Question: expected to be thorough and accurate. As a result, no partial credit will be awarded on this assignment; only complete and correct responses will receive

expected to be thorough and accurate. As a result, no partial credit will be awarded on this assignment; only complete and correct responses will receive full credit.

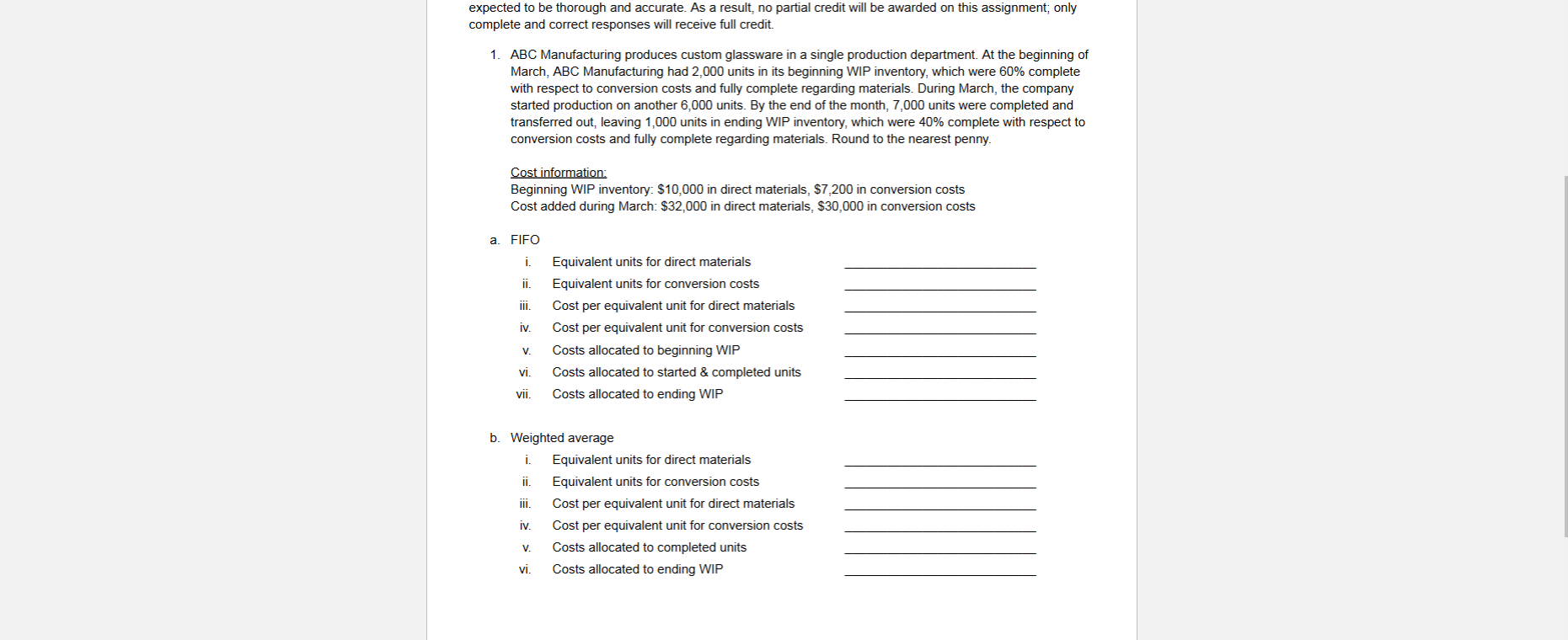

ABC Manufacturing produces custom glassware in a single production department. At the beginning of March, ABC Manufacturing had units in its beginning WIP inventory, which were complete with respect to conversion costs and fully complete regarding materials. During March, the company started production on another units. By the end of the month, units were completed and transferred out, leaving units in ending WIP inventory, which were complete with respect to conversion costs and fully complete regarding materials. Round to the nearest penny.

Cost information:

Beginning WIP inventory: $ in direct materials, $ in conversion costs

Cost added during March: $ in direct materials, $ in conversion costs

a FIFO

i Equivalent units for direct materials

ii Equivalent units for conversion costs

iii. Cost per equivalent unit for direct materials

iv Cost per equivalent unit for conversion costs

v Costs allocated to beginning WIP

vi Costs allocated to started & completed units

vii. Costs allocated to ending WIP

b Weighted average

i Equivalent units for direct materials

ii Equivalent units for conversion costs

iii. Cost per equivalent unit for direct materials

iv Cost per equivalent unit for conversion costs

v Costs allocated to completed units

vi Costs allocated to ending WIP

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock