Question: Exhibit 5.24 in your textbook presents selected financial data for The Tribune Company and The Washington Post Company for fiscal 2006 and 2007. The Washington

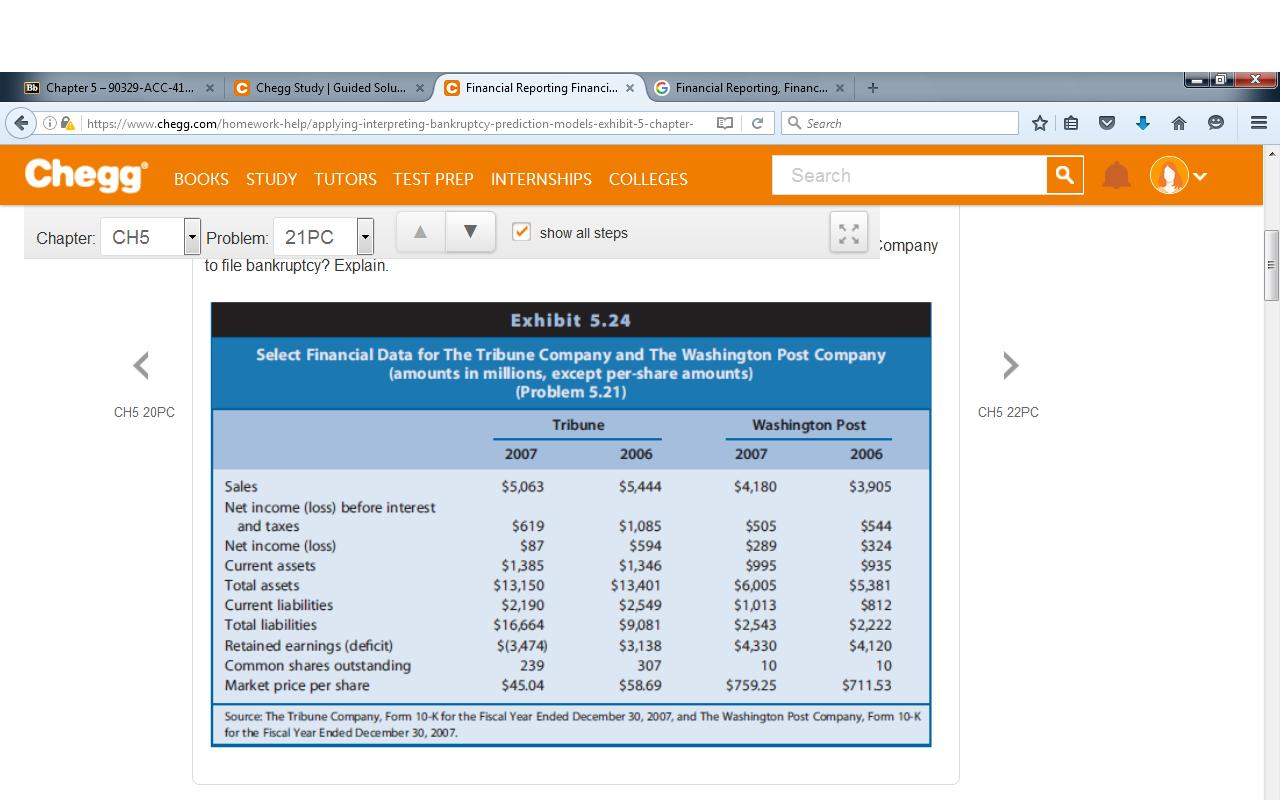

Exhibit 5.24 in your textbook presents selected financial data for The Tribune Company and The Washington Post Company for fiscal 2006 and 2007. The Washington Post Company is an education and media company. It owns, among others, Kaplan, Inc.; Cable ONE Inc.; Newsweek magazine; and Washington Post Media. The Tribune Company is a media and entertainment company, which also is diversified, owning the Chicago Tribune, the Los Angeles Times, television and radio affiliates such as The CW Network and WGN, and the Chicago Cubs. The Tribune Company filed for bankruptcy in December 2008.

Requirement #1 ask you to compute the Altman Z-score and probability of bankruptcy for both companies. However, for part a, you just have to do The Tribune Company and I have provided you The Washington Post so you can confirm your understanding of the calculations involved in order to complete questions b. - d. Show your work for Tribune Company in Part a like I did for you in providing The Washington Post information.

Altmans Z-Score for Washington Post - 2006

Working Capital/Assets: 1.2[($935 $812)/$5,381] ............................. 0.027

Retained Earnings/Assets: 1.4($4,120/$5,381) ...................................... 1.072

EBIT/Assets: 3.3($544/$5,381) .............................................................. 0.334

Mkt. Value Equity/Liabilities: 0.6[(10 $711.53)/$2,222] ......................... 1.921

Sales/Assets: 1.0($3,905/$5,381) ........................................................... 0.726

Z-Score .......................................................................................... 4.080

Probability of Bankruptcy ................................................................... 0.1%

2007

Working Capital/Assets: 1.2[($995 $1,013)/$6,005] ........................... (0.004)

Retained Earnings/Assets: 1.4($4,330/$6,005) ...................................... 1.010

EBIT/Assets: 3.3($505/$6,005) .............................................................. 0.278

Mkt. Value Equity/Liabilities: 0.6[(10 $759.25)/$2,543] ......................... 1.791

Sales/Assets: 1.0($4,180/$6,005) ........................................................... 0.696

Z-Score ......................................................................................... 3.771

Probability of Bankruptcy .................................................................. 0.4%

Chapter 5-90329 ACC 41 Chegg Study Guided Solu., x e Financial Reporting Financi. G Financial Reporting, Financ. x https://www.chegg.com/homework-help/applying-interpreting-bankruptcy-prediction-models-exhibit-5-chapter CSearch Chegg BOOKS STUDY TUTORS TEST PREP INTERNSHIPS COLLEGES Search | show all steps Chapter CH5 Problem: 21PC ompany to file bankruptcy? Explain. Exhibit 5.24 Select Financial Data for The Tribune Company and The Washington Post Company (amounts in millions, except per-share amounts) Problem 5.21) CH5 20PC CH5 22PC Tribune Washington Post 2007 2006 2007 2006 Sales Net income (loss) before interest $5,063 $5,444 $4,180 $3,905 and taxes Net income (loss) Current assets Total assets Current liabilities Total liabilities Retained earnings (deficit) Common shares outstanding Market price per share Source: The Tribune Company, Form 10-K for the Fiscal Year Ended December 30, 2007, and The Washington Post Company, Form 10-K for the Fiscal Year Ended December 30, 2007 $619 587 $1385 $13,150 $2,190 $16,664 $(3A74) 239 $45.04 $1,085 $594 $1,346 $13401 $2,549 $9,081 $3,138 $505 $289 $995 $6,005 $1,013 2,543 4330 $544 $324 $935 $5,381 $812 $2,222 4,120 307 10 10 $58.69 $759.25 $71153

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts