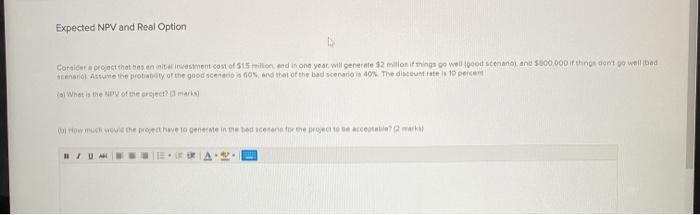

Question: Expected NPV and Real Option Consider a project that he entenement cost of 515 million and in one you will generate 52 milionimings go well

Expected NPV and Real Option Consider a project that he entenement cost of 515 million and in one you will generate 52 milionimings go well food scenenand 500000D ir things don't go well bad enrol Assume the probably of the good scenes and that of the bad scenario The date is 10 percent What is the ID ofte reject? Cow much wie we to pene in meedoen to me to accetta BUM Expected NPV and Real Option Consider a project that he entenement cost of 515 million and in one you will generate 52 milionimings go well food scenenand 500000D ir things don't go well bad enrol Assume the probably of the good scenes and that of the bad scenario The date is 10 percent What is the ID ofte reject? Cow much wie we to pene in meedoen to me to accetta BUM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts