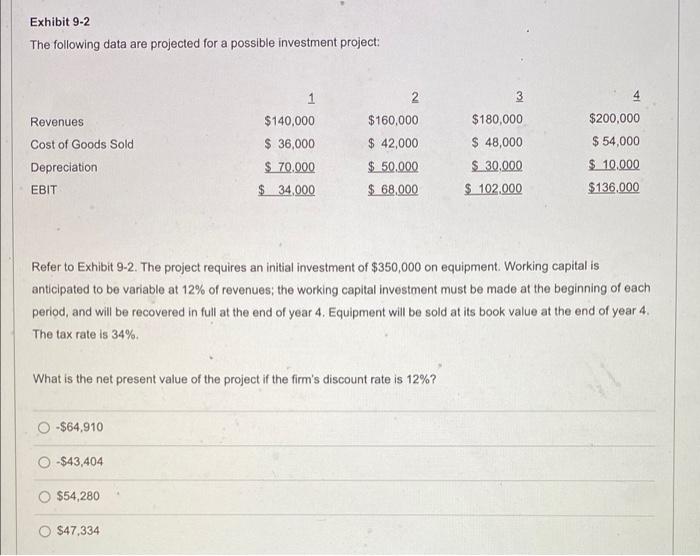

Question: Exhibit 9-2 The following data are projected for a possible investment project: Revenues Cost of Goods Sold 1 $140,000 $ 36,000 $ 70.000 $ 34,000

Exhibit 9-2 The following data are projected for a possible investment project: Revenues Cost of Goods Sold 1 $140,000 $ 36,000 $ 70.000 $ 34,000 2 $160,000 $ 42,000 $_50.000 $ 68,000 3 $180,000 $ 48,000 $ 30,000 $ 102,000 $200,000 $ 54,000 $ 10.000 $136.000 Depreciation EBIT Refer to Exhibit 9-2. The project requires an initial investment of $350,000 on equipment. Working capital is anticipated to be variable at 12% of revenues; the working capital investment must be made at the beginning of each period, and will be recovered in full at the end of year 4. Equipment will be sold at its book value at the end of year 4. The tax rate is 34% What is the net present value of the project if the firm's discount rate is 12%? O $64.910 -$43,404 $54,280 $47,334

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts