Question: EXHIBIT 5.10 Internal Control Questionnaire-Payroll Processing Control Environment 1. Are all employees paid by check or direct deposit? 2. Is a special payroll bank

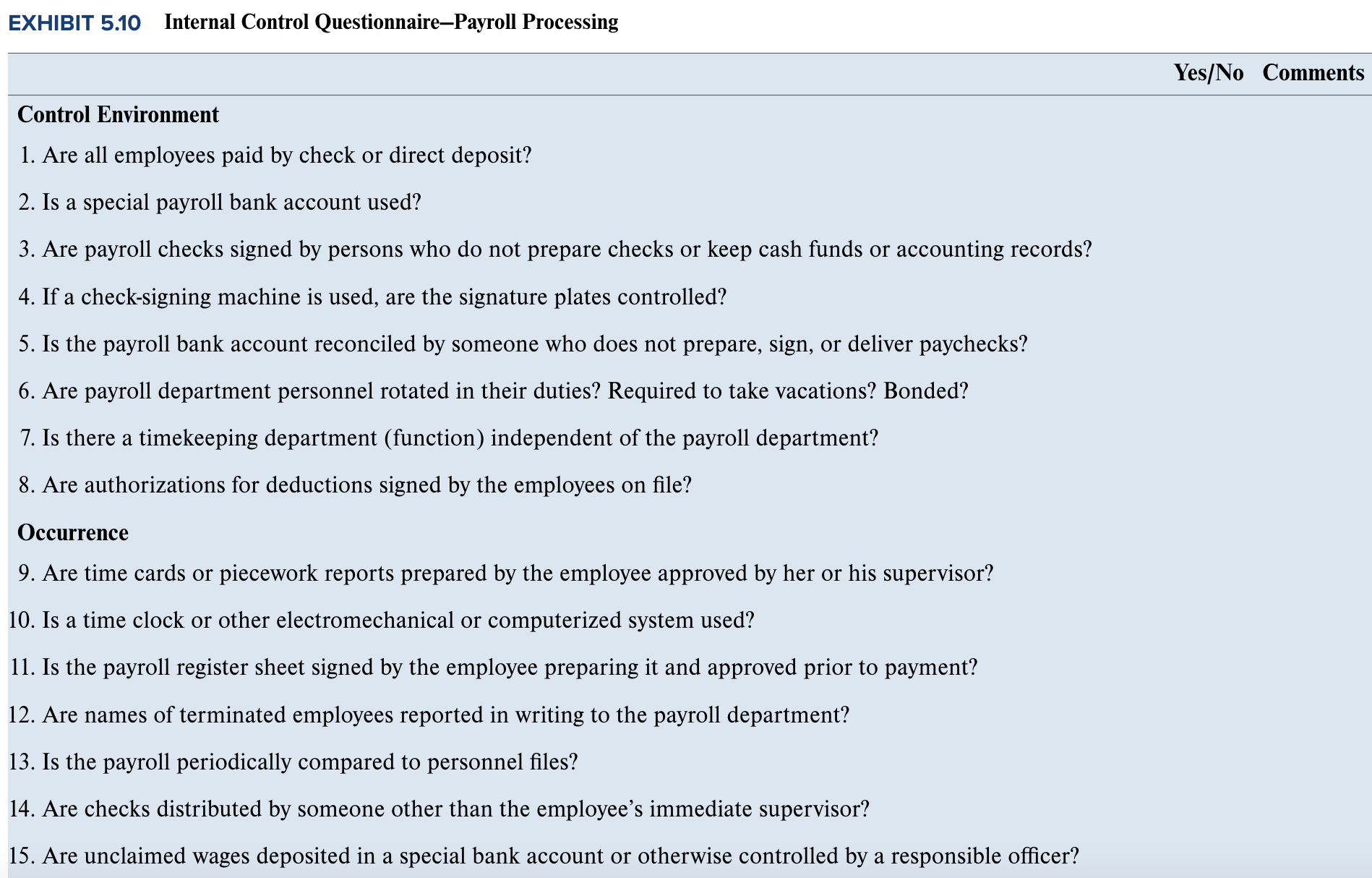

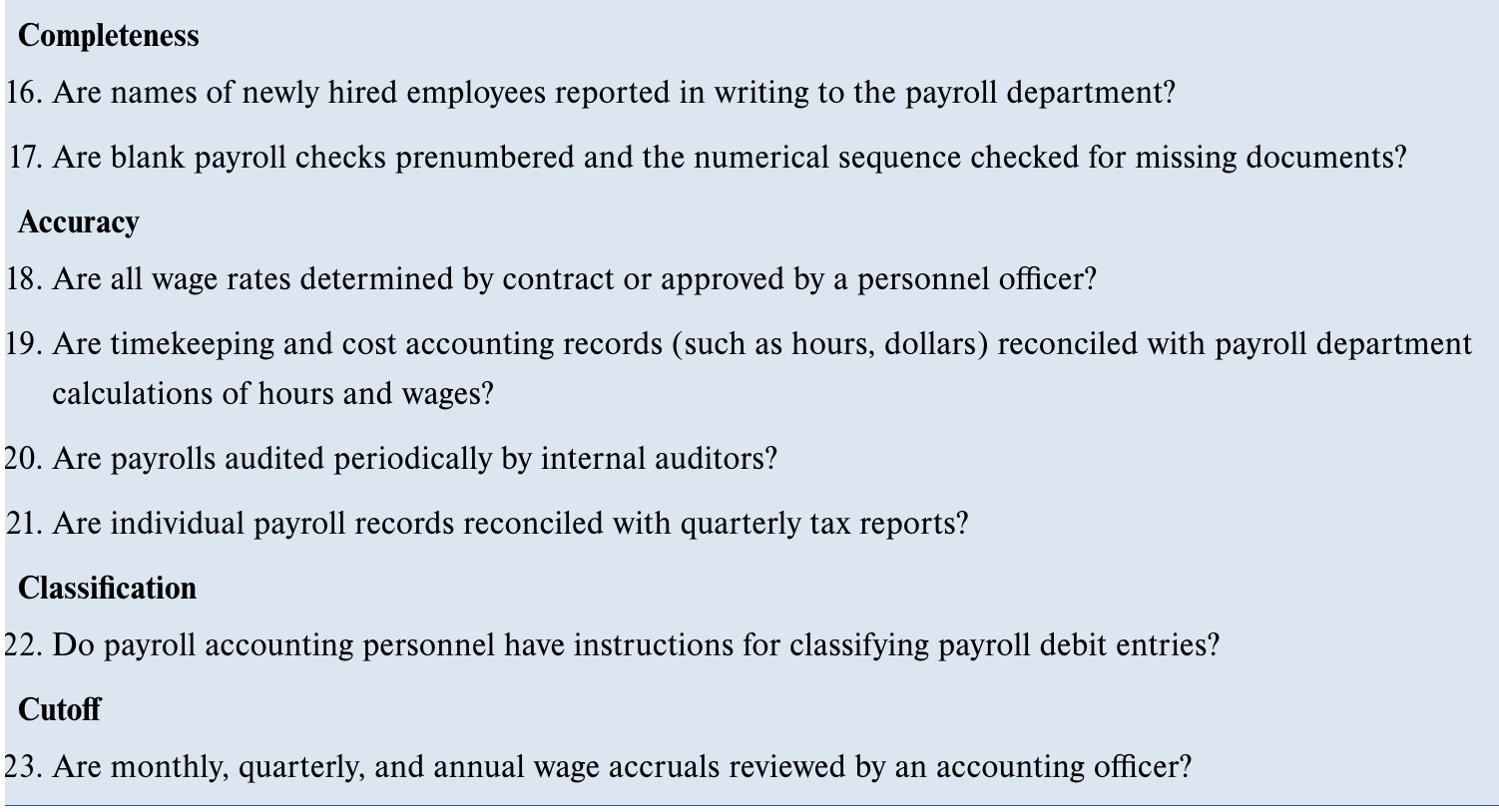

EXHIBIT 5.10 Internal Control Questionnaire-Payroll Processing Control Environment 1. Are all employees paid by check or direct deposit? 2. Is a special payroll bank account used? 3. Are payroll checks signed by persons who do not prepare checks or keep cash funds or accounting records? 4. If a check-signing machine is used, are the signature plates controlled? 5. Is the payroll bank account reconciled by someone who does not prepare, sign, or deliver paychecks? 6. Are payroll department personnel rotated in their duties? Required to take vacations? Bonded? 7. Is there a timekeeping department (function) independent of the payroll department? 8. Are authorizations for deductions signed by the employees on file? Occurrence 9. Are time cards or piecework reports prepared by the employee approved by her or his supervisor? 10. Is a time clock or other electromechanical or computerized system used? 11. Is the payroll register sheet signed by the employee preparing it and approved prior to payment? 12. Are names of terminated employees reported in writing to the payroll department? 13. Is the payroll periodically compared to personnel files? 14. Are checks distributed by someone other than the employee's immediate supervisor? 15. Are unclaimed wages deposited in a special bank account or otherwise controlled by a responsible officer? Yes/No Comments Completeness 16. Are names of newly hired employees reported in writing to the payroll department? 17. Are blank payroll checks prenumbered and the numerical sequence checked for missing documents? Accuracy 18. Are all wage rates determined by contract or approved by a personnel officer? 19. Are timekeeping and cost accounting records (such as hours, dollars) reconciled with payroll department calculations of hours and wages? 20. Are payrolls audited periodically by internal auditors? 21. Are individual payroll records reconciled with quarterly tax reports? Classification 22. Do payroll accounting personnel have instructions for classifying payroll debit entries? Cutoff 23. Are monthly, quarterly, and annual wage accruals reviewed by an accounting officer?

Step by Step Solution

There are 3 Steps involved in it

Here are the responses to the questions regarding control environment and occurrence related to payroll processes Control Environment 1 Are all employees paid by check or direct deposit Yes all employ... View full answer

Get step-by-step solutions from verified subject matter experts