Question: explain both with in excel with formula please You own a $1,000-par zero-coupon bond that has 5 years of remaining maturity. You plan on selling

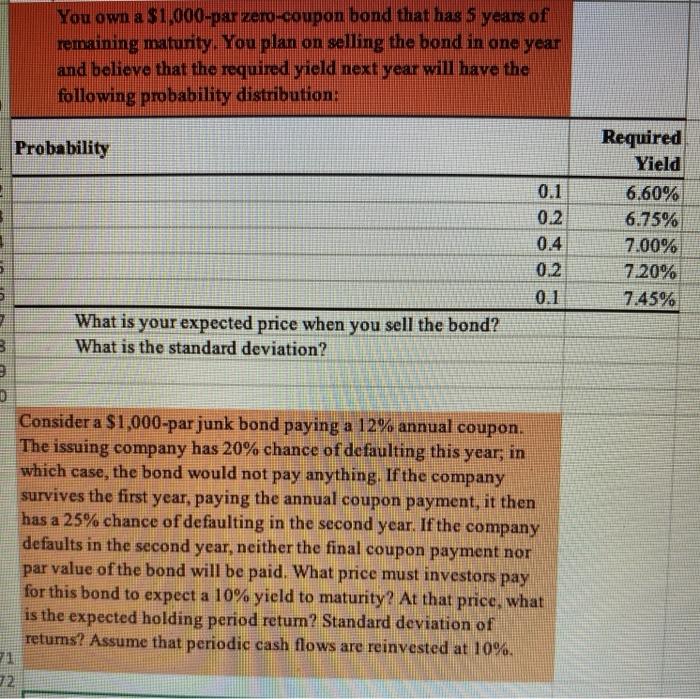

You own a $1,000-par zero-coupon bond that has 5 years of remaining maturity. You plan on selling the bond in one year and believe that the required yield next year will have the following probability distribution: Probability 0.1 0.2 0.4 0.2 0.1 Required Yiela 6.60% 6.75% 7.00% 7.20% 7.45% What is your expected price when you sell the bond? What is the standard deviation? 3 Consider a $1,000-par junk bond paying a 12% annual coupon. The issuing company has 20% chance of defaulting this year; in which case, the bond would not pay anything. If the company survives the first year, paying the annual coupon payment, it then has a 25% chance of defaulting in the second year. If the company defaults in the second year, neither the final coupon payment nor par value of the bond will be paid. What price must investors pay for this bond to expect a 10% yield to maturity? At that price, what is the expected holding period return? Standard deviation of returns? Assume that periodic cash flows are reinvested at 10%. 72

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts