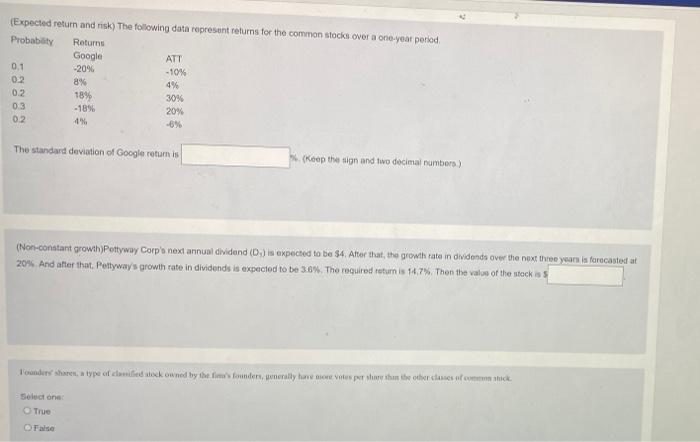

Question: (Expected return and risk) The following data represent returns for the common stocks over a one-year period Probability Returns Google ATT 0.1 -20% -10% 0.2

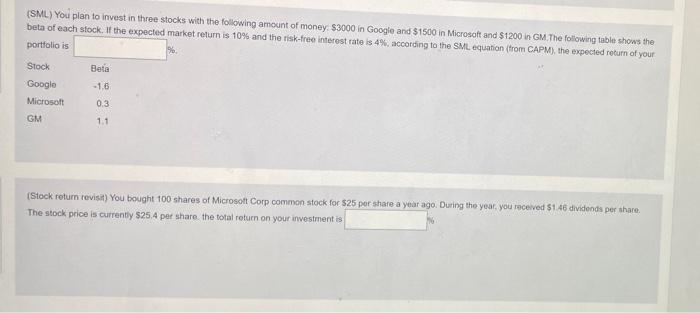

(Expected return and risk) The following data represent returns for the common stocks over a one-year period Probability Returns Google ATT 0.1 -20% -10% 0.2 8% 4% 02 18% 30% 0.3 -18% 20% 0.2 4 The standard deviation of Google return is Keep the sign and two decimal numbers) (Non-constant growth)Pottyway Corp's next annual dividend (D) is expected to be $4. After that, the growth rate in dividends over the next three years is forecasted at 20% And after that, Pettyway's growth rate in dividends is expected to be 3.0%. The required return is 14.7%. Then the value of the stock is Toaders share a type of deck owned by the former meally bont vous per the other case of comic Select one True False (SML) You plan to invest in three stocks with the following amount of money $3000 in Google and $1500 in Microsoft and $1200 in GM. The following table shows the beta of each stock. If the expected market return is 10% and the risk-free interest rate is 4%, according to the SML equation (from CAPM), the expected return of your portfolio is Stock Beta -1.6 Google Microsoft GM 0.3 1.1 (Stock return revisit) You bought 100 shares of Microsoft Corp common stock for $25 por share a year ago. During the year, you received $1.46 dividends per share The stock price is currently $25.4 per share the total return on your investment is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts