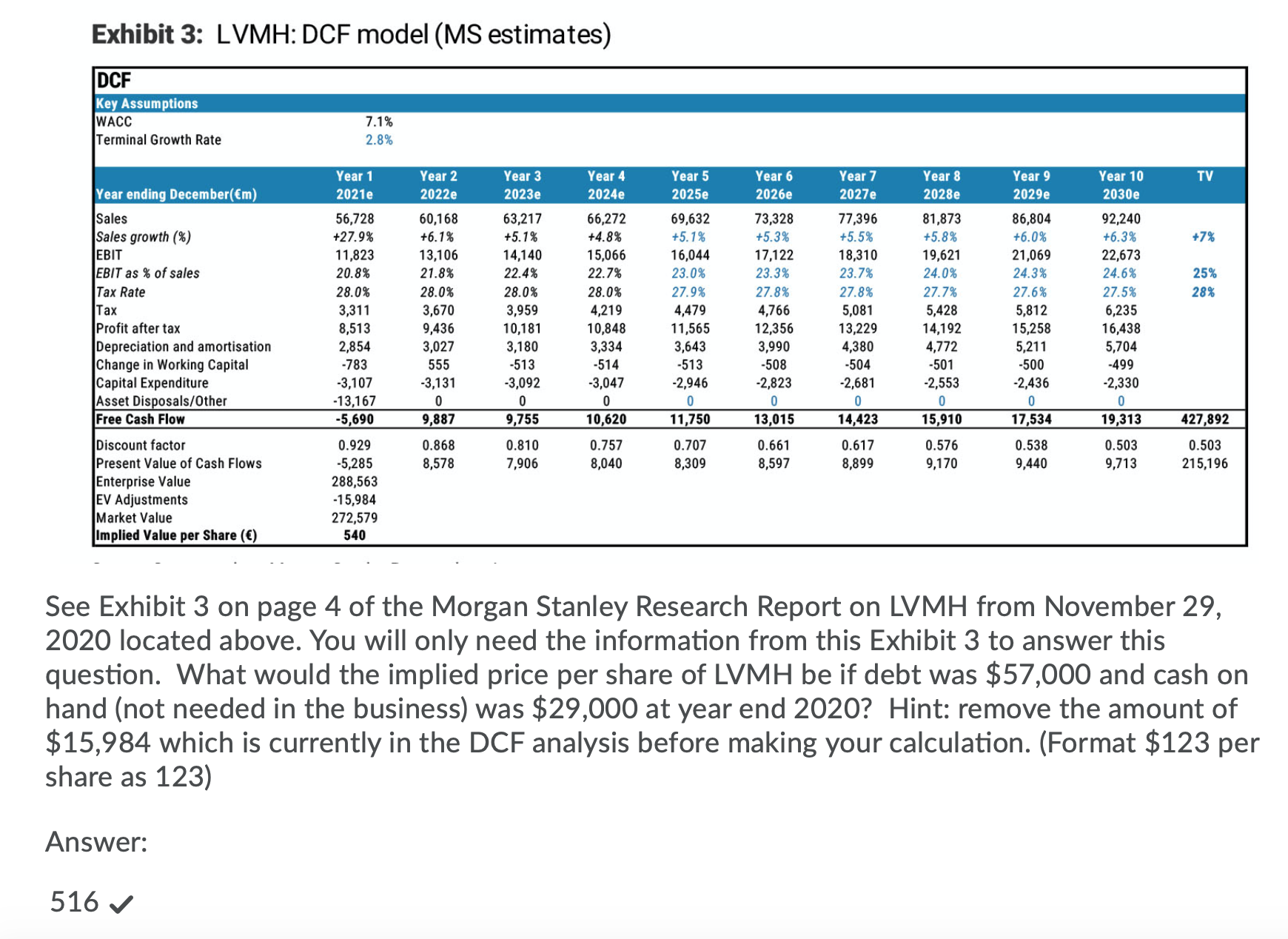

Question: Exhibit 3: LVMH: DCF model (MS estimates) DCF Key Assumptions WACO 7.1% Terminal Growth Rate 2.8% Year 1 Year 2 Year 3 Year 4 Year

Exhibit 3: LVMH: DCF model (MS estimates) DCF Key Assumptions WACO 7.1% Terminal Growth Rate 2.8% Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 TV Year ending December(Em) 2021e 2022e 023e 2024e 2025e 2026e 2027e 2028e 029e 2030e 56,728 60,168 63,217 66,272 69,632 73,328 77,396 81,873 86,804 92,240 Sales Sales growth (%) +27.9% +6.1% +5.1% +4.8% +5.1% +5.3% 5.5% +5.8% -6.0% +6.3% +7% EBIT 11.823 13,106 14,140 15,066 16,044 17,122 18,310 19,621 21,069 22,673 23.7% 24.0% 24.3% 24.69 25% EBIT as % of sales 20.8% 21.8% 22.4% 22.7% 23.0% 23.3% Tax Rate 28.0% 28.0% 28.0% 28.0% 27.9% 27.89 27.8% 27.7% 27.69 27.59 28% Tax 3,311 3,670 3,959 4,219 4,479 4,766 5,081 5,428 5,812 6,235 8,513 9,436 10,181 10,848 11,565 12,356 13,229 14,192 15,258 16,438 Profit after tax Depreciation and amortisation 2,854 3,027 3,180 3,334 3.643 3,990 4,380 4,772 5,211 5,704 -783 555 -513 -514 -513 -508 -504 -501 -500 -499 Change in Working Capital -2,553 -2,436 -2,330 Capital Expenditure -3,107 -3,131 -3,092 -3,047 -2,946 -2,823 -2,681 Asset Disposals/Other -13,167 0 0 0 0 0 0 19,313 427,892 Free Cash Flow -5,690 9,887 ,755 10,620 11,750 13,015 14,423 15,910 17,534 Discount factor 0.929 0.868 0.810 0.757 0.70 0.66 0.617 0.576 0.538 0.503 0.503 -5,285 7,906 8,040 8,309 8,597 8,899 9,170 9,440 9,713 215,196 Present Value of Cash Flows 8,578 Enterprise Value 288,563 EV Adjustments -15,984 Market Value 272,579 Implied Value per Share (() 540 See Exhibit 3 on page 4 of the Morgan Stanley Research Report on LVMH from November 29, 2020 located above. You will only need the information from this Exhibit 3 to answer this question. What would the implied price per share of LVMH be if debt was $57,000 and cash on hand (not needed in the business) was $29,000 at year end 2020? Hint: remove the amount of $15,984 which is currently in the DCF analysis before making your calculation. (Format $123 per share as 123) Answer: 516 v