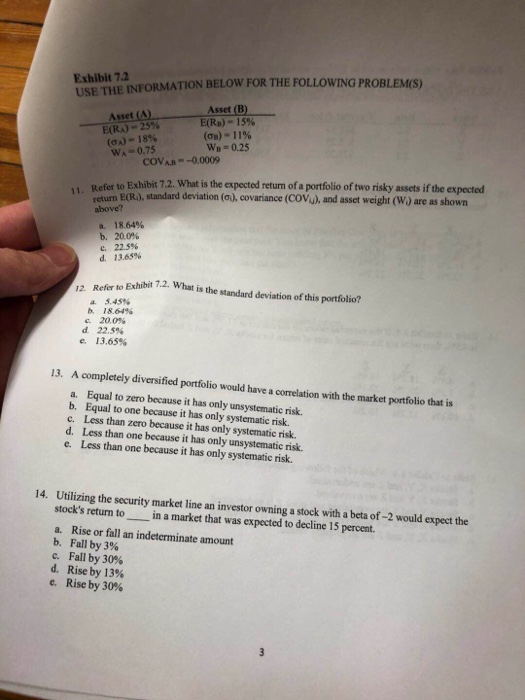

Question: Exhibit 72 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Asset A) ERA)-25% (on)= 18% Asset (B) E(Ra)-15% (on)-11% =0.25 WA-0.75 COVA,B =-0.0009 Refer to

Exhibit 72 USE THE INFORMATION BELOW FOR THE FOLLOWING PROBLEM(S) Asset A) ERA)-25% (on)= 18% Asset (B) E(Ra)-15% (on)-11% =0.25 WA-0.75 COVA,B =-0.0009 Refer to Exhibit 7.2. What is the expected return of a portfolio of two risky assets if the expected return E(R), standard deviation (a), covariance (COVu), and asset weight (W) are as shown above? a, 1864% b, 20.0% c. 22.5% d. 13.65% fer to Exhibit 7.2. What is the standard deviation of this portfolio? 5.45% 18.64% a. c.200% d 22.5% e. 13.65% 13. A completely diversified portfolio would have a correlation with the market portfolio that is a. Equal to zero because it has only unsystematic risk. b. Equal to one because it has only systematic risk. c. Less than zero because it has only systematic risk. d. Less than one because it has only unsystematic risk. e Less than one because it has only systematic risk. 14. Utilizing the security market line an investor owning a stock with a beta of -2 would expect the stock's return to in a market that was expected to decline 15 percent. a. Rise or fall an indeterminate amount b. Fall by 3% c. Fall by 30% d. Rise by 13% e. Rise by 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts