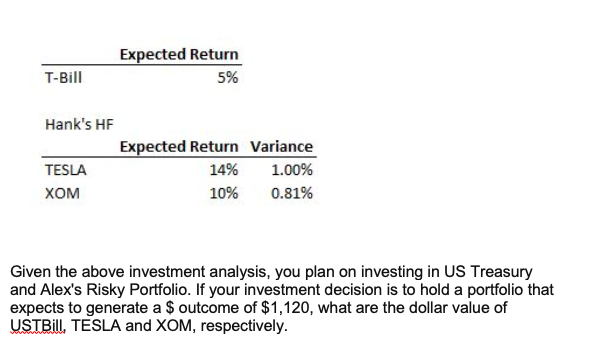

Question: Expected Return 5% T-Bill Hank's HF Expected Return Variance TESLA 14% 1.00% XOM 10% 0.81% Given the above investment analysis, you plan on investing in

Expected Return 5% T-Bill Hank's HF Expected Return Variance TESLA 14% 1.00% XOM 10% 0.81% Given the above investment analysis, you plan on investing in US Treasury and Alex's Risky Portfolio. If your investment decision is to hold a portfolio that expects to generate a $ outcome of $1,120, what are the dollar value of USTBill, TESLA and XOM, respectively. Expected Return 5% T-Bill Hank's HF Expected Return Variance TESLA 14% 1.00% XOM 10% 0.81% Given the above investment analysis, you plan on investing in US Treasury and Alex's Risky Portfolio. If your investment decision is to hold a portfolio that expects to generate a $ outcome of $1,120, what are the dollar value of USTBill, TESLA and XOM, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts