Question: Expert Q&A Find solutions to your homework Search Question Which of the following taxpayers may report the sale of their property as an installment sale?

Expert Q&A

Find solutions to your homework

Search

Question

Which of the following taxpayers may report the sale of their property as an installment sale?

1. Alexander. He sold a backhoe to Reno for $8,000. Reno made two payments, one payment of $ 2,500 on March 15 and one payment of $5,500 on September 15 of the tax year.

Alexander paid $ 6,000 for the backhoe when it was new; it had fully depreciated before he sold it,

2. Georgia. She sold her entire inventory, valued at $9000, to Maxim for $12,000, Maxim intends to pay $4,000 per year, plus interest, for the next three years.

3, Jackson. He sold a plot of land for $50,000/ He purchased the land for $ 45,000 and paid $ 10,000 to improve it, His buyer intends to pay for the land over five years.

4, Sita. She sold a rental condominium for $120,000. She purchased it for $ 95,000 and had claimed $20,000 depreciation. Her buyer intends to pay her $19,000 per year plus 6% interest for five years.

Expert Answer

This solution was written by a subject matter expert. It's designed to help students like you learn core concepts.

Anonymous answered this1,532 answers

Sita. She sold a rental condominium for $120,000. She purchased it for $ 95,000 and had claimed $20,000 depreciation. Her buyer intends to pay her $19,000 per year plus 6% interest for five years.

Was this answer helpful?

0

0

Questions viewed by other students

-

Q:

Which of the following taxpayers may report the sale of theirproperty as an installment sale?1. Alexander. He sold a backhoe to Reno for$8,000. Reno made two payments, one payment of $ 2,500on March 15 and one payment of $5,500 on September 15 of the taxyear.Alexander paid $ 6,000 for the backhoe when it was new; it hadfully depreciated before he sold it,2. Georgia. She sold her entire inventory, valued at$9000, to Maxim for $12,000, Maxim...

A:

See answer -

Q:

sally sold land she purchased three months earlier for use in her business. her cost and adjusted basis in the land is $80,000. She incurred $5,000 in expenses related to the sale .

A:

See answer -

Q:

Martin and sons, Landscaping purchased shares of BCD stock atthree different times: 100 shares for $4,300 on Feb 1, 2018; 300shares for $6,900 on May 15, 2019; 200 shares for $10,000 on Jan30, 2020.On Jun 1, 2021, they sold 265 shares and received gross proceedsof $13,010. If they wanted to reduce the capital gain as much aspossible, which shares would they have had to specifically identifyat the time of sale?1 65 shares in 2018 and 200 shares pu...

A:

Step-by-step answer100% (1 rating)

-

Q:

Which of the following taxpayers may report the sale of theirproperty as an installment sale?Franklin - He sold a tractor to Roberto for $9000. Robertomade two payments, one payment of $3,500 on May 15 and one paymentof $5,500 on September 15 of the tax year. Franklin paid$7,000 for the tractor when it was new, it had fully depreciatedbefore he sold itJanet - She sold her entire inventory, valued at $8,000 toMarvin for $12,000. Marvin intends ...

A:

See answer -

Q:

In 2021, Jamil a single member LLC and single taxpayer, hadtaxable income of $85,000. This amount included shortterm capital losses of $6,000 and long term losses of $7,000. He had no capital gains in 2021, and hed had no other capitaltransactions in prior years. What is the amount of loss Jamilwill carry forward to later tax years? 13,00010,0007,0006,000

A:

Step-by-step answer -

Q:

please questions 12,13,and14

A:

See answer100% (1 rating)

-

Q:

Chuck purchased a van for $24,000 to use exclusively in hisplumbing business. He sold it four months later in the same yearfor $18,000. What is the amount of gain or loss, and where on Form4797 does Chuck report the sale? $6,000 gain; Part I. $6,000 gain; Part II. $6,000 loss; Part II. $6,000 loss; Part III.

A:

See answer100% (6 ratings)

-

Q:

Melba's office building was foreclosed upon and the mortgageholder issued Form 1099-A, Acquisition or Abandonment of SecuredProperty, to her, reporting the outstanding balance of the loan as$125,000, and the fair market value of the building was $146,000 onthe date of foreclosure.What is the amount Melba realized from the foreclosure of thisproperty, which was secured by a nonrecourse loan? $0 $21,000 $125,000 $146,000

A:

See answer

Show less

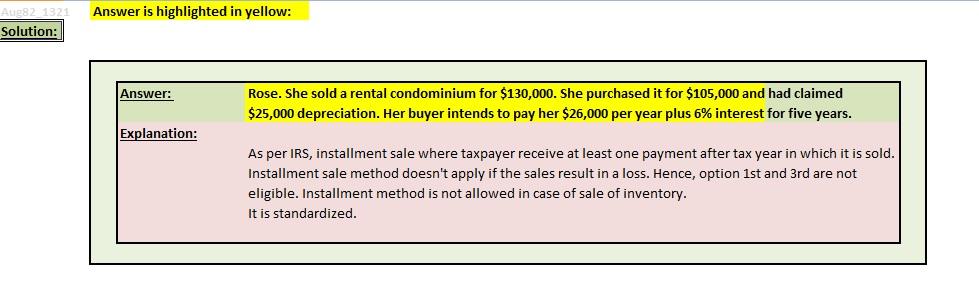

Answer is highlighted in yellow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts