Question: Expected future data that differs among alternative courses of action are referred to as A. relevant information. B. predictable information. C. irrelevant information. D. historical

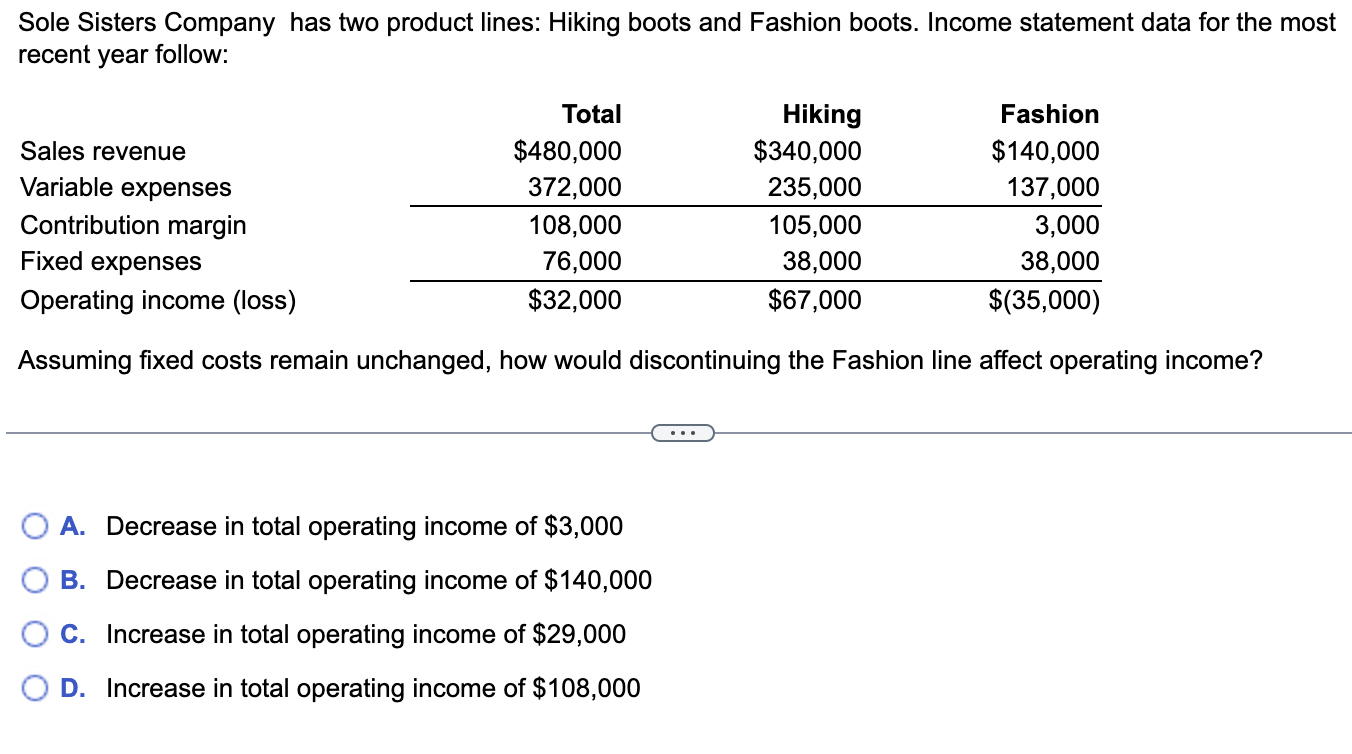

Expected future data that differs among alternative courses of action are referred to as A. relevant information. B. predictable information. C. irrelevant information. D. historical information. Greenpark Skateboards uses a standard part in the manufacture of several of its skateboards. The cost of producing 40,000 parts is $139,000, which includes fixed costs of $71,000 and variable costs of $68,000. The company can buy the part from an outside supplier for $3.50 per unit, and avoid 30% of the fixed costs. If the company makes the part, how much will its operating income be? A. $92,300 less than if the company bought the part B. $50,700 greater than if the company bought the part C. $50,700 less than if the company bought the part D. $92,300 greater than if the company bought the part Broad Baskets has in its inventory 2,500 damaged baskets that cost $23,000. The baskets can be sold in their present condition for $14,000, or repaired at a cost of $17,000 then sold for $37,000. What is the opportunity cost of selling the baskets in their present condition? A. $20,000 B. $37,000 C. $54,000 D. $31,000 Blue Technologies manufactures and sells tablets. Great Products Company has offered Blue Technologies $21 per tablet for 10,000 tablets. Blue Technologies' normal selling price is $32 per tablet. The total manufacturing cost per tablet is $16 and consists of variable costs of $11 per tablet and fixed overhead costs of $5 per tablet. (NOTE: Assume excess capacity and no effect on regular sales.) Should Blue Technologies accept or reject the special sales order? A. Reject, because operating income would decrease $210,000. B. Accept, because operating income would increase $100,000. C. Accept, because operating income would increase $320,000. D. Reject, because operating income would decrease $100,000. Sole Sisters Company has two product lines: Hiking boots and Fashion boots. Income statement data for the most recent year follow: Assuming fixed costs remain unchanged, how would discontinuing the Fashion line affect operating income? A. Decrease in total operating income of $3,000 B. Decrease in total operating income of $140,000 C. Increase in total operating income of $29,000 D. Increase in total operating income of $108,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts