Question: expected monetary value and opportunity loss 5. (16 points) Blackbeard's Phantom Fireworks is considering two new bottle rockets. The company can add both to the

expected monetary value and opportunity loss

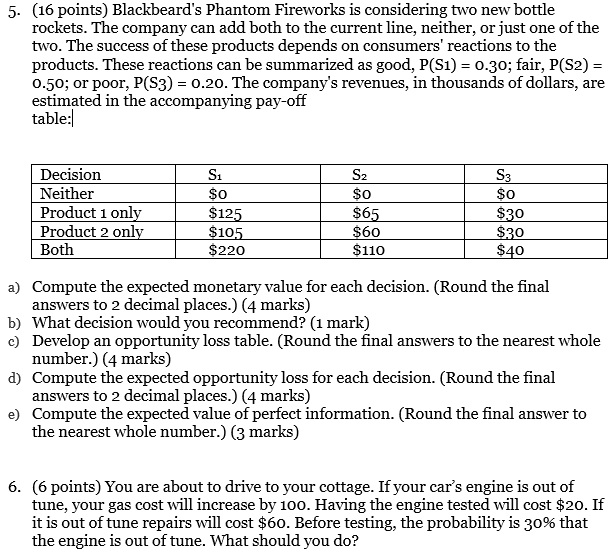

5. (16 points) Blackbeard's Phantom Fireworks is considering two new bottle rockets. The company can add both to the current line, neither, or just one of the two. The success of these products depends on consumers' reactions to the products. These reactions can be summarized as good, P(S1) = 0.30; fair, P(S2) = 0.50; or poor, P(S3) = 0.20. The company's revenues, in thousands of dollars, are estimated in the accompanying pay-off table: Decision S1 S2 S3 Neither SO SO Product 1 only $125 $65 $30 Product 2 only $105 $60 $30 Both $220 $110 $40 a) Compute the expected monetary value for each decision. (Round the final answers to 2 decimal places.) (4 marks) b) What decision would you recommend? (1 mark) c) Develop an opportunity loss table. (Round the final answers to the nearest whole number.) (4 marks) d) Compute the expected opportunity loss for each decision. (Round the final answers to 2 decimal places.) (4 marks) e) Compute the expected value of perfect information. (Round the final answer to the nearest whole number.) (3 marks) 6. (6 points) You are about to drive to your cottage. If your car's engine is out of tune, your gas cost will increase by 100. Having the engine tested will cost $20. If it is out of tune repairs will cost $60. Before testing, the probability is 30% that the engine is out of tune. What should you do

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts