Question: Explain and solve, no excel Security C: 1.25 Security K: 0.95 Example - CAPM Consider the betas for each of the assets given earlier. If

Explain and solve, no excel

Security C: 1.25

Security K: 0.95

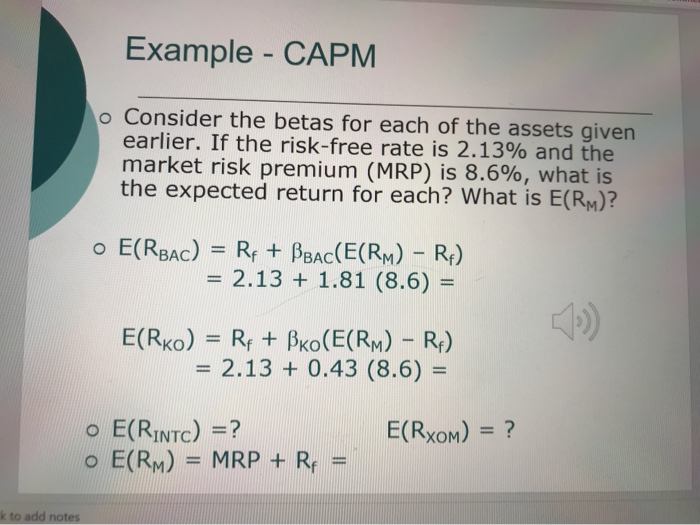

Example - CAPM Consider the betas for each of the assets given earlier. If the risk-free rate is 2.13% and the market risk premium (MRP) is 8.6%, what is the expected return for each? What is E(RM)?! o E(Rbac) = Rp + Blac(E(RM) - Rp) = 2.13 + 1.81 (8.6) = E(RKO) = Rp + Bko(E(Rm) R) = 2.13 + 0.43 (8.6) = E(Rxom) = ? o E(Rintc) = ? o E(RM) = MRP + Rp =

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts