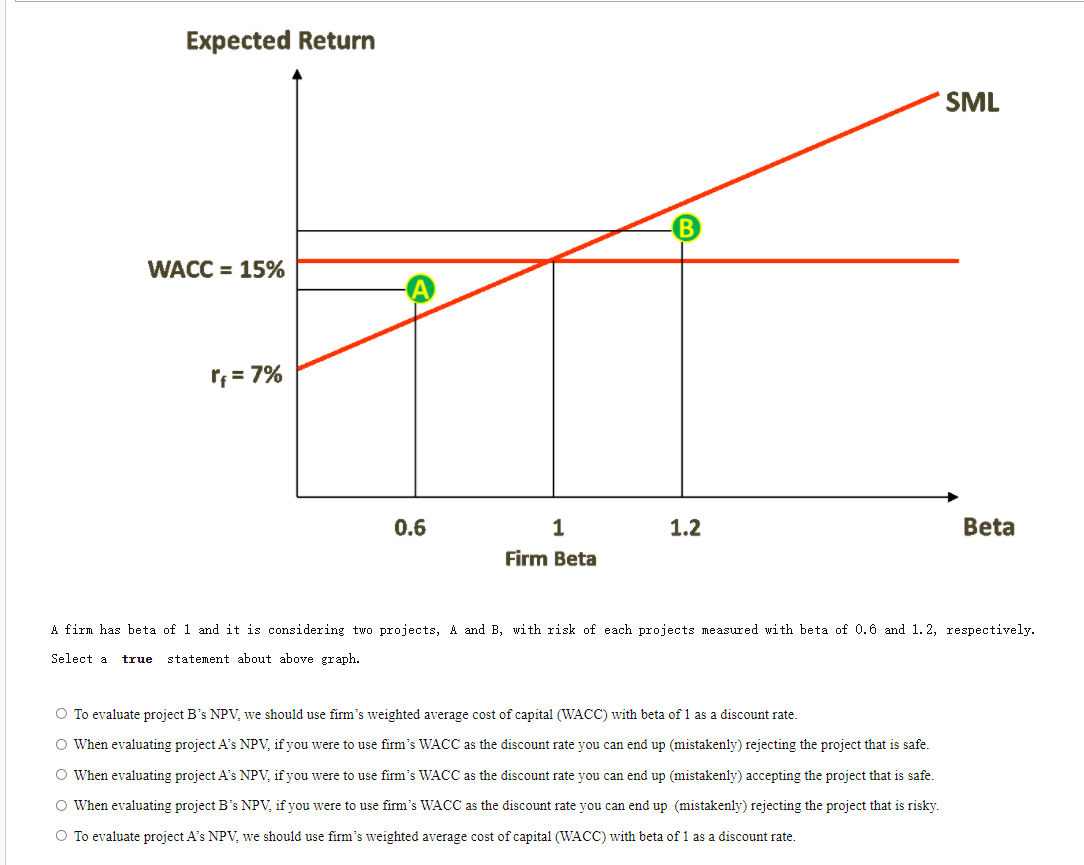

Question: Expected Return SML WACC = 15% If = 7% 0.6 1.2 Beta 1 Firm Beta A firm has beta of 1 and it is considering

Expected Return SML WACC = 15% If = 7% 0.6 1.2 Beta 1 Firm Beta A firm has beta of 1 and it is considering two projects, A and B, with risk of each projects measured with beta of 0.6 and 1.2, respectively. Select a statement about above graph. true To evaluate project B's NPV, we should use firm's weighted average cost of capital (WACC) with beta of 1 as a discount rate. When evaluating project A's NPV, if you were to use firm's WACC as the discount rate you can end up (mistakenly) rejecting the project that is safe. When evaluating project A's NPV, if you were to use firm's WACC as the discount rate you can end up (mistakenly) accepting the project that is safe. When evaluating project B's NPV, if you were to use firm's WACC as the discount rate you can end up (mistakenly) rejecting the project that is risky. To evaluate project A's NPV. we should use firm's weighted average cost of capital (WACC) with beta of 1 as a discount rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts