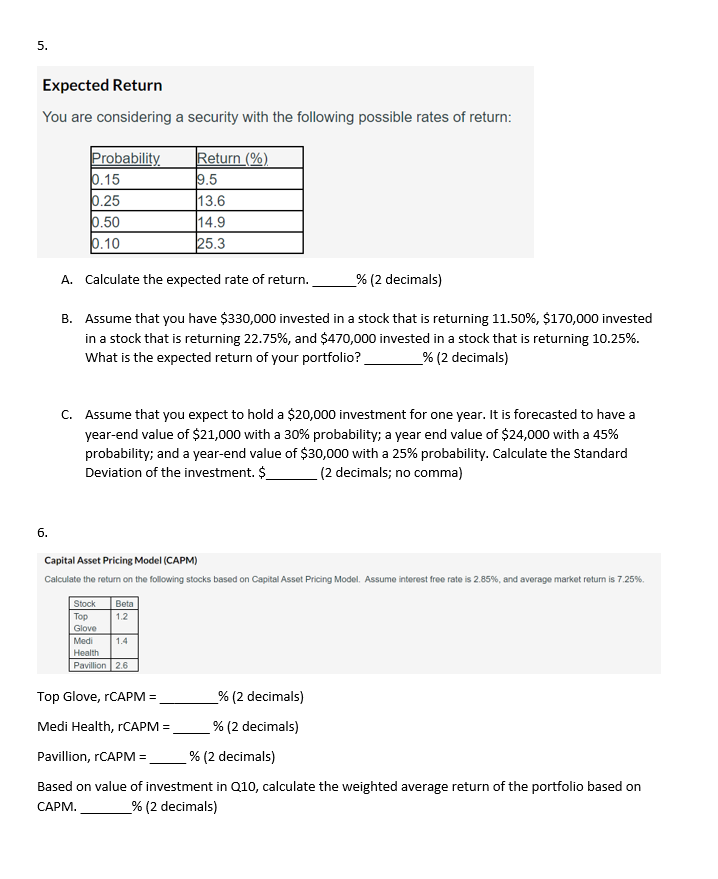

Question: Expected Return You are considering a security with the following possible rates of return: A. Calculate the expected rate of return. % ( 2 decimals)

Expected Return You are considering a security with the following possible rates of return: A. Calculate the expected rate of return. % ( 2 decimals) B. Assume that you have $330,000 invested in a stock that is returning 11.50%, $170,000 invested in a stock that is returning 22.75%, and $470,000 invested in a stock that is returning 10.25%. What is the expected return of your portfolio? % (2 decimals) C. Assume that you expect to hold a $20,000 investment for one year. It is forecasted to have a year-end value of $21,000 with a 30% probability; a year end value of $24,000 with a 45% probability; and a year-end value of $30,000 with a 25% probability. Calculate the Standard Deviation of the investment. \$ (2 decimals; no comma) 6. Capital Asset Pricing Model (CAPM) Calculate the return on the following stocks based on Capital Asset Pricing Model. Assume interest free rate is 2.85%, and average market retum is 7.25%. Top Glove, rCAPM =%(2 decimals ) Medi Health, rCAPM = % (2 decimals) Pavillion, rCAPM = % (2 decimals) Based on value of investment in Q10, calculate the weighted average return of the portfolio based on CAPM. % (2 decimals)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts