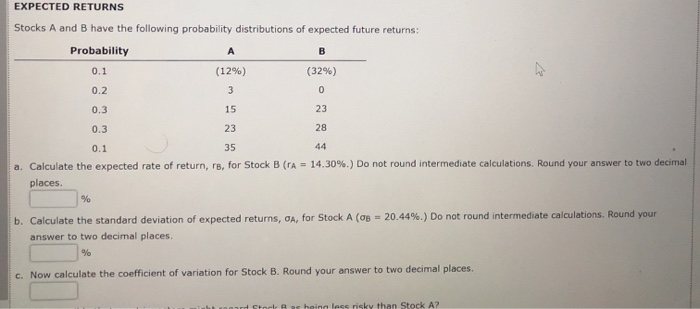

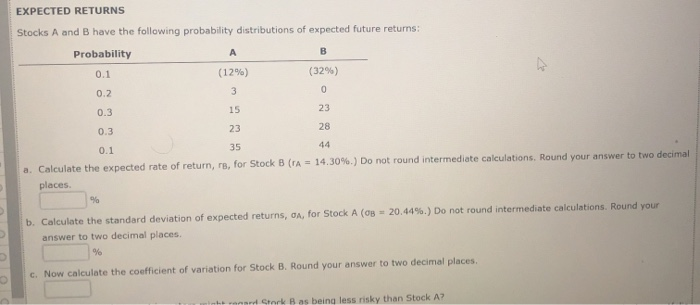

Question: EXPECTED RETURNS Stocks A and B have the following probability distributions of expected future returns: Probability 0.1 (12%) (32%) 0.2 0.3 15 44 a. Calculate

EXPECTED RETURNS Stocks A and B have the following probability distributions of expected future returns: Probability 0.1 (12%) (32%) 0.2 0.3 15 44 a. Calculate the expected rate of return, re, for Stock B (A - 14.30%.) Do not round intermediate calculations. Round your answer to two decimal places. b. Calculate the standard deviation of expected returns, OA, for Stock A (08 - 20.44%.) Do not round intermediate calculations. Round your answer to two decimal places, c. Now calculate the coefficient of variation for Stock B. Round your answer to two decimal places. hailece risky than Stock A? EXPECTED RETURNS Stocks A and B have the following probability distributions of expected future returns: Probability 0.1 (12%) (329) 0.2 0.3 15 0.3 0.1 a. Calculate the expected rate of return, rs, for Stock B (A = 14,30%.) Do not round intermediate calculations, Round your answer to two decimal places b. Calculate the standard deviation of expected returns, A, for Stock A (0g = 20.44%.) Do not round intermediate calculations. Round your answer to two decimal places c. Now calculate the coefficient of variation for Stock B. Round your answer to two decimal places, Check as being less risky than Stock A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts