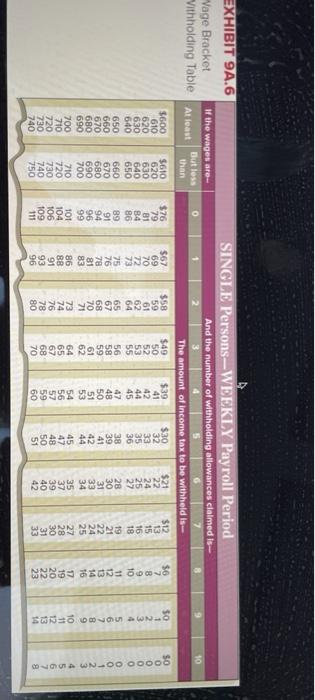

Question: EXHIBIT 9A.6 Vage Bracket Vithholding Table SINGLE Persons-WEEKLY Payroll Period And the number of withholding allowances claimed is If the wages are But less At

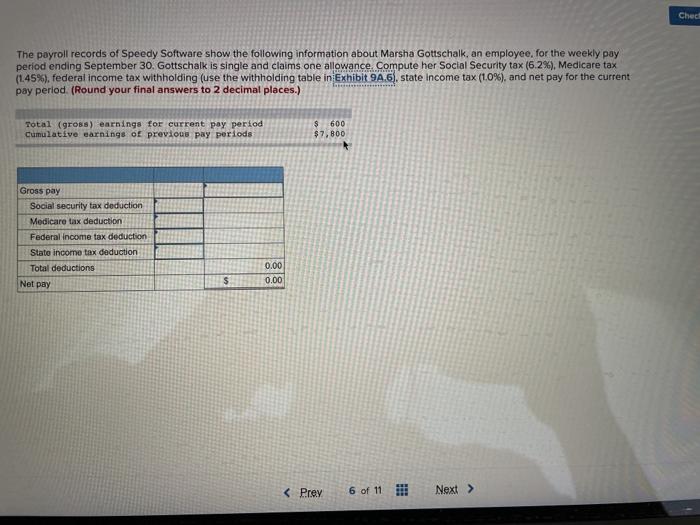

EXHIBIT 9A.6 Vage Bracket Vithholding Table SINGLE Persons-WEEKLY Payroll Period And the number of withholding allowances claimed is If the wages are But less At least than The amount of income tax to be withheld is 59% 5 & !4356789H Ched The payroll records of Speedy Software show the following information about Marsha Gottschalk, an employee, for the weekly pay period ending September 30. Gottschalk is single and claims one allowance Compute her Social Security tax (6.2%), Medicare tax (1.45%), federal income tax withholding (use the withholding table in Exhibit 94.6.state Income tax (1.0%), and net pay for the current pay period (Round your final answers to 2 decimal places.) Total (gross) earnings for current pay period Cumulative earnings of previous pay periods $ 600 $7,800 Gross pay Social security tax deduction Medicare tax deduction Federal income tax deduction Slato income tax deduction Total deductions 0.00 0.00 Net pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts