Question: * * Expert needs experience with eMoney * * Please help me put all the information into eMoney. Mainly need help with where to put

Expert needs experience with eMoney

Please help me put all the information into eMoney. Mainly need help with where to put the information in the picture.

Mike Mitchell's Email to John Burke

January X

Dear John and Mary:

I am sending you our complete case file of internal and external data collected along with:

Income Statement for the year X

Statement of Financial Position as ofX

Pie chart of your current Income Statement along with a benchmark pie chart

Pie chart of your current Statement of Financial Position along with a benchmark pie chart

Please review these for accuracy and we can discuss them at our next meeting on the th

Regards,

Mike Mitchell, CFP

Partner

Mitchell and Mitchell

PERSONAL BACKGROUND AND INFORMATION COLLECTED

The Family

John Burke, age is an assistant manager in the marketing department of Florida Gas. His annual salary is $ His wife, Mary, is an administrative assistant with an accounting firm. Mary is also years old and has an annual salary of $

John and Mary have been married for three years and have no children from their marriage. They hope to have two to three children in the next five years. However, John has one child, Patrick age from a former marriage. Patrick lives with his mother, Kathy, out of state and as a result, John has not seen Patrick for three years.

John pays $ per month in child support to Kathy for Patrick until he reaches age John also pays for a term life insurance policy on himself for Kathy beneficiary as a result of the divorce. The contingent beneficiary on the policy is Patrick. Patrick's education is fully funded by a Plan established by Kathy's father.

EXTERNAL INFORMATION

Economic Information

Inflation is expected to be annually.

The Burkes' salaries should increase for the next five to ten years.

There is no state income tax.

It is expected that there will be a slow growth economy; stocks are expected to return an average of annually

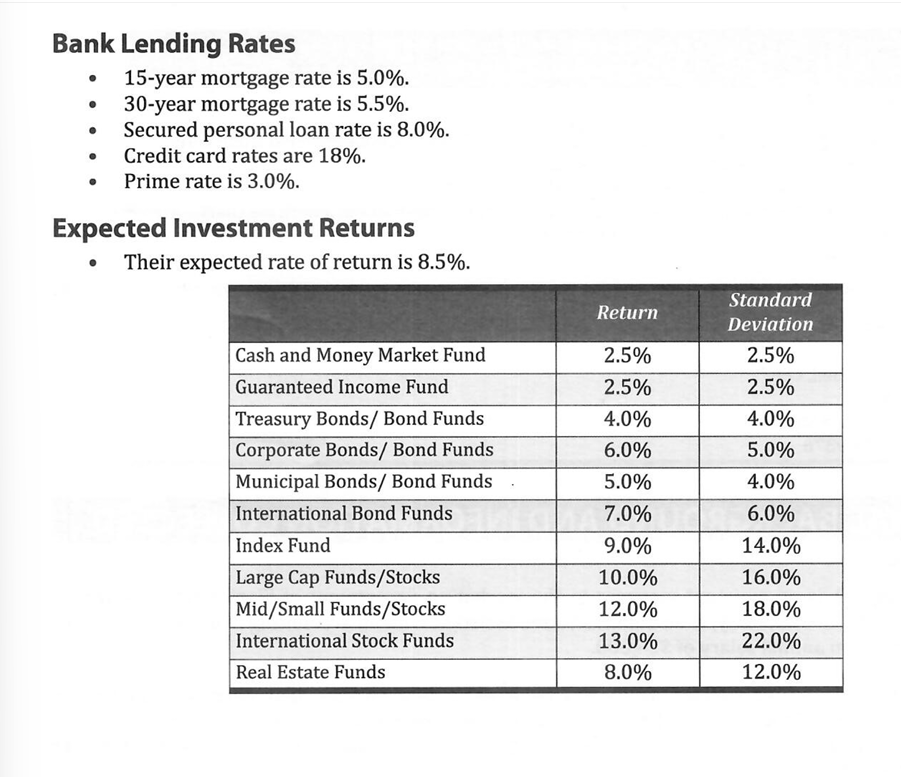

Bank Lending Rates

year mortgage rate is

year mortgage rate is

Secured personal loan rate is

Credit card rates are

Prime rate is

Expected Investment Returns

Their expected rate of return is

Return

Standard

Deviation

Cash and Money Market Fund

Guaranteed Income Fund

Treasury Bonds Bond Funds

Corporate Bonds Bond Funds

Municipal Bonds Bond Funds

International Bond Funds

Index Fund

Large Cap FundsStocks

MidSmall FundsStocks

International Stock Funds

Real Estate Funds

Bank Lending Rates

year mortgage rate is

year mortgage rate is

Secured personal loan rate is

Credit card rates are

Prime rate is

Expected Investment Returns

Their expected rate of return is

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock