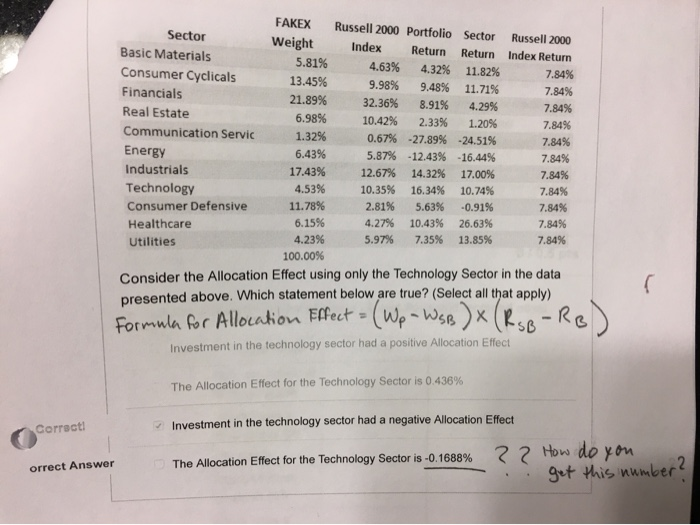

Question: Explain correct answer using the formula I provided. FAKEX Russell 2000 Portfolio Sector Weight Sector Russell 2000 Index Basic Materials Return Return Index Return 5.81%

FAKEX Russell 2000 Portfolio Sector Weight Sector Russell 2000 Index Basic Materials Return Return Index Return 5.81% 4.63% Consumer Cyclicals 4.32% 11.82% 13.45% 7.84% 9.98% Financials 9.48% 11.71% 7.84% 21.89% 32.36% 8.91% Real Estate 4.29% 7.84% 6.98% 10.42% 2.33% 1.20% 7.84% Communication Servic 1.32% 0.67% -27.89% -24.51% 7.84% Energy 6.43% 5.87% -12.43% -16.44% 7.84% Industriais 17.43% 12.67% 14.32% 17.00% 7.84% Technology 4.53% 10.35% 16.34% 10.74% 7.84% Consumer Defensive 11.78% 2.81% 5.63% -0.91% 7.84% Healthcare 6.15% 4.27% 10.43% 26.63% 7.84% Utilities 4.23% 5.97% 7.35% 13.85% 7.84% 100.00% Consider the Allocation Effect using only the Technology Sector in the data presented above. Which statement below are true? (Select all that apply) Formula for Allocation Effect =( Wp - WSB )X| Investment in the technology sector had a positive Allocation Effect The Allocation Effect for the Technology Sector is 0.436% Correct! Investment in the technology sector had a negative Allocation Effect orrect Answer The Allocation Effect for the Technology Sector is -0.1688% i How do you get this number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts