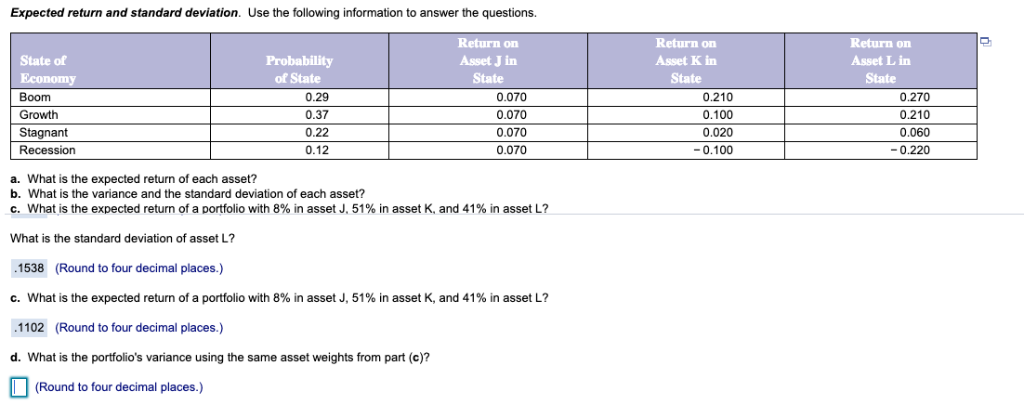

Question: Expected return and standard deviation. Use the following information to answer the questions. Return on Asset J in State Return on Asset K in State

Expected return and standard deviation. Use the following information to answer the questions. Return on Asset J in State Return on Asset K in State Return on Asset L in State of Probability of State Boom Growth Stagnant Recession 0.29 0.37 0.22 0.12 0.070 0.070 0.070 0.070 0.210 0.100 0.020 -0.100 0.270 0.210 0.060 -0.220 a. What is the expected return of each asset? b. What is the variance and the standard deviation of each asset? c. what is the expected return of a portfolio with 8% in asset J. 51% in asset K, and 41% in asset L? What is the standard deviation of asset L? 538 (Round to four decimal places.) c. what is the expected return of a portfolio with 8% in asset J, 51% in asset K, and 41% in asset L? 1102 (Round to four decimal places.) d. What is the portfolio's variance using the same asset weights from part (c)? (Round to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts