Question: a) RM1,000 sale is credited to the sundry expenses account instead of the sales account. b) Payment RM2,000 to a supplier has been omitted

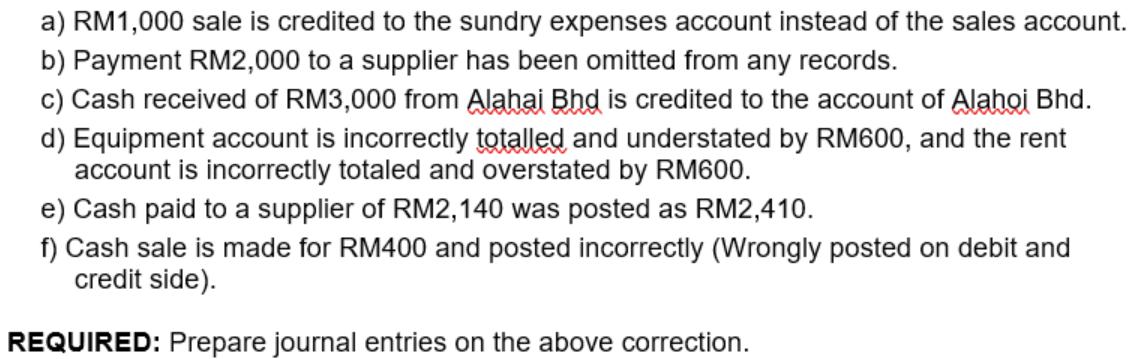

a) RM1,000 sale is credited to the sundry expenses account instead of the sales account. b) Payment RM2,000 to a supplier has been omitted from any records. c) Cash received of RM3,000 from Alahai Bhd is credited to the account of Alahoi Bhd. d) Equipment account is incorrectly totalled and understated by RM600, and the rent account is incorrectly totaled and overstated by RM600. e) Cash paid to a supplier of RM2,140 was posted as RM2,410. f) Cash sale is made for RM400 and posted incorrectly (Wrongly posted on debit and credit side). REQUIRED: Prepare journal entries on the above correction.

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts