Question: expenses associated with this machine? 2. The machine in Problem 1 will generate incremental revenues of $5 million per year along with incremental costs of

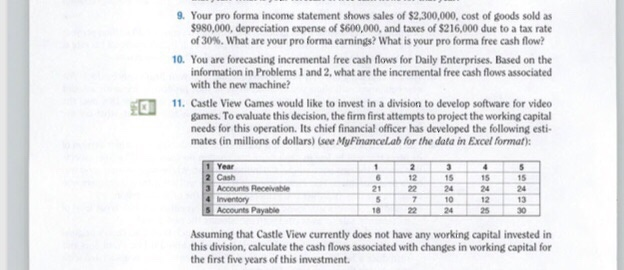

expenses associated with this machine? 2. The machine in Problem 1 will generate incremental revenues of $5 million per year along with incremental costs of $2.3 million per year. If Daily's marginal tax rate is 4096, what are the incremental earnings associated with the new machine? 9. Your pro forma income statement shows sales of $2,300,000, cost of goods sold as $980,000, depreciation expense of $600,000, and taxes of $216,000 due to a tax rate of 30%. What are your pro forma earnings? What is your pro forma free cash flow? 10. You are forecasting incremental free cash flows for Daily Enterprises. Based on the information in Problems 1 and 2, what are the incremental free cash flows associated with the new machine 11. Castle View Games would like to invest in a division to develop software for video games. To evaluate this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial officer has developed the following esti- mates (in millions of dollars) (see MyFinancelab for the data in Excel format) Year 2 Cash Accounts Recevable 4 Inventory 12 15 24 10 24 15 24 12 25 15 24 13 30 21 5 Accounts Payable 18 Assuming that Castle View currently does not have any working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment expenses associated with this machine? 2. The machine in Problem 1 will generate incremental revenues of $5 million per year along with incremental costs of $2.3 million per year. If Daily's marginal tax rate is 4096, what are the incremental earnings associated with the new machine? 9. Your pro forma income statement shows sales of $2,300,000, cost of goods sold as $980,000, depreciation expense of $600,000, and taxes of $216,000 due to a tax rate of 30%. What are your pro forma earnings? What is your pro forma free cash flow? 10. You are forecasting incremental free cash flows for Daily Enterprises. Based on the information in Problems 1 and 2, what are the incremental free cash flows associated with the new machine 11. Castle View Games would like to invest in a division to develop software for video games. To evaluate this decision, the firm first attempts to project the working capital needs for this operation. Its chief financial officer has developed the following esti- mates (in millions of dollars) (see MyFinancelab for the data in Excel format) Year 2 Cash Accounts Recevable 4 Inventory 12 15 24 10 24 15 24 12 25 15 24 13 30 21 5 Accounts Payable 18 Assuming that Castle View currently does not have any working capital invested in this division, calculate the cash flows associated with changes in working capital for the first five years of this investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts