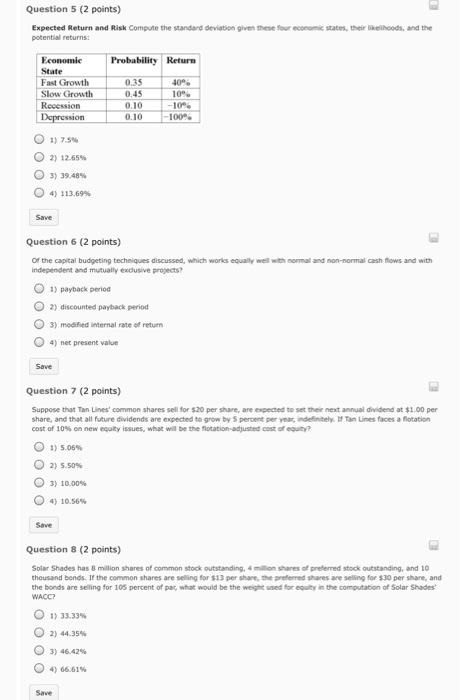

Question: Expected Return end Risk Compute the standard deviation given these four economic states, their likelihoods, and the potential returns: 7.5% 12-65% 39.48% 113 69% Of

Expected Return end Risk Compute the standard deviation given these four economic states, their likelihoods, and the potential returns: 7.5% 12-65% 39.48% 113 69% Of the capital budgeting techniques discussed, which works equally well with normal end non-normal cash flows and with independent and mutually exclusive project? payback period discounted payback period modified internal rate of return net present value Suppose that Ten Lines' common shares sell for $20 per share, are expected to set their next annual dividend at $1.00 per share, and that all future dividends are expected to grow by $ percent per year, indefinitely. If Ten lines faces a flotation cost of 10% on new equity issues, what will be the flotation adjusted cost of equity? 5.06% 5.50% 10.00% 10.56% Solar Shades has 8 million shares of common stock outstanding. 4 mien shares of preferred stock outstanding, and 10 thousand bonds. If the common shares are selling for $13 per share, the preferred shares are selling for $30 per share, and the bonds are selling for 105 percent of par, what would be the weight used for equity in the computation of Solar Shades WACC? 33-33% 44.35% 46.42% 66.61%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts