2: Applying Excel: Exercise (Part 2 of 2) 2. Change the total fixed manufocturing overhead cost for the Milling Department in Data area back to $390,000, keeping all of the other dath the same as in the original example. Consider a new job, Job 408 , with the following characteristics: in your worksheet, enter thas new data in the cells for Job 407 . What is the new seling price for Job 408 ? (Round your final answer to 2 decimal places.) 3. Without changing the dista for the job from requirement 2 above, whot is the selling price for Job 408 if the total number of mochinehours in the Acsembly Department increases from 3.000 machine-houfs to 4.000 machine-hours? (Round your finel answer to 2 decimel pleces 4. Restore the total number of machine hours in the Assembly Department to 3.000 machine-hours. And keep the job data the same as it was in Requirement 2 What is the sellng price for Job 408 if the total number of direct labor hours in the Assembiy Department decreases from 80,000 direct labothours to 40,000 direct labor-hours? (Round your final answer to 2 decimal places.) EXHIBIT 2 - 5 Dickson Company: An Example Using Multiple Predetermined Overhead Rates Step 1: Calculate the estimated total manufacturing overhead cost for each department. Malling Department Overhead Cost (Y)=$390,000($2.00 per MH 60,000MH5) =$390,000+$120,000 =5510,000 Assembly Department Overhead Cost (Y)=$500,000+($3.75 per DLH $0,000DLHs) =5500,000$300,000 =$800,000 Step 2: Calculate the predetermined overhead rate in each department. Malling Department Overhead Rate =$510,000,60,000 machine-hours =$8.50 per machine-hour Assembly Department Overhead Rate =$00,000/80,000 direct labor-hours =$10.00 per direct labor-hour Step 3: Calculate the amount of overhead applied from both departments to Job 407 . Milling Department: Overhead Applied to Job 407 =$8.50 per MH90MIHs =5765 Assembly Department: Overhead Applied to Job 407 =$10.00 per DLH 20 DLHs =5200 Step 4: Calculate the total job cost for Job 407 . Step 5: Calculate the selling price for Job 407 . =$390,000$120,000=$510,000 Assembly Department Overhead Cost (Y)=$500,000+($3.75 per DLH 80,000 DLHs ) =$500,000+$300,000 =5800,000 Step 2: Calculate the predetermined overhead rate in each department. Milling Department Overhead Rate =$510,000/60,000 machine-hours = 58.50 per machine-hour Assembly Department Overhead Rate =$800,00080,000 direct labor-hours - \$10.00 per direct labor-hour Step 3: Calculate the amount of overhead applied from both departments to Job 407. Milling Department: Overhead Applied to Job 407 =58.50 per MIH 90MHs =5765 Assembly Department: Overhead Applied to Job 407 =$10.00 per DLH 20 DLHs =5200 Step 4: Calculate the total job cost for Job 407 . Step 5: Calculate the selling price for Job 407

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts