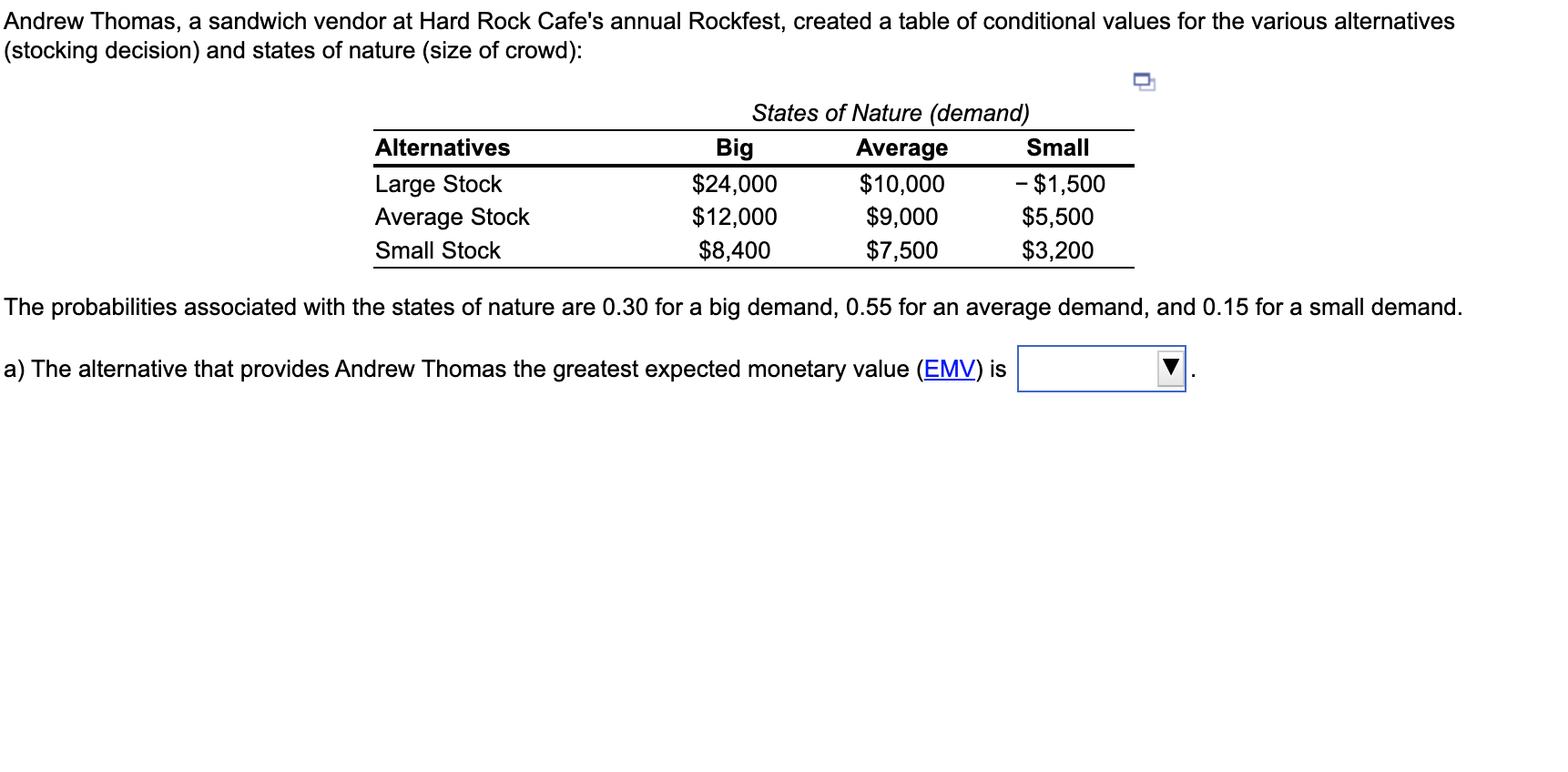

Question: expected value for alternative of large stock = expected value for alternative average stock= expected value for alternative small stock = The maximum value of

expected value for alternative of large stock =

expected value for alternative average stock=

expected value for alternative small stock =

The maximum value of return using the expected value =

The alternative that provides Andrew Thomas the greatest EMV is __________

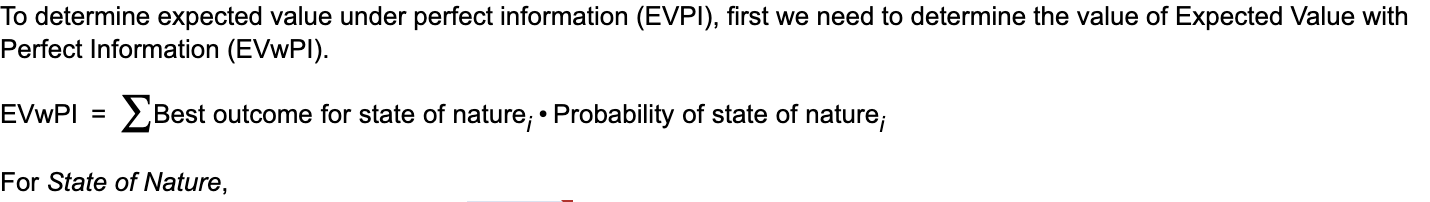

Big": the best outcome value =

"Average": the best outcome value =

"Small": the best outcome value =

For the given information, EVwPI =

the expected value of perfect information EVOI for Andrew thomas =

Please show your work and steps **

Andrew Thomas, a sandwich vendor at Hard Rock Cafe's annual Rockfest, created a table of conditional values for the various alternatives (stocking decision) and states of nature (size of crowd): The probabilities associated with the states of nature are 0.30 for a big demand, 0.55 for an average demand, and 0.15 for a small demand. a) The alternative that provides Andrew Thomas the greatest expected monetary value (EMV) is To determine expected value under perfect information (EVPI), first we need to determine the value of Expected Value with Perfect Information (EVwPI). EVwPI= Best outcome for state of nature i Probability of state of nature i For State of Nature

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts