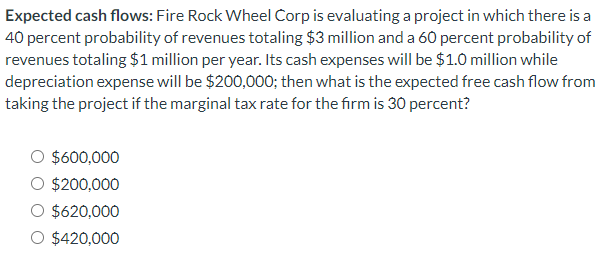

Question: Expected cash flows: Fire Rock Wheel Corp is evaluating a project in which there is a 40 percent probability of revenues totaling $3 million and

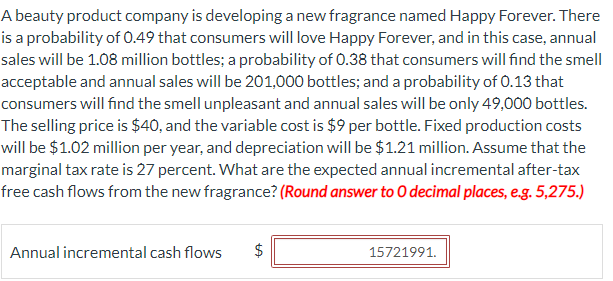

Expected cash flows: Fire Rock Wheel Corp is evaluating a project in which there is a 40 percent probability of revenues totaling $3 million and a 60 percent probability of revenues totaling $1 million per year. Its cash expenses will be $1.0 million while depreciation expense will be $200,000; then what is the expected free cash flow from taking the project if the marginal tax rate for the firm is 30 percent? $600,000$200,000$620,000$420,000 A beauty product company is developing a new fragrance named Happy Forever. There is a probability of 0.49 that consumers will love Happy Forever, and in this case, annual sales will be 1.08 million bottles; a probability of 0.38 that consumers will find the smell acceptable and annual sales will be 201,000 bottles; and a probability of 0.13 that consumers will find the smell unpleasant and annual sales will be only 49,000 bottles. The selling price is $40, and the variable cost is $9 per bottle. Fixed production costs will be $1.02 million per year, and depreciation will be $1.21 million. Assume that the marginal tax rate is 27 percent. What are the expected annual incremental after-tax free cash flows from the new fragrance? (Round answer to 0 decimal places, e.g. 5,275.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts