Question: experts dont give me wrong answer please read instruction and then answer please last chance left (Compare ratios and comment on results) Selected financial data

experts dont give me wrong answer please read instruction and then answer please last chance left

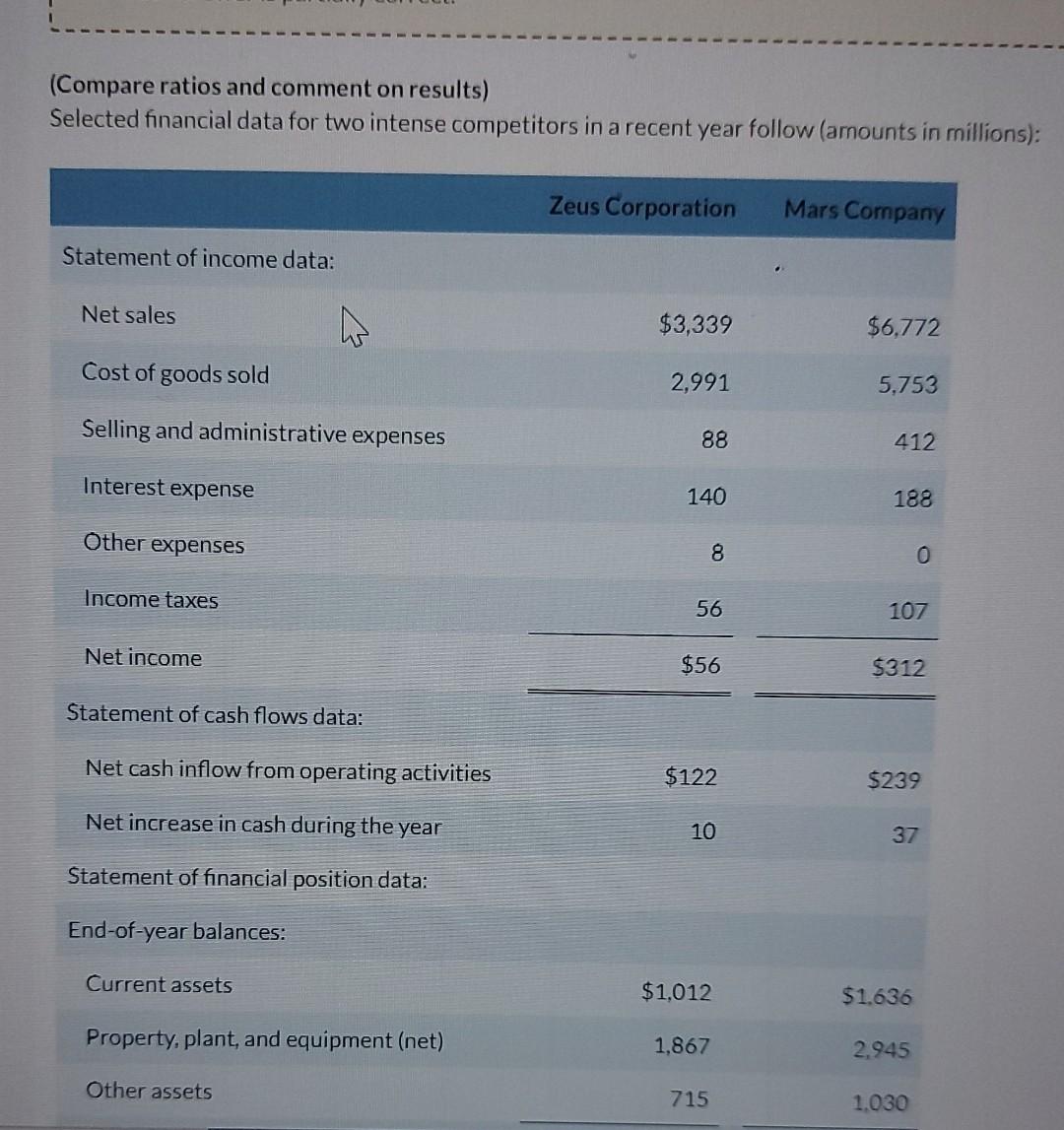

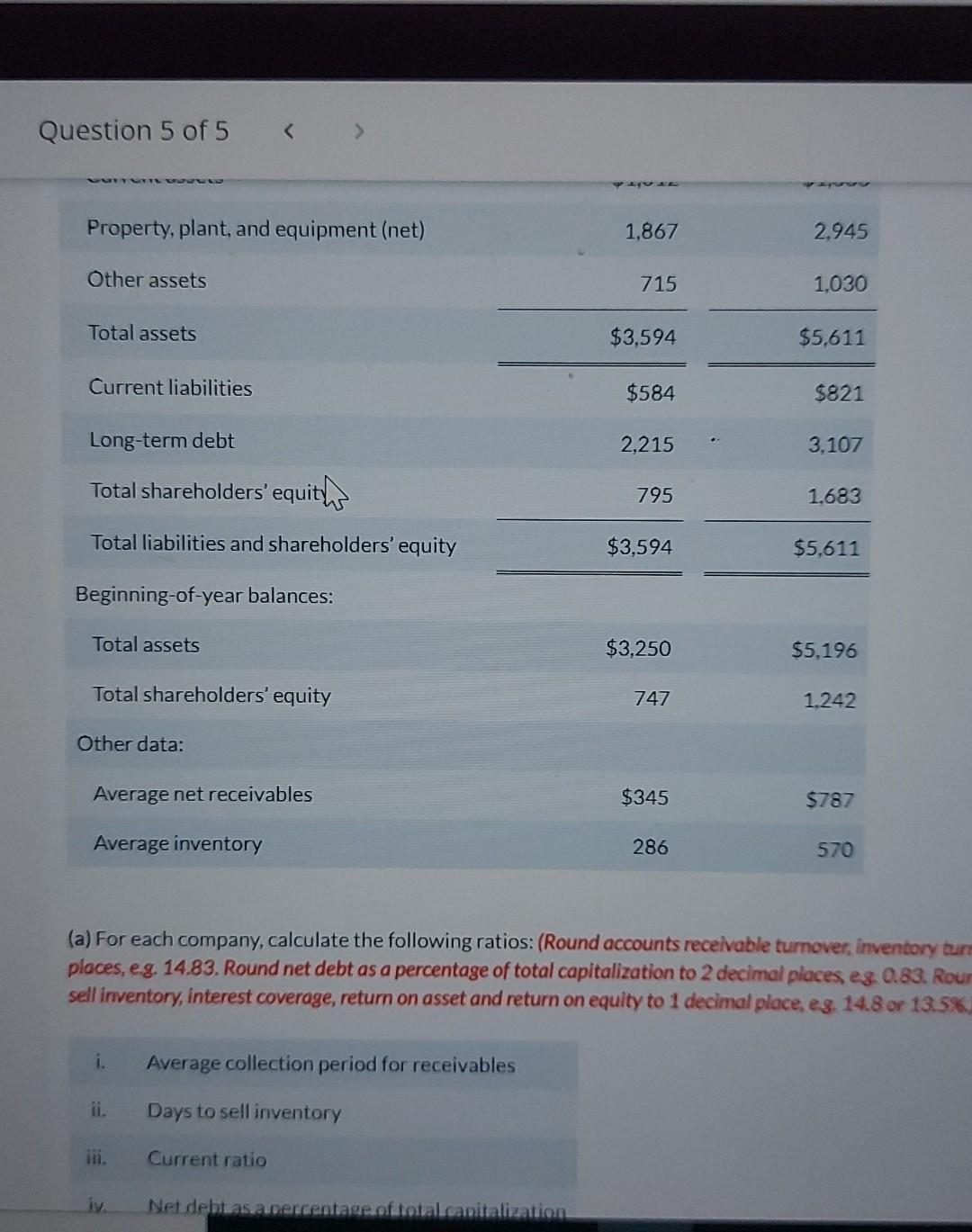

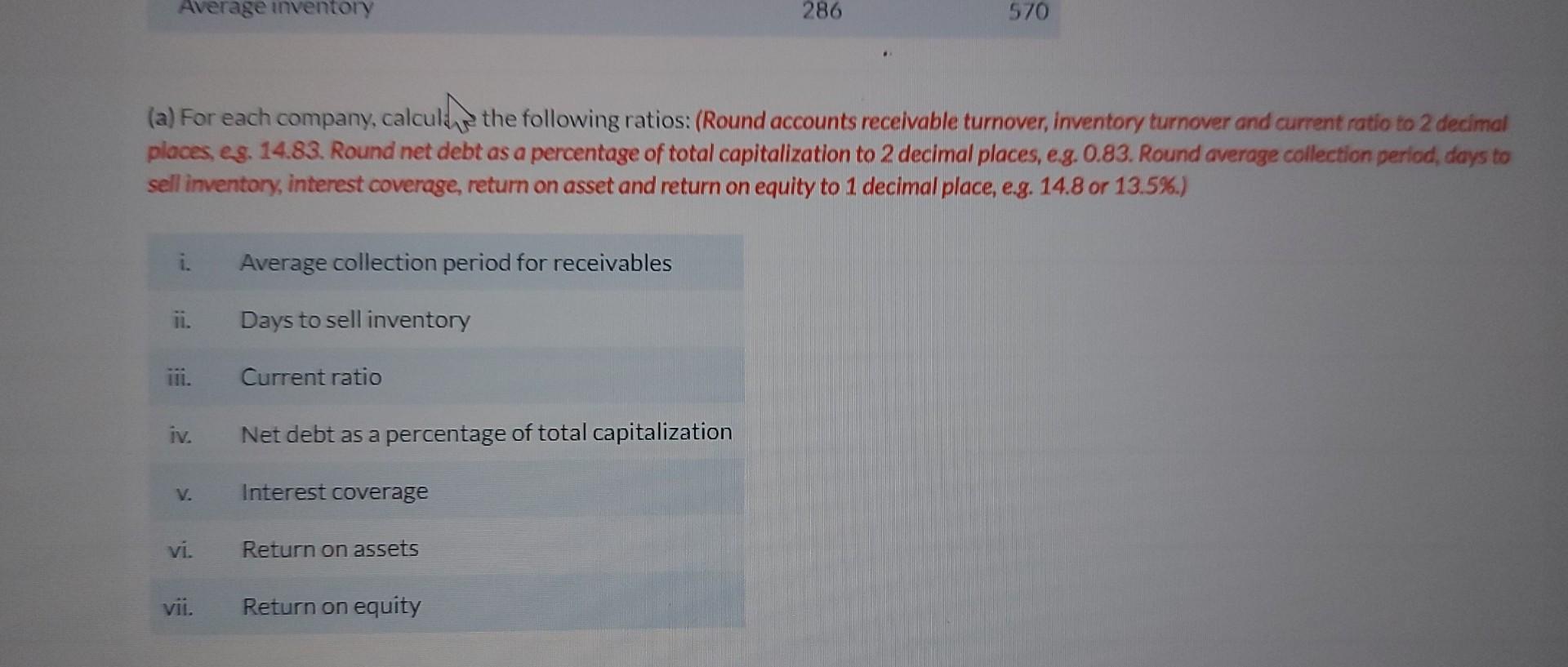

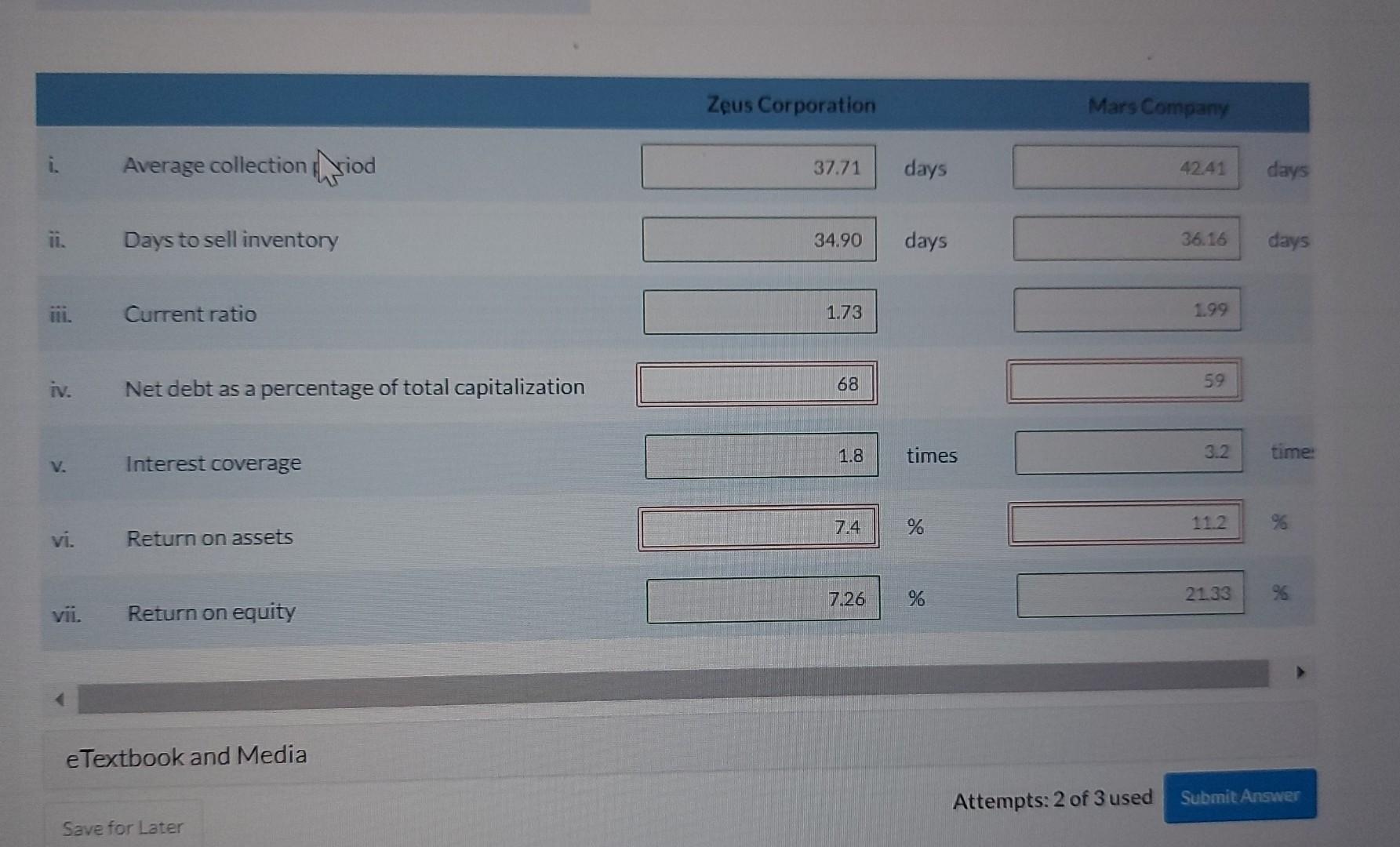

(Compare ratios and comment on results) Selected financial data for two intense competitors in a recent year follow (amounts in millions) (a) For each company, calculate the following ratios: (Round accounts receivable turnover, inventory turn places, eg. 14.83. Round net debt as a percentage of total capitalization to 2 decimal places, es. 0.83. Rour sell inventory, interest coverage, return on asset and return on equity to 1 decimal place, es. 14.8 or 13.5%. (a) For each company, calculas the following ratios: (Round accounts receivable turnover, inventory turnover and current ratio to 2 decimal places, es. 14.83. Round net debt as a percentage of total capitalization to 2 decimal places, e.g. 0.83. Round average collection period, days to sell inventory, interest coverage, return on asset and return on equity to 1 decimal place, e.g. 14.8 or 13.5%. Attempts: 2 of 3 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts