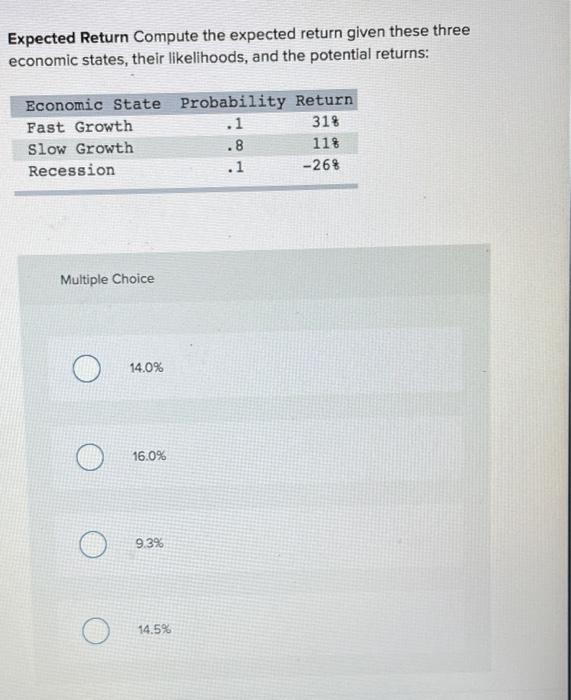

Question: Expected Return Compute the expected return given these three economic states, their likelihoods, and the potential returns: Economic State Fast Growth Slow Growth Recession Probability

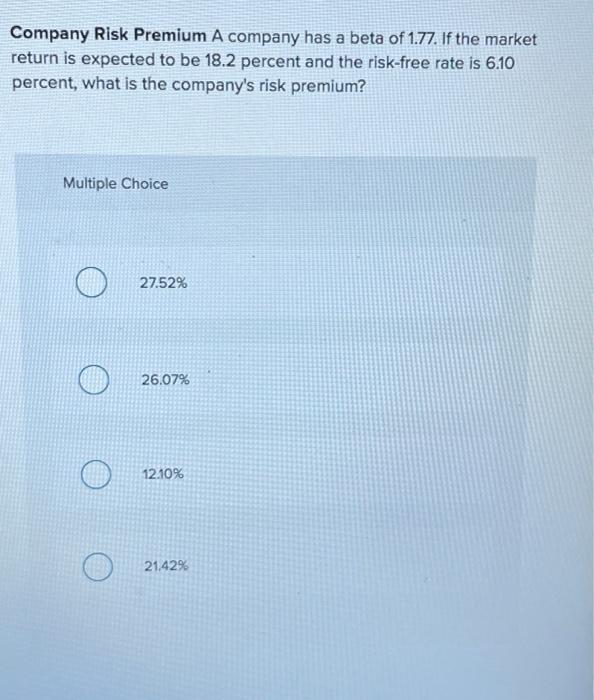

Expected Return Compute the expected return given these three economic states, their likelihoods, and the potential returns: Economic State Fast Growth Slow Growth Recession Probability Return .1 31% .8 11% .1 -26% Multiple Choice 14.0% 16.0% 9.3% 14,5% Company Risk Premium A company has a beta of 1.77. If the market return is expected to be 18.2 percent and the risk-free rate is 6.10 percent, what is the company's risk premium? Multiple Choice 27.52% 26.07% 12.10% 21.42%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts