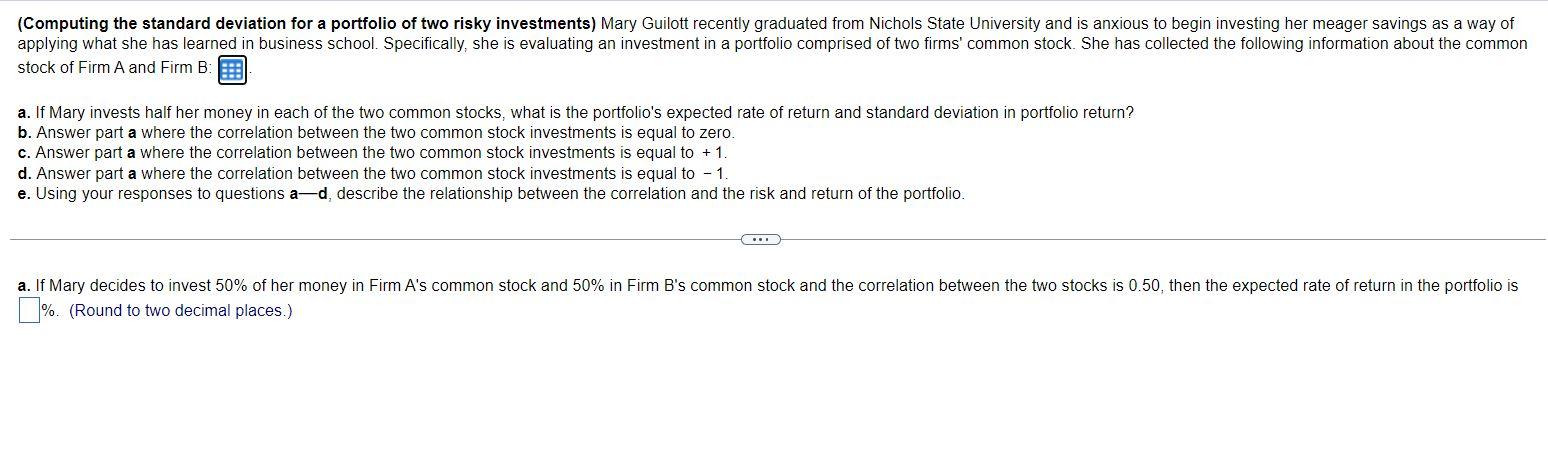

Question: Expected Return Standard Deviation Firm A's common stock 0.17 0.16 Firm B's common stock 0.17 0.25 Correlation coefficient 0.50 stock of Firm A and Firm

| Expected Return | Standard Deviation | |

|---|---|---|

| Firm A's common stock | 0.17 | 0.16 |

| Firm B's common stock | 0.17 | 0.25 |

| Correlation coefficient | 0.50 | |

stock of Firm A and Firm B: a. If Mary invests half her money in each of the two common stocks, what is the portfolio's expected rate of return and standard deviation in portfolio return? b. Answer part a where the correlation between the two common stock investments is equal to zero. c. Answer part a where the correlation between the two common stock investments is equal to +1. d. Answer part a where the correlation between the two common stock investments is equal to 1. e. Using your responses to questions a-d, describe the relationship between the correlation and the risk and return of the portfolio. \%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts