Question: Exhibit 3.4 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM You decide to sell 100 shares of Davis Industries short when it is selling at

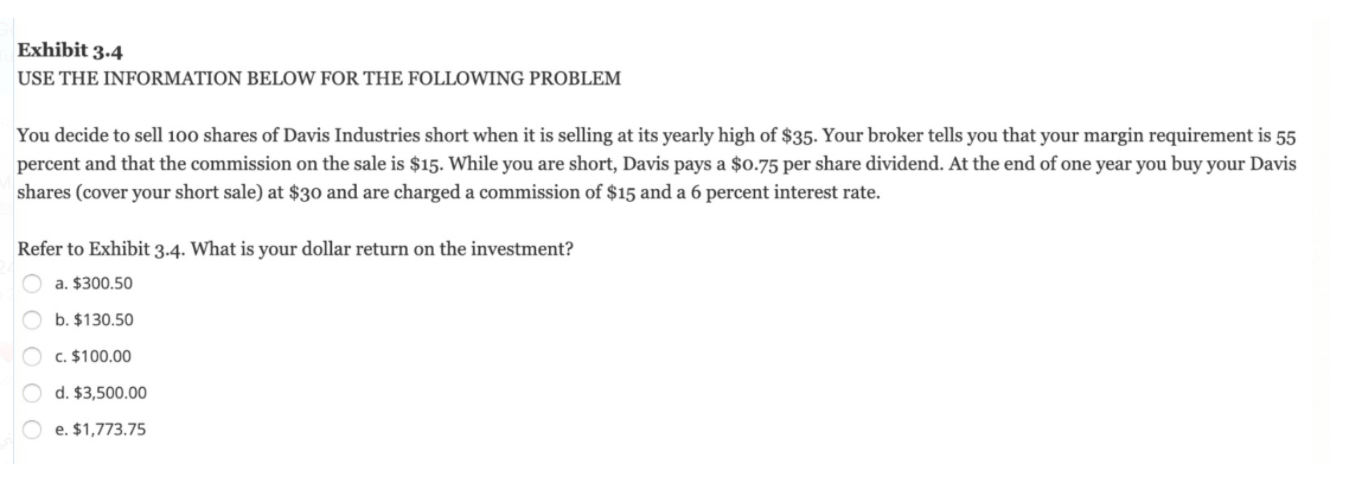

Exhibit 3.4 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM You decide to sell 100 shares of Davis Industries short when it is selling at its yearly high of $35. Your broker tells you that your margin requirement is 55 percent and that the commission on the sale is $15. While you are short, Davis pays a $0.75 per share dividend. At the end of one year you buy your Davis shares (cover your short sale) at $30 and are charged a commission of $15 and a 6 percent interest rate. Refer to Exhibit 3.4. What is your dollar return on the investment? a. $300.50 b. $130.50 c. $100.00 d. $3,500.00 e. $1,773.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts