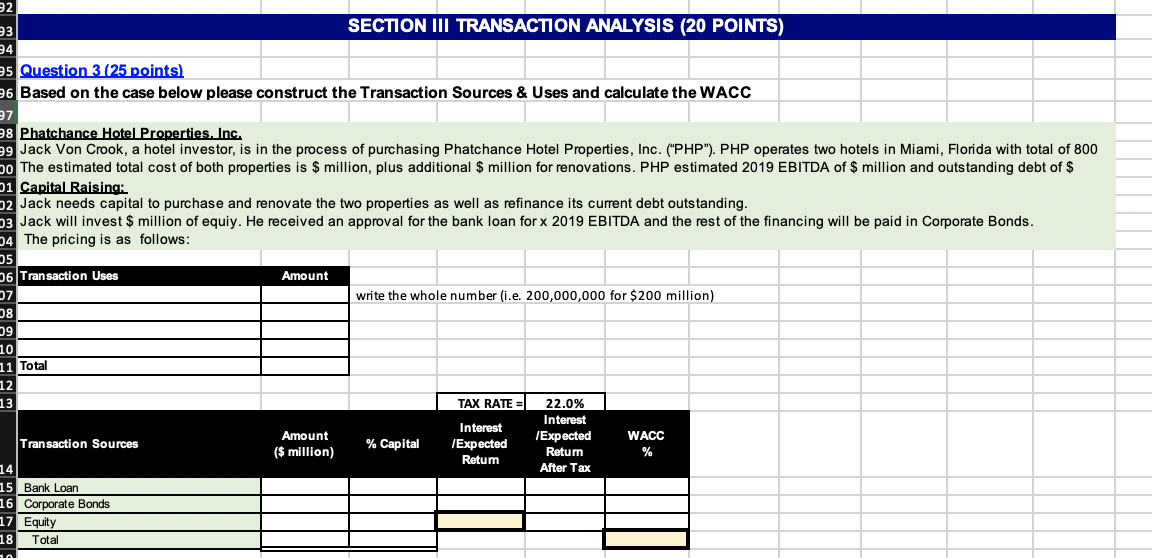

Question: Explain 22 33 SECTION III TRANSACTION ANALYSIS (20 POINTS) 34 25 Question 3 (25 points) 96 Based on the case below please construct the Transaction

Explain

Explain

22 33 SECTION III TRANSACTION ANALYSIS (20 POINTS) 34 25 Question 3 (25 points) 96 Based on the case below please construct the Transaction Sources & Uses and calculate the WACC 37 98 Phatchance Hotel Properties. Inc. 99 Jack Von Crook, a hotel investor, is in the process of purchasing Phatchance Hotel Properties, Inc. ("PHP"). PHP operates two hotels in Miami, Florida with total of 800 Do The estimated total cost of both properties is $ million, plus additional $ million for renovations. PHP estimated 2019 EBITDA of $ million and outstanding debt of $ 1 Capital Raising: 02 Jack needs capital to purchase and renovate the two properties as well as refinance its current debt outstanding. 03 Jack will invest $ million of equiy. He received an approval for the bank loan for x 2019 EBITDA and the rest of the financing will be paid in Corporate Bonds. 34 The pricing is as follows: 35 06 Transaction Uses Amount 7 write the whole number (i.e. 200,000,000 for $200 million) 28 29 10 11 Total 12 13 TAX RATE=1 22.0% Interest Interest Amount /Expected WACC Transaction Sources % Capital /Expected ($ million) Retum % Retum 14 After Tax 15 Bank Loan 16 Corporate Bonds 17 Equity 18 in Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts