Question: Expected Future Value Since we are calculating for the Expected Future Value, we will use FVE. We can think of the Expected Future Value as

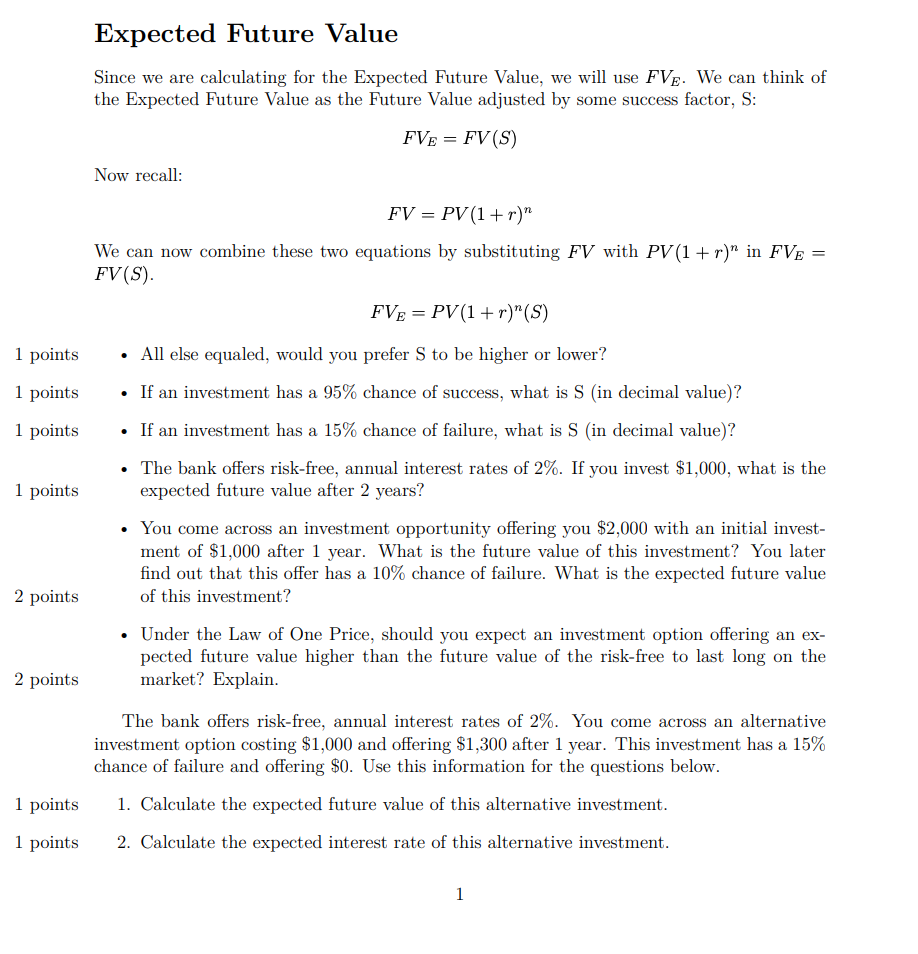

Expected Future Value Since we are calculating for the Expected Future Value, we will use FVE. We can think of the Expected Future Value as the Future Value adjusted by some success factor, S: FVE = FV(S) Now recall: FV = PV(1 + r)" We can now combine these two equations by substituting FV with PV(1 + r)" in FVE FV(S). FVE = PV(1 + r)"(S) = 1 points 1 points 1 points 1 points All else equaled, would you prefer S to be higher or lower? If an investment has a 95% chance of success, what is S (in decimal value)? If an investment has a 15% chance of failure, what is S (in decimal value)? The bank offers risk-free, annual interest rates of 2%. If you invest $1,000, what is the expected future value after 2 years? You come across an investment opportunity offering you $2,000 with an initial invest- ment of $1,000 after 1 year. What is the future value of this investment? You later find out that this offer has a 10% chance of failure. What is the expected future value of this investment? Under the Law of One Price, should you expect an investment option offering an ex- pected future value higher than the future value of the risk-free to last long on the market? Explain. 2 points 2 points The bank offers risk-free, annual interest rates of 2%. You come across an alternative investment option costing $1,000 and offering $1,300 after 1 year. This investment has a 15% chance of failure and offering $0. Use this information for the questions below. 1. Calculate the expected future value of this alternative investment. 2. Calculate the expected interest rate of this alternative investment. 1 points 1 points 1 1 points 2 points 2 points 3. Calculate the expected future value if you instead took the $1,000 and invested in the risk-free option for 1 year. 4. Would you prefer to invest in the alternative option, or the risk-free option? Explain. 5. Is there an arbitrage opportunity? Explain. 6. Calculate the risk premium interest rate that will equate the alternative investment with the risk-free option. Why is the risk premium interest rate different from the risk-free rate? 2 points Expected Future Value Since we are calculating for the Expected Future Value, we will use FVE. We can think of the Expected Future Value as the Future Value adjusted by some success factor, S: FVE = FV(S) Now recall: FV = PV(1 + r)" We can now combine these two equations by substituting FV with PV(1 + r)" in FVE FV(S). FVE = PV(1 + r)"(S) = 1 points 1 points 1 points 1 points All else equaled, would you prefer S to be higher or lower? If an investment has a 95% chance of success, what is S (in decimal value)? If an investment has a 15% chance of failure, what is S (in decimal value)? The bank offers risk-free, annual interest rates of 2%. If you invest $1,000, what is the expected future value after 2 years? You come across an investment opportunity offering you $2,000 with an initial invest- ment of $1,000 after 1 year. What is the future value of this investment? You later find out that this offer has a 10% chance of failure. What is the expected future value of this investment? Under the Law of One Price, should you expect an investment option offering an ex- pected future value higher than the future value of the risk-free to last long on the market? Explain. 2 points 2 points The bank offers risk-free, annual interest rates of 2%. You come across an alternative investment option costing $1,000 and offering $1,300 after 1 year. This investment has a 15% chance of failure and offering $0. Use this information for the questions below. 1. Calculate the expected future value of this alternative investment. 2. Calculate the expected interest rate of this alternative investment. 1 points 1 points 1 1 points 2 points 2 points 3. Calculate the expected future value if you instead took the $1,000 and invested in the risk-free option for 1 year. 4. Would you prefer to invest in the alternative option, or the risk-free option? Explain. 5. Is there an arbitrage opportunity? Explain. 6. Calculate the risk premium interest rate that will equate the alternative investment with the risk-free option. Why is the risk premium interest rate different from the risk-free rate? 2 points

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts