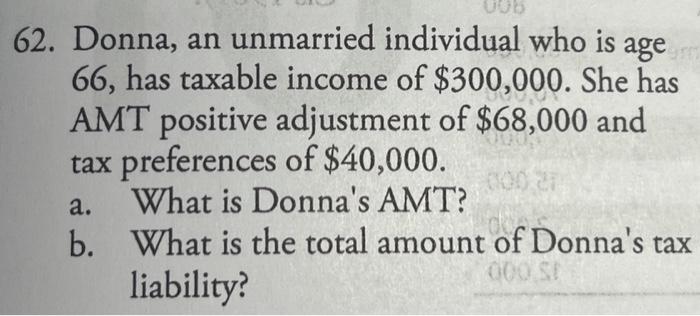

Question: Explain answer and use updated tax rules for 2023 please 62. Donna, an unmarried individual who is age 66 , has taxable income of $300,000.

62. Donna, an unmarried individual who is age 66 , has taxable income of $300,000. She has AMT positive adjustment of $68,000 and tax preferences of $40,000. a. What is Donna's AMT? b. What is the total amount of Donna's tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts