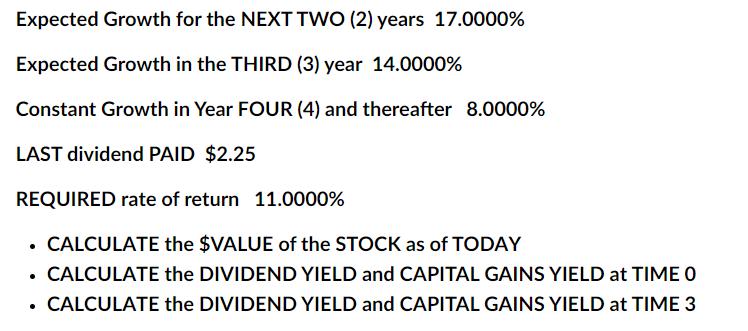

Question: Expected Growth for the NEXT TWO (2) years 17.0000% Expected Growth in the THIRD (3) year 14.0000% Constant Growth in Year FOUR (4) and

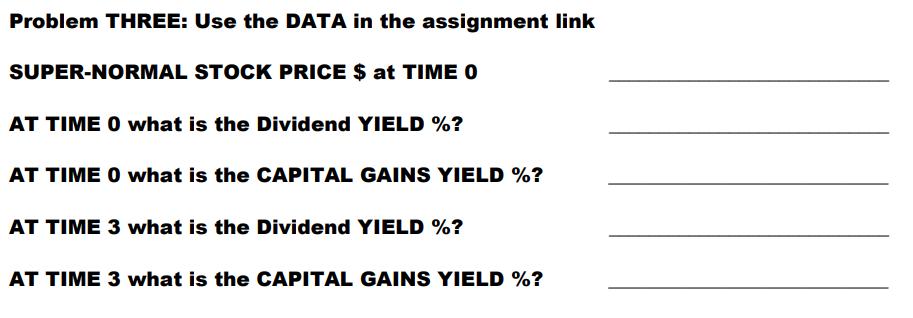

Expected Growth for the NEXT TWO (2) years 17.0000% Expected Growth in the THIRD (3) year 14.0000% Constant Growth in Year FOUR (4) and thereafter 8.0000% LAST dividend PAID $2.25 REQUIRED rate of return 11.0000% . CALCULATE the $VALUE of the STOCK as of TODAY CALCULATE the DIVIDEND YIELD and CAPITAL GAINS YIELD at TIME 0 CALCULATE the DIVIDEND YIELD and CAPITAL GAINS YIELD at TIME 3 . Problem THREE: Use the DATA in the assignment link SUPER-NORMAL STOCK PRICE $ at TIME 0 AT TIME 0 what is the Dividend YIELD %? AT TIME 0 what is the CAPITAL GAINS YIELD %? AT TIME 3 what is the Dividend YIELD %? AT TIME 3 what is the CAPITAL GAINS YIELD %?

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

To calculate the value of the stock as of today we can use the dividend discount model DDM The formu... View full answer

Get step-by-step solutions from verified subject matter experts