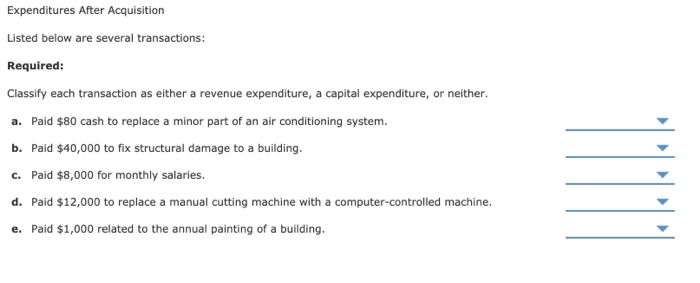

Question: Expenditures After Acquisition Listed below are several transactions: Required: Classify each transaction as either a revenue expenditure, a capital expenditure, or neither. a. Paid $80

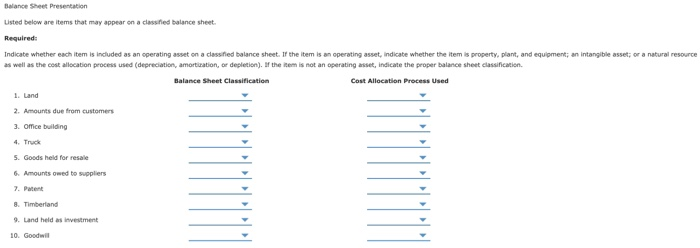

Expenditures After Acquisition Listed below are several transactions: Required: Classify each transaction as either a revenue expenditure, a capital expenditure, or neither. a. Paid $80 cash to replace a minor part of an air conditioning system. b. Paid $40,000 to fix structural damage to a building. c. Paid $8,000 for monthly salaries. d. Paid $12,000 to replace a manual cutting machine with a computer-controlled machine. e. Paid $1,000 related to the annual painting of a building. Balance Sheet Presentation Listed below are items that may appear on a classified balance sheet Required: Indicate whether each item is included as an operating asset on a classified balance sheet. If the item is an operating asset, indicate whether the item is property, plant, and equipment, an intangible asset; or a natural resource as well as the cost allocation process used (depreciation, amortization, or depletion). If the item is not an operating asset, indicate the proper balance sheet classification Balance Sheet Classification Cost Allocation Process Used 1. Land 2. Amounts due from customers 3. Omice building 4. Truck 5. Goods held for resale 6. Amounts owed to suppliers 7. Patent 8. Timberland 9. Land held as investment 10. Goodwill

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts