Question: * * Expert needs experience with eMoney * * Mainly need to know where to put the information on the picture on eMoney. Mike Mitchell's

Expert needs experience with eMoney

Mainly need to know where to put the information on the picture on eMoney.

Mike Mitchell's Email to John Burke

January X

Dear John and Mary:

I am sending you our complete case file of internal and external data collected along with:

Income Statement for the year X

Statement of Financial Position as of X

Pie chart of your current Income Statement along with a benchmark pie chart

Pie chart of your current Statement of Financial Position along with a benchmark pie chart

Please review these for accuracy and we can discuss them at our next meeting on the th

Regards,

Mike Mitchell, CFP

Partner

Mitchell and Mitchell

PERSONAL BACKGROUND AND INFORMATION COLLECTED

The Family

John Burke, age is an assistant manager in the marketing department of Florida Gas. His annual salary is $ His wife, Mary, is an administrative assistant with an accounting firm. Mary is also years old and has an annual salary of $

John and Mary have been married for three years and have no children from their marriage. They hope to have two to three children in the next five years. However, John has one child, Patrick age from a former marriage. Patrick lives with his mother, Kathy, out of state and as a result, John has not seen Patrick for three years.

John pays $ per month in child support to Kathy for Patrick until he reaches age John also pays for a term life insurance policy on himself for Kathy beneficiary as a result of the divorce. The contingent beneficiary on the policy is Patrick. Patrick's education is fully funded by a Plan established by Kathy's father.

EXTERNAL INFORMATION

Economic Information

Inflation is expected to be annually.

The Burkes' salaries should increase for the next five to ten years.

There is no state income tax.

It is expected that there will be a slow growth economy; stocks are expected to return an average of annually

Bank Lending Rates

year mortgage rate is

year mortgage rate is

Secured personal loan rate is

Credit card rates are

Prime rate is

Expected Investment Returns

Their expected rate of return is

Return

Standard

Deviation

Cash and Money Market Fund

Guaranteed Income Fund

Treasury Bonds Bond Funds

Corporate Bonds Bond Funds

Municipal Bonds Bond Funds

International Bond Funds

Index Fund

Large Cap FundsStocks

MidSmall FundsStocks

International Stock Funds

Real Estate Funds

Insurance Information

Life Insurance

Policy A

Policy B

Policy C

Insured

John

John

Mary

Face Amount

$

$

$

Term

Group Term

Group Term

Cash Value

$

$

$

Annual Premium

$

$

$

Who pays premium

John

Employer

Employer

Beneficiary

Kathy then Patrick

Kathy

John

Policy Owner

Kathy

John

Mary

Settlement options clause selected

None

None

None

John is required, as a result of the divorce, to maintain a term life insurance policy Policy A of

The premiums are $ per month.

Health Insurance

John and Mary are both covered under John's employer health plan. The policy is an indemnity plan with a $ deductible per person per year and an major medical coinsurance clause with a family annual stop loss of $ Patrick's health insurance is provided by his mother.

LongTerm Disability Insurance

John is covered by an "own occupation" policy with premiums paid by his employer. The benefits equal percent of his gross pay after an elimination period of days. The policy covers both sickness and accidents and is guaranteed renewable. The term of benefits is to age

Mary is not covered by disability insurance.

LongTerm Care Insurance

Neither John nor Mary have longterm care insurance.

Renters Insurance

The Burkes have an HO renters policy a Contents Broad Form policy that covers contents and liability without endorsements. The annual premium is $

Content coverage is $ and liability coverage is $

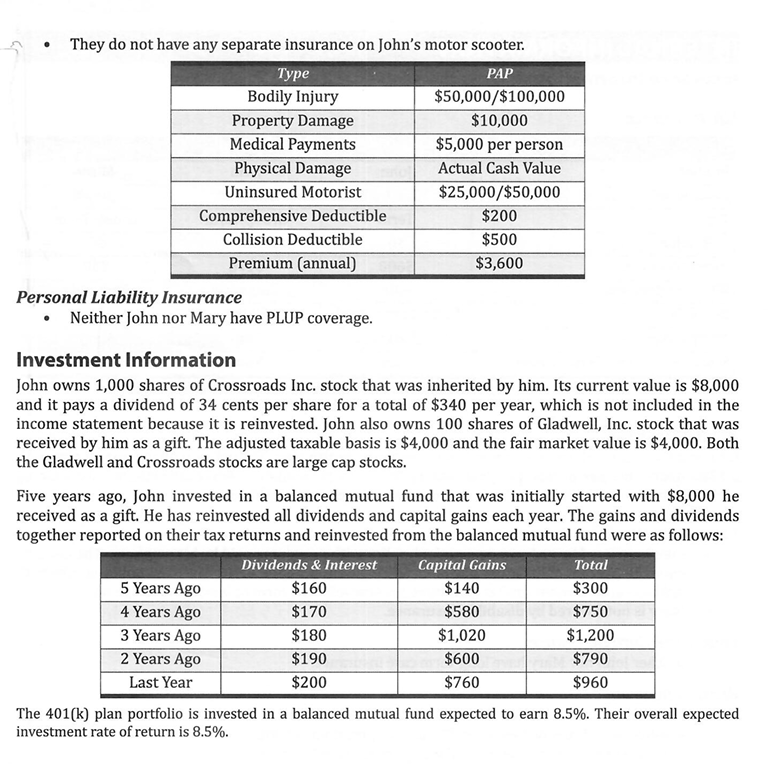

Automobile Insurance

Both their car and truck are covered.

They do not have any separate insurance on John's motor scooter.

Personal Liability Insurance

Neither John nor Mary have PLUP coverage.

Investment Information

John owns shares of Crossroads Inc. stock that was inherited by him. Its current value is $

and it pays a dividend of cents per share for a total of $ per year, which is not included in the

income statement because it is reinvested. John also owns shares of Gladwell, Inc. stock that was

received by him as a gift. The adjusted taxable basis is $ and the fair market value is $ Both

the Gladwell and Crossroads stocks are large cap stocks.

Five years ago, John invested in a balanced mutual fund that was initially started with $ he

received as a gift. He has reinvested all dividends and capital gains each year. The g

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock