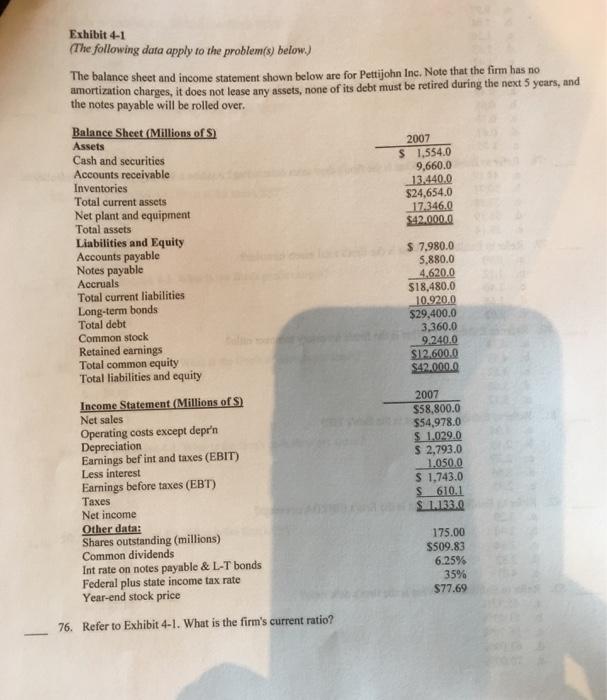

Question: Exhibit 4-1 The following data apply to the problem(s) below.) The balance sheet and income statement shown below are for Pettjiohn Inc. Note that the

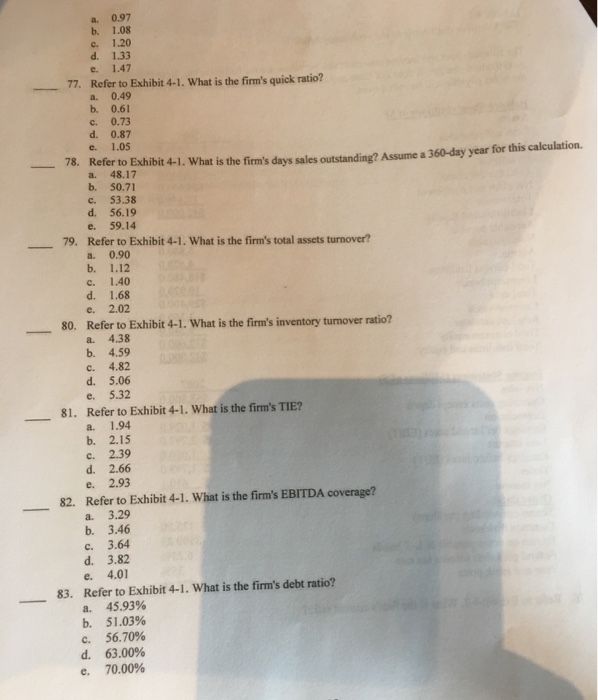

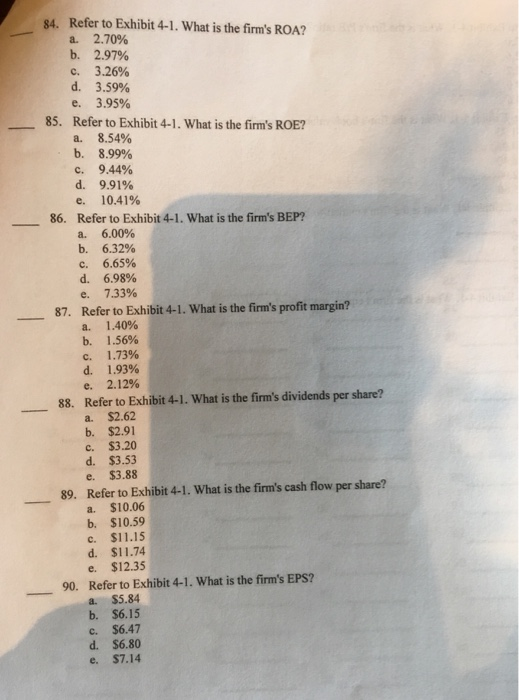

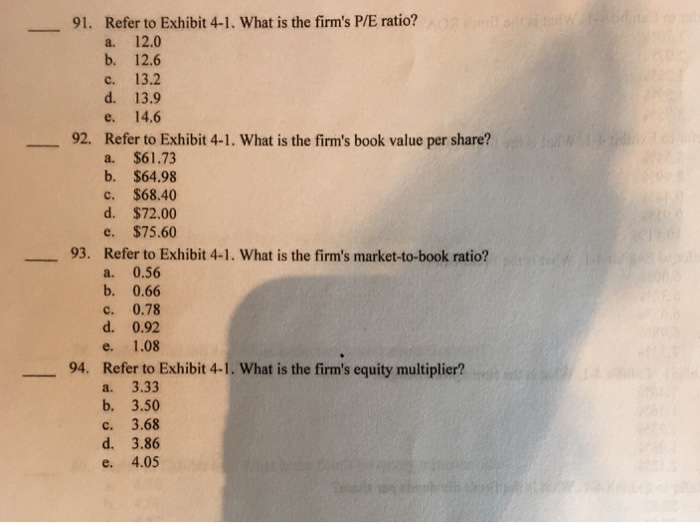

Exhibit 4-1 The following data apply to the problem(s) below.) The balance sheet and income statement shown below are for Pettjiohn Inc. Note that the firm has no amortization charges, it does not lease any assets the notes payable will be rolled over. none of its debt must be retired during the next 5 years, and Assets Cash and securities Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Notes payable Accruals Total current liabilities Long-term bonds Total debt Common stock Retained earnings Total common equity Total liabilities and equity 2007 S 1,554.0 9,660.0 13.440.0 $24,654.0 17.346.0 42.000.0 7,980.0 5,880.0 $18,480.0 $29,400.0 3,360.0 $12.600.0 $42.000.0 2007 $58,800.0 $54,978.0 $ 1029.0 S 2,793.0 Net sales Operating costs except depr'n Depreciation Earmings bef int and taxes (EBIT Less interest Earnings before taxes (EBT) Taxes Net income S 1,743.0 S 1.133.0 Shares outstanding (millions) Common dividends Int rate on notes payable & L-T bonds Federal plus state income tax rate Year-end stock price 175.00 $509.83 6.25% 35% $77.69 76. Refer to Exhibit 4-1. What is the firm's current ratio? a. 0.97 b. 1.08 c. 1.20 d. 1.33 e. 1.47 -77. Refer to Exhibit 4-1. What is the firm's quick ratio? a. 0.49 b. 0.61 c. 0.73 d. 0.87 e. 1.05 Refer to Eshibit 4-1. What is the firm's days sales outstanding? Assume 360-day year for this calculation. a. 48.17 b. 50.71 c. 53.38 d. 56.19 e. 59.14 79. Refer to Exhibit 4-1. What is the firm's total assets turnover? a. 0.90 b. 1.12 c. 1.40 d. 1.68 e. 2.02 Refer to Exhibit 4-1. What is the firm's inventory tunover ratio? 80. a. 4.38 b. 4.59 c. 4.82 d. 5.06 e. 5.32 81. Refer to Exhibit 4-1. What is the firm's TIE? a. 1.94 b. 2.15 c. 2.39 d. 2.66 e. 2.93 82. Refer to Exhibit 4-1. What is the firm's EBITDA coverage? a. 3.29 b. 3.46 c. 3.64 d. 3.82 e. 4.01 Refer to Exhibit 4-1. What is the firm's debt ratio? a. b. c. d. 83. 45.93% 51.03% 56.70% 63.00% 70.00% e. 84. Refer to Exhibit 4-1. What is the firm's ROA? 2.70% b. c. d. e. 2.97% 3.26% 3.59% 3.95% 85. Refer to Exhibit 4-1. What is the firm's ROE? a. b. 8.54% 8.99% c. 9.44% d. 9.91% 10.41% e. Refer to Exhibit 4-1. What is the firm's BEP? a. b. c. d. e. Refer to Exhibit 4-1. What is the firm's profit margin? a. b. c. d. e. 86. 6.00% 6.32% 6.65% 6.98% 7.33% 87. 1.40% 1.56% 1.73% 1.93% 2.12% 88. Refer to Exhibit 4-1. What is the firm's dividends per share? a. $2.62 b. $2.91 c. $3.20 d. $3.53 e. $3.88 89. Refer to Exhibit 4-1. What is the firm's cash flow per share? a. $10.06 b. $10.59 c. $11.15 d. $11.74 e. $12.35 Refer to Exhibit 4-1. What is the firm's EPS? a. $5.84 b. $6.15 c. $6.47 d. $6.80 e. $7.14 90. Refer to Exhibit 4-1. What is the firm's P/E ratio? a. 12.0 b. 12.6 c. 13.2 d. 13.9 e. 14.6 91. 92. Refer to Exhibit 4-1. What is the firm's book value per share? a. $61.73 b. $64.98 c. $68.40 d. $72.00 e. $75.60 93. Refer to Exhibit 4-1. What is the firm's market-to-book ratio? a. 0.56 b. 0.66 c. 0.78 d. 0.92 e. 1.08 Refer to Exhibit 4-1. What is the firm's equity multiplier? a. 3.33 b. 3.50 c. 3.68 d. 3.86 e. 4.05 94

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts