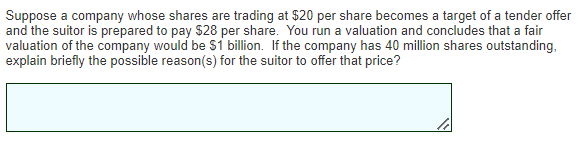

Question: Explain briefly what is wrong with the following reasoning. Suppose a company whose shares are trading at $20 per share becomes a target of a

Explain briefly what is wrong with the following reasoning. Suppose a company whose shares are trading at $20 per share becomes a target of a tender offer and the suitor is prepared to pay $28 per share. You run a valuation and concludes that a fair valuation of the company would be $1 billion. If the company has 40 million shares outstanding, explain briefly the possible reason(s) for the suitor to offer that price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts