Question: explain each stop please 10 Profilwards-Late Start Fall 2020 A 11/12/20 PM HW Score: 0%, 0 of 8 Homework: Week Six: Homework Mastery Problem Chapter

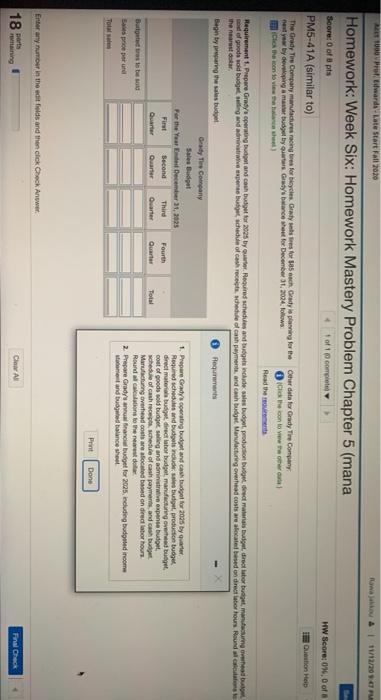

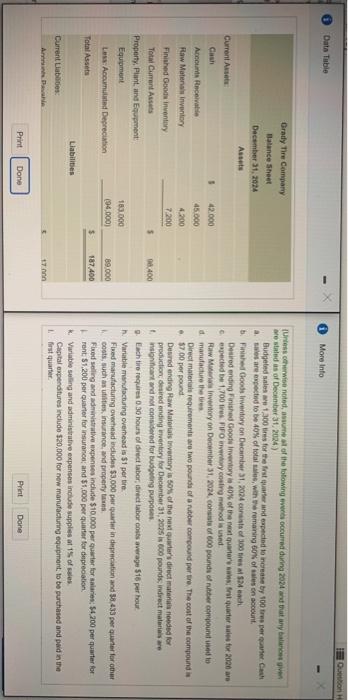

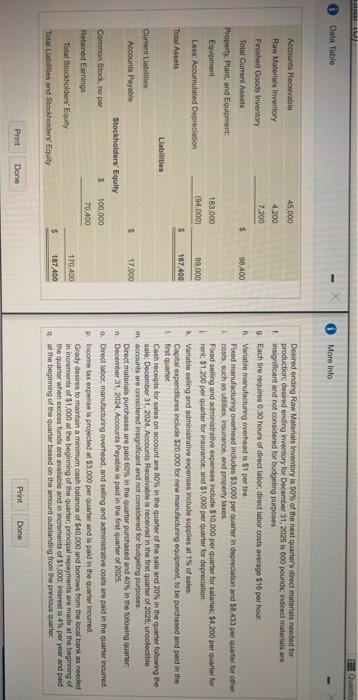

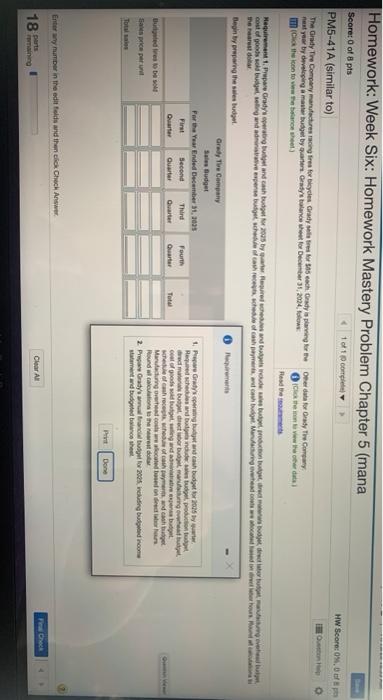

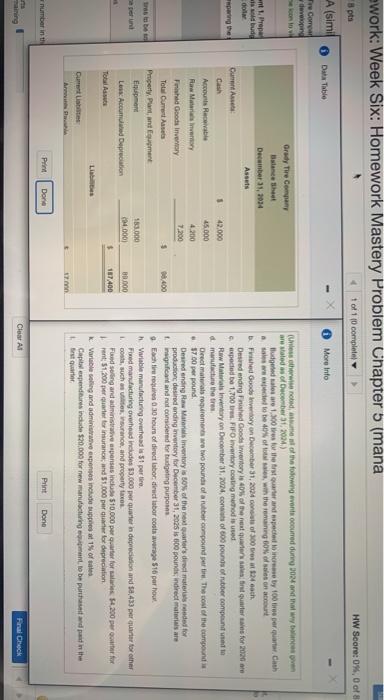

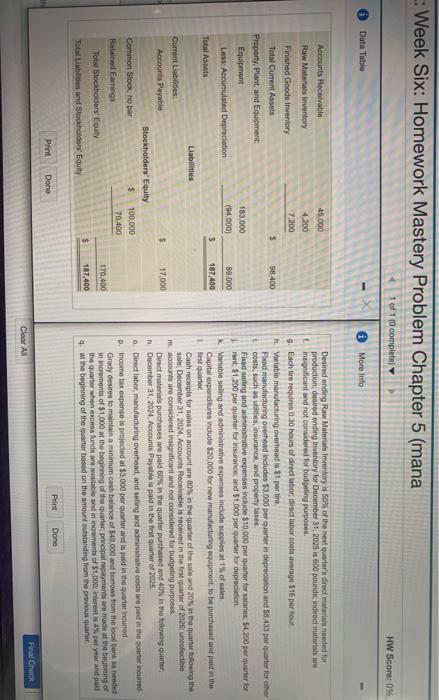

10 Profilwards-Late Start Fall 2020 A 11/12/20 PM HW Score: 0%, 0 of 8 Homework: Week Six: Homework Mastery Problem Chapter 5 (mana Score: 0 of 8 pts of compte PM5-41A (similar to) The Grady The Company mature range for boycles. Gintys for 105ch die planning for the other data for Grady The Company nesty by developing a budget by Graybe that for December 31, 2024. Follow Click the icon to the the soon to view let) Read the movements Question Help Requirement. Prepare Grayperating budget and cash budget for 2005 byter Required schedules and gets hesses budget production et ret materials buitrectator buget, manufacturing web model goods sold buat ang and we expense budget chedule of cash recheduled cash payment and Cath budget Manufacturing overhead costs are located besed on director hours Round close the nearest or Begin by paring the sales budget Requirements Gesty Company Sales Budget 1. Prepare Grady's operating budget and cabudget for 2025 byger For the Year December 31, 2015 Required schedules and budgets indus butel broduction budget Fint Second Third Fourth direct material budget direct aber budget, mancing ved buget cost of goods sold budgets and are expense budou Quarter Quarter Quarter Quarter schedule of cash rece, che of cash paymes and cash budget Manufacturing overed costs are alocated based on director hours Batters to be sa Round caktons to the rest of price per un 2. Prepare Gradac budget for 2025, including budged income and budged balance sheel Total sa Done Enter any number in the edit folds and then click Check Answer. 18 Clear All Final Check ning Qubo Data Table More info 42.000 45.000 Grady The Company Balance Sheet December 31, 2024 Assets Current As Cash 3 Account Receive Raw Materials inventory Finished God inventory Total Current Assets Property. Plant and Equipment Equipment Less: Accumulated Depreciation Total Assets Liabilities Current Liabilities: 4.200 7.200 (Unless otherwise noted, uume of the totowing werd ocurred during 2024 and that any blogi me stated as of December 31, 2024) Budgeted sales e 1.300 tires for the first quarter and expected to increase by 100 tres per te Cash as repected to be 10% of total win romaning 60% of son con . Finished Goods Inventory on December 31, 2024 consists of 300 tires Mach Desired ending Finished Good Inventory 40% of the next quarters arst quarter sales for 2020 are expected be 1,700 trs FIFO very cling thod is used Raw Minventory on December 31, 2024. consist of 600 pounds of the compound to d manufacture the Direct material requirements are two pounds of a rubber compound per tre. The cost of the compound in $7.00 per pound Desred ending Raw Materials inventory is 50% of the next quarter's direct materials needed for production desired ending wively for December 31, 2005 is 60 pounds, indirect materiais e significant and not considered for budgeting purposes g. Each tre requires 0.30 hours ofrect labor, direct labor costs average 516 per hour Variable montacturing overhead is 1 perire Fired manufacturing overhead dudes $3,000 per quarter in depreciation and 433 per quarter for other costs, such as the insurance and property Fixed selling and administrative expenses include $10.000 per quarter for salaries: $4,200 per quarter for rent $1,200 per quarter for insurance and 51,000 per quarter for depreciation * Variable seling and administrative expenses include supplies at 15 of sales Capital expenditures include 520,000 for new manufacturing equipment to be purchased and put in the first quarter 5 08.400 183.000 (94,000) $ 89.000 187.400 17 Print Done Print Done Q Data Table - More Info 58.400 89.000 187 400 Accounts Receivable 45.000 Raw Materials Inventory 4.200 Finished Goods Inventory 7,200 Total Current Assets $ Property. Plant, and Equipment: Equipment 163.000 Lost: Accumulated Depreciation (94000) $ Total Assets Liabilities Current Liabilities Accounts Payable $ Stockholders' Equity Common Stock, no por 5 100,000 Retained Earnings 70,400 Total Stockholders' Equity Total Liabilities and Stockholders' Equity Desired ending Raw Materials inventory is 50% of the next quarter's direct materials needed for production desired ending witory for December 31, 2025 is 600 pounds, indirect materials are 1 insignificant and not considered for budgeting purposes Each time requires 0.30 hours of direct labor direct labor costs average 516 per hour Variable manufacturing overhead is st per tre Fixed manufacturing overhead includes $3,000 per quarter in depreciation and 58,433 per quarter for other costs, such as the insurance, and property taxes Fored selling and administrative expenses include 510.000 per quarter for salaries: 34.200 per quarter to rent: $1.200 per quarter for insurance, and $1,000 per quarter for depreciation Variable soling and administrative expenses include supplies of 1% of sale Capital expenditures include $20,000 for new manufacturing equipment to be purchased and paid in the Lfirst quarter Cash receipts for sales on account are 80% in the quarter of the sale and 20% in the quarter following the sale. December 31, 2024. Accounts Receivable is received in the first quarter of 2026, uncollectie m accounts are considered Insignificant and not considered for budgeting purposes Direct materials purchases are paid 60% in the quarter purchased and 40% in the flowing quarter in December 31, 2024. Accounts Payable is paid in the first quarter of 2025 Drector, manufacturing overhead, and selling and administrative costs are paid in the quarter incurred Income tax expense is projected at $3,000 per quarter and is paid in the quarter incurred Grady desires to maintain a minimum cash balance of $40.000 and borrows from the local bank as needed in increments of $1,000 at the beginning of the quarter principal repayments are made at the beginning of the quarter when excess funds are available and in increments of $1,000 rest is 4% per year and paid at the beginning of the quarter based on the amount outstanding from the previous quarter. 17.000 170.400 187.400 Print Done Print Done Homework: Week Six: Homework Mastery Problem Chapter 5 (mana Score: 0 of 8 pts 1 of 1 come PM5-41A (similar to) The Guy Tre Company manufactures moing fires for bydlet Grady altres for each. Orady plager data for Orady The Company nastyow by developing a master budget by water. Geady's balance sheet for December 31, 2004 the view the ordus mich ein to viewer HW Score: 0.0 FO Mequirement Proper Grayscoring and enthu 2025 by gured when the bottom bodde cod pods sold building and experie buige che che ho capito de Maring a wooden houHann the most doar Begin by owparing the sales budget Grady To Company Sales Budget For the Year Ended December 11, 2005 Gray's powing buwan cash budget for 2016 by www Required the bude production First Second Third Fourth red to be directorul margt Quarter Quarter Quarter Total coa good debet wheelche die Bulled from Murdering when cowocuted before her Round calculate the do Saw price per 2 Pro Grady warna tuto for 2005, coding budged.com Total Done Enter y humor in the edit folds and then click Chick Answer Clear All Check 18 ework: Week Six: Homework Mastery Problem Chapter 5 mana 8 pts 1 of 10 completely HW Score: 0%, 0 of 8 Data Table More Info A (simi Com developing Grady The Company ent. Prepa is sold budd December 31, 2014 Assets CA paring the 42.000 45.000 4.200 7,200 (Unless otherwise noted, as of the flowing events occurred during and how anestled of Oceber 31, 202M.) Budgeted sales are 1.300 tres for the first quarter and espected to increase by 100 tire per quarter Cash sa tobe 40% of total with the remaining of sales on account Fished de inventory on December 31, 2024 of 300 trs 24 cach Desired ending Fished Goods wertory is 40% of the next questions que les for 2020 expected to 1.700 FIFO Inventory costing method is used Raw Materials or on December 31, 2024.com of 600 pounds of rubber compound d. manufacture the tre Direct materials rourements we two pounds of anber compound per te. The cost of the compound $7.00 per pound Desireening Raw Materials inventory is 50% of the quarter's dreaded for production desired ending inventory for December 31, 2015 is 100 pounds, indirect materials are significant and not considered to budgeting purposes Each treo 30 hours of direct labor direct labor costa average 516 per hout Variable manufacturing overhead is st per tire Fed manufacturing overhoed includes $3.000 por quarter in depreciation and $0,43) per quarter for other bot, such as surance and property taxes Fundering and administrative arpenses incluse $10.000 per quarter for a 4.200 percer for rent51.200 per te for insurance, and $1.000 percebe depreciation Variable soling and adminive expenses include supprest 1of Capital expenditures include $20.000 for new unlawigant to be pard paid in the List Account Receive Raw Mater Finished Goods in Total Curessata Property Plant, and went Ensumo Les Accumulated Depreciation Tobias La Current 28.400 pen 133.000 1.000) $ B2.000 187.400 number in the Print Done Print Done maining Clear All Final Check Week Six: Homework Mastery Problem Chapter 5 (mana 1 of 1 (0 completo) HW Score: 0% Data Table More Info 45,000 4.200 Accounts Receivable Raw Materials inventory Finished Goods inventory Total Current Assets 7,200 $ 98,400 Property, Plant and Equipment Equipment Less: Accumulated Depreciation 183.000 (94.000) 89,000 187,400 $ Total Assets Desired ending Raw Materials Inventory is 50% of the next quarter's direct materials needed for production desired ending inventory for December 31, 2025 is 600 pound indirect materials are insignificant and not considered for budgeling purposes 9. Each tire requires 0.30 hours of direct labor direct labor costs average 516 per hour Variable manufacturing overhead is $1 per tire Find manufacturing over and includes $3.000 per quarter in depreciation and 58.433 per quartet for other costs, such as insurance and property taxes Flad selling and administrative expenses include $10,000 per quarter for salanes54200 per quarter for rent: $1.200 per quarter for Insurance and $1.000 per quarter for depreciation Variable selling and administrative expenses include suppresa of sale Capital expenditures include $20,000 for new manufacturing equipment to be purchased and paid in the 1 first quarter Cash receipts for sales on account are 30% in the quarter of the sale and 20% in the quarter following the Sale: December 31, 2024. Accounts Receivable is received in the first quarter of 2025: un obiectible m. accounts are considered insignificant and not considered for budgeting purposes Direct materials purchases are paid 60% in the quarter purchased and 40 in the following quarter n December 31, 2024, Accounts Payable is paid in the first quarter of 2005 o Direct labor, tacturing overhead, and selling and administrative costs are paid in the art incurred p. Income tax expense is projected at $3.000 per quarter and is paid in the water incurred Grady desires to maintain a minimum cash balance of $40,000 and bonos from the local bank needed in increments of $1.000 at the beginning of the quarter principal payments are made at the beginning of the quarter when excess unde are valable and in increments of $1,000; interest is per year and paid 4. the beginning of the quarter based on the amount outstanding from the previous quarter Liabilities Current Liabilities Accounts Payable 17.000 Stockholders' Equity $ Comeon Stock no par 100.000 70.400 Reed Earnings Total Scholars Equity 170.400 187,400 $ Total Liabetes and Stockholders' Equity Print Done Print Done Final Check Clear Al

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts