Question: Expected Utility and Optimal Portfolio (15 marks) Consider a risk averse investor with utility of wealth u (w) = Inw. She has initial wealth wo

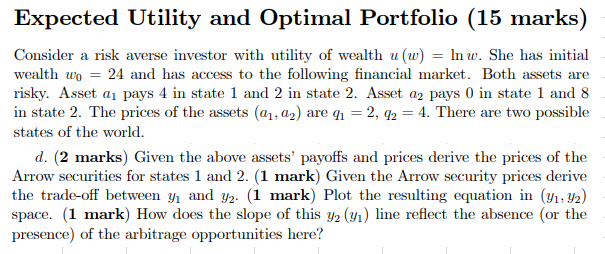

Expected Utility and Optimal Portfolio (15 marks) Consider a risk averse investor with utility of wealth u (w) = Inw. She has initial wealth wo = 24 and has access to the following financial market. Both assets are risky. Asset a, pays 4 in state 1 and 2 in state 2. Asset a2 pays ( in state 1 and 8 in state 2. The prices of the assets (21, 22) are 41 = 2, 92 = 4. There are two possible states of the world. d. (2 marks) Given the above assets' payoffs and prices derive the prices of the Arrow securities for states 1 and 2. (1 mark) Given the Arrow security prices derive the trade-off between y and y2. (1 mark) Plot the resulting equation in (91: y2) space. (1 mark) How does the slope of this yz (y) line reflect the absence (or the presence of the arbitrage opportunities here? Expected Utility and Optimal Portfolio (15 marks) Consider a risk averse investor with utility of wealth u (w) = Inw. She has initial wealth wo = 24 and has access to the following financial market. Both assets are risky. Asset a, pays 4 in state 1 and 2 in state 2. Asset a2 pays ( in state 1 and 8 in state 2. The prices of the assets (21, 22) are 41 = 2, 92 = 4. There are two possible states of the world. d. (2 marks) Given the above assets' payoffs and prices derive the prices of the Arrow securities for states 1 and 2. (1 mark) Given the Arrow security prices derive the trade-off between y and y2. (1 mark) Plot the resulting equation in (91: y2) space. (1 mark) How does the slope of this yz (y) line reflect the absence (or the presence of the arbitrage opportunities here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts